Taxable value represents the portion of an asset's value subject to taxation, often calculated after accounting for allowable deductions and exemptions. Residual value refers to the estimated remaining worth of an asset after it has fully depreciated and is no longer productive. Understanding the difference between taxable value and residual value is crucial for accurate tax reporting and asset management.

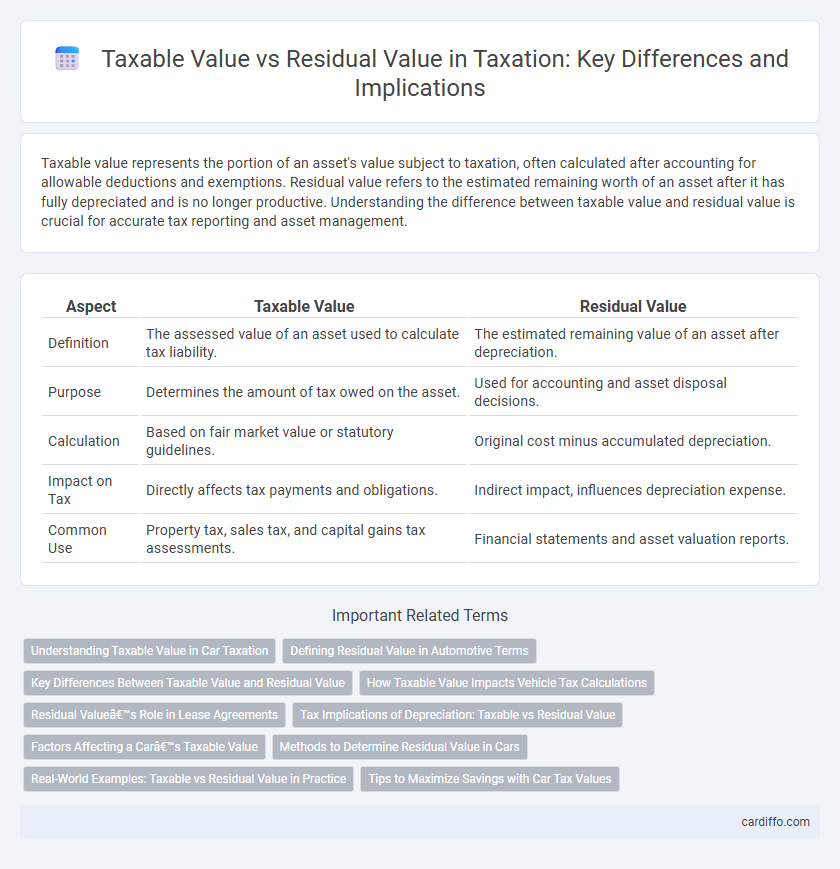

Table of Comparison

| Aspect | Taxable Value | Residual Value |

|---|---|---|

| Definition | The assessed value of an asset used to calculate tax liability. | The estimated remaining value of an asset after depreciation. |

| Purpose | Determines the amount of tax owed on the asset. | Used for accounting and asset disposal decisions. |

| Calculation | Based on fair market value or statutory guidelines. | Original cost minus accumulated depreciation. |

| Impact on Tax | Directly affects tax payments and obligations. | Indirect impact, influences depreciation expense. |

| Common Use | Property tax, sales tax, and capital gains tax assessments. | Financial statements and asset valuation reports. |

Understanding Taxable Value in Car Taxation

Taxable value in car taxation refers to the assessed worth of a vehicle used to calculate the amount of tax owed, often based on the market value or purchase price minus allowable deductions. Unlike residual value, which estimates the vehicle's worth at the end of a lease or depreciation period, taxable value directly impacts the tax liability during ownership or registration. Accurate determination of taxable value ensures compliance with tax regulations and avoids overpayment or penalties in vehicle taxation.

Defining Residual Value in Automotive Terms

Residual value in automotive terms refers to the estimated worth of a vehicle at the end of a lease or ownership period, impacting depreciation calculations crucial for tax purposes. It contrasts with taxable value, which represents the current appraised worth used to determine the tax liability on the vehicle. Accurately defining residual value helps ensure precise tax reporting and compliance in automotive asset management.

Key Differences Between Taxable Value and Residual Value

Taxable value refers to the assessed value of an asset or property used to calculate tax liability, often based on market value or appraisal. Residual value represents the estimated remaining worth of an asset at the end of its useful life, serving as a basis for depreciation calculations. The key difference lies in taxable value driving tax obligations, while residual value impacts accounting and asset management decisions.

How Taxable Value Impacts Vehicle Tax Calculations

Taxable value determines the amount on which vehicle tax is calculated, directly influencing the tax liability for the owner. Residual value represents the estimated worth of the vehicle at the end of its useful life, but it does not affect the initial tax calculation. Accurate assessment of taxable value ensures fair taxation aligned with the vehicle's current market value, impacting annual registration fees and sales tax amounts.

Residual Value’s Role in Lease Agreements

Residual value plays a crucial role in lease agreements by determining the expected worth of an asset at the end of the lease term, directly impacting the lessee's depreciation deductions and taxable value calculations. This estimated salvage value helps establish lease payments and tax obligations by reducing the capitalized cost subject to depreciation. Accurately assessing residual value ensures compliance with tax regulations and optimizes the financial benefits related to leased asset depreciation.

Tax Implications of Depreciation: Taxable vs Residual Value

Taxable value refers to the asset's depreciable base used to calculate depreciation deductions, impacting the amount of taxable income a business reports each year. Residual value, or salvage value, is the estimated asset worth at the end of its useful life and reduces the depreciable base, influencing overall tax depreciation limits. Understanding the distinction between taxable value and residual value is crucial for accurate depreciation schedules and optimizing tax benefits under applicable tax regulations.

Factors Affecting a Car’s Taxable Value

A car's taxable value is influenced by factors such as its original purchase price, depreciation rate, mileage, and condition, all of which determine the current market worth for tax purposes. Residual value, often used in lease agreements, reflects the estimated future worth of the vehicle at the end of the lease term, impacting tax calculations and potential depreciation claims. Local tax regulations and periodic reassessments also play a significant role in defining the taxable value versus residual value for accurate tax reporting.

Methods to Determine Residual Value in Cars

Methods to determine residual value in cars include market value analysis, which assesses the vehicle's expected selling price at the end of the lease or ownership period. Another approach is the automated valuation model (AVM), using algorithms and historical data to predict future value based on similar vehicles. Depreciation schedules and industry guides like Kelley Blue Book also provide standardized estimates crucial for tax calculations involving taxable value and residual value.

Real-World Examples: Taxable vs Residual Value in Practice

Real-world tax scenarios often distinguish taxable value from residual value, particularly in asset depreciation and property tax assessments. For instance, a company purchasing machinery may report the taxable value based on the asset's depreciated cost over time, while the residual value represents the estimated salvage price at the end of its useful life, affecting tax deductions and capital gains calculations. Property tax assessments, on the other hand, use taxable value to determine tax liabilities, which may differ from residual value reflecting maintenance costs and market fluctuations.

Tips to Maximize Savings with Car Tax Values

To maximize savings with car tax values, prioritize understanding the difference between taxable value and residual value, as taxable value determines the amount subject to taxation while residual value affects lease-end purchase decisions. Regularly update documentation to reflect the accurate taxable value and negotiate residual values in lease agreements to reduce overall tax liability. Utilize tax deduction opportunities by tracking depreciation and capitalizing on residual value differences to optimize tax outcomes on vehicle transactions.

Taxable value vs residual value Infographic

cardiffo.com

cardiffo.com