Road tax is an annual fee imposed on vehicle owners, calculated based on factors such as vehicle weight, engine size, or emissions, intended to fund road maintenance and infrastructure. Luxury car tax (LCT) applies to the purchase of high-value vehicles exceeding a certain price threshold, targeting luxury or high-performance cars to ensure equitable tax contribution from affluent buyers. While road tax is recurring and tied to vehicle usage, luxury car tax is a one-time cost applied at the point of sale.

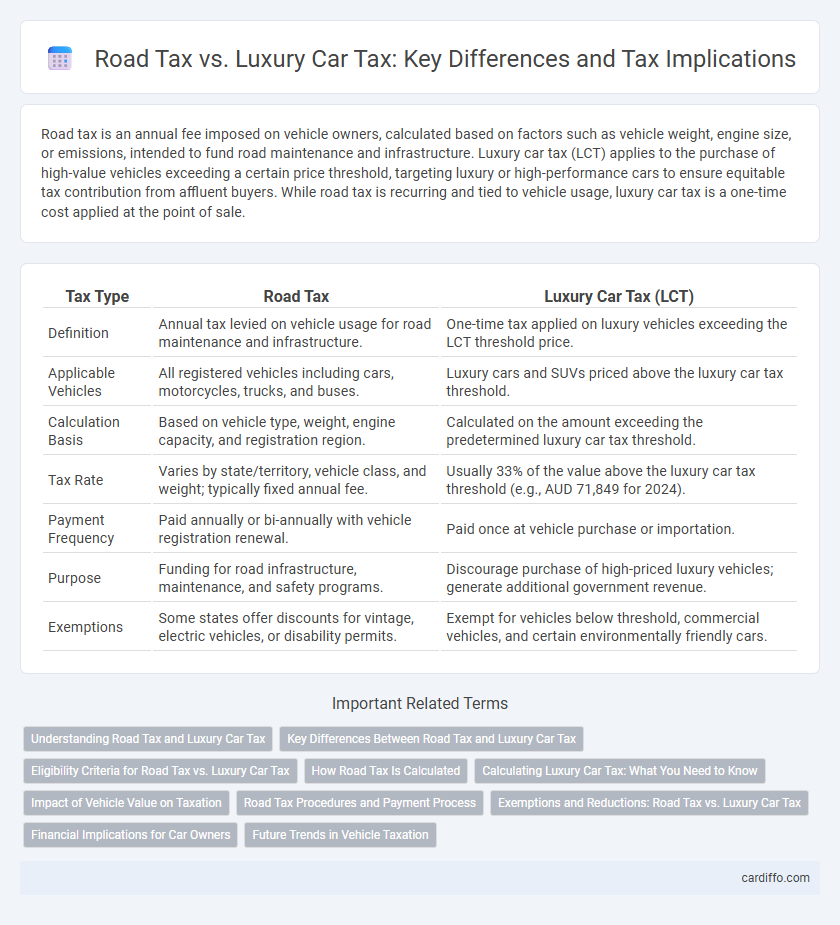

Table of Comparison

| Tax Type | Road Tax | Luxury Car Tax (LCT) |

|---|---|---|

| Definition | Annual tax levied on vehicle usage for road maintenance and infrastructure. | One-time tax applied on luxury vehicles exceeding the LCT threshold price. |

| Applicable Vehicles | All registered vehicles including cars, motorcycles, trucks, and buses. | Luxury cars and SUVs priced above the luxury car tax threshold. |

| Calculation Basis | Based on vehicle type, weight, engine capacity, and registration region. | Calculated on the amount exceeding the predetermined luxury car tax threshold. |

| Tax Rate | Varies by state/territory, vehicle class, and weight; typically fixed annual fee. | Usually 33% of the value above the luxury car tax threshold (e.g., AUD 71,849 for 2024). |

| Payment Frequency | Paid annually or bi-annually with vehicle registration renewal. | Paid once at vehicle purchase or importation. |

| Purpose | Funding for road infrastructure, maintenance, and safety programs. | Discourage purchase of high-priced luxury vehicles; generate additional government revenue. |

| Exemptions | Some states offer discounts for vintage, electric vehicles, or disability permits. | Exempt for vehicles below threshold, commercial vehicles, and certain environmentally friendly cars. |

Understanding Road Tax and Luxury Car Tax

Road tax is an annual fee imposed on vehicle owners for using public roads, calculated based on factors like vehicle weight, engine capacity, or fuel type. Luxury Car Tax (LCT) applies to the sale or importation of high-priced luxury vehicles exceeding a specific threshold, targeting premium passenger cars and SUVs. Understanding the distinction helps in accurate budgeting for vehicle ownership costs and compliance with relevant tax regulations.

Key Differences Between Road Tax and Luxury Car Tax

Road tax is an annual fee imposed by state or local governments for the use of roads, primarily aimed at funding infrastructure maintenance, while luxury car tax (LCT) is a federal tax applied on cars exceeding a specific price threshold, targeting high-value vehicle purchases. Road tax rates vary by vehicle type, weight, and registration location, whereas luxury car tax is calculated as a percentage of the amount above the luxury car threshold. Unlike road tax, which affects all vehicle owners, luxury car tax specifically impacts buyers of premium vehicles, reflecting different fiscal objectives and regulatory scopes.

Eligibility Criteria for Road Tax vs. Luxury Car Tax

Eligibility for road tax primarily depends on vehicle registration, type, weight, and usage, with private and commercial vehicles required to pay annually or biannually based on jurisdictional rules. Luxury car tax applies specifically to new or imported vehicles with a value exceeding the luxury car tax threshold, calculated on the amount above this limit to target high-value vehicles. While road tax funds general road infrastructure maintenance, luxury car tax aims to regulate luxury vehicle sales and generate additional revenue from higher-end automobile purchases.

How Road Tax Is Calculated

Road tax is typically calculated based on factors such as vehicle weight, engine capacity, and registration location, varying significantly across regions. Unlike luxury car tax, which targets high-value vehicles with a percentage of the car's price above a certain threshold, road tax focuses on operational attributes to fund road maintenance. This calculation method ensures that heavier and more powerful vehicles contribute more to infrastructure upkeep.

Calculating Luxury Car Tax: What You Need to Know

Calculating Luxury Car Tax (LCT) involves determining the taxable value of a vehicle that exceeds the LCT threshold set by the Australian Taxation Office, typically updated annually. The LCT rate is applied to the amount above the threshold, which varies depending on the fuel efficiency of the car, with a higher threshold for fuel-efficient vehicles. Accurate calculation requires understanding the GST-inclusive price, applicable discounts, and whether on-road costs are included, ensuring compliance with tax regulations for high-value vehicle purchases.

Impact of Vehicle Value on Taxation

The impact of vehicle value on taxation varies significantly between road tax and luxury car tax, with road tax typically calculated based on factors like engine size and vehicle weight rather than value. In contrast, luxury car tax directly targets high-value vehicles exceeding a specified threshold, imposing a premium tax rate on the amount above this limit. This distinction emphasizes that while road tax remains relatively stable regardless of vehicle price, luxury car tax escalates sharply with increasing vehicle market value, affecting buyers of high-end automobiles more substantially.

Road Tax Procedures and Payment Process

Road tax procedures require vehicle owners to register their vehicles with the local transport department, submit necessary documents such as proof of ownership and insurance, and pay the prescribed fee based on vehicle type and engine capacity. Payment processes for road tax are commonly available online through government portals, at authorized banks, or local transport offices, with options for annual or multiple-year payments to ensure compliance. In contrast, luxury car tax is calculated separately, levied on the value of imported or high-priced vehicles, and paid during the vehicle purchase or registration stage, not as a recurring road tax fee.

Exemptions and Reductions: Road Tax vs. Luxury Car Tax

Road tax exemptions commonly apply to electric vehicles, vintage cars, and disabled drivers, reducing or eliminating annual registration fees to encourage eco-friendly transportation and accommodate special needs. Luxury car tax exemptions or reductions are limited and typically exclude vehicles under a certain price threshold or those used for specific business purposes, ensuring the tax targets only high-value passenger vehicles. Both taxes aim to balance government revenue with incentives but apply different criteria to define eligible exemptions and reductions.

Financial Implications for Car Owners

Road tax is an annual fee imposed on vehicle owners based primarily on vehicle weight, engine size, or emissions, directly impacting ongoing ownership costs. Luxury car tax (LCT) applies to vehicles exceeding a specific value threshold, typically over $70,000 AUD, taxing the luxury portion of the price and significantly increasing initial purchase expenses. Car owners must factor both taxes into total cost of ownership, as road tax affects recurring expenses while LCT influences upfront financial outlay for high-end vehicles.

Future Trends in Vehicle Taxation

Future trends in vehicle taxation indicate a shift towards increased emphasis on environmental impact, with road tax systems progressively incorporating emissions-based criteria. Luxury car tax policies are expected to evolve, targeting higher-value vehicles with stricter tax brackets to discourage excessive carbon footprints from premium automotive segments. Advancements in digital tax administration will enhance transparency and efficiency, enabling real-time adjustments aligned with sustainability goals.

Road tax vs luxury car tax Infographic

cardiffo.com

cardiffo.com