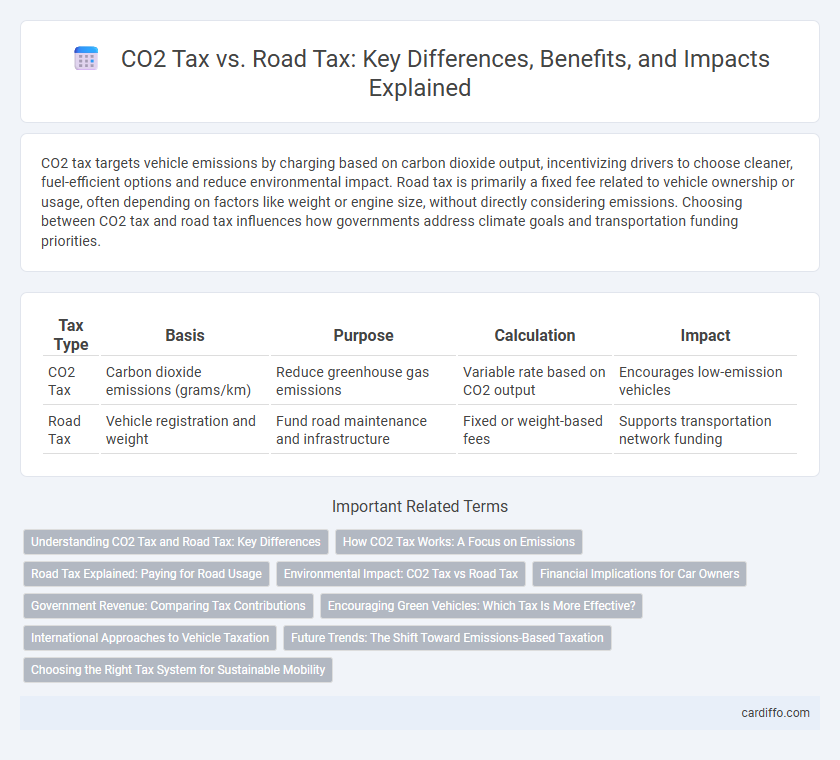

CO2 tax targets vehicle emissions by charging based on carbon dioxide output, incentivizing drivers to choose cleaner, fuel-efficient options and reduce environmental impact. Road tax is primarily a fixed fee related to vehicle ownership or usage, often depending on factors like weight or engine size, without directly considering emissions. Choosing between CO2 tax and road tax influences how governments address climate goals and transportation funding priorities.

Table of Comparison

| Tax Type | Basis | Purpose | Calculation | Impact |

|---|---|---|---|---|

| CO2 Tax | Carbon dioxide emissions (grams/km) | Reduce greenhouse gas emissions | Variable rate based on CO2 output | Encourages low-emission vehicles |

| Road Tax | Vehicle registration and weight | Fund road maintenance and infrastructure | Fixed or weight-based fees | Supports transportation network funding |

Understanding CO2 Tax and Road Tax: Key Differences

CO2 tax targets vehicle emissions by charging based on carbon dioxide output, incentivizing lower pollution and environmental sustainability. Road tax is primarily a fee for vehicle usage on public roads, often calculated by engine size or vehicle weight, focusing on infrastructure maintenance funding. Understanding these distinctions helps taxpayers optimize costs and comply with regulatory requirements effectively.

How CO2 Tax Works: A Focus on Emissions

CO2 tax directly targets vehicle emissions by charging drivers based on the amount of carbon dioxide their cars emit per kilometer, incentivizing the use of low-emission and electric vehicles. This tax is calculated using precise emissions data from manufacturers, allowing for a fairer system compared to traditional road tax, which solely depends on vehicle weight or engine size. By aligning costs with environmental impact, CO2 tax encourages a reduction in greenhouse gas emissions and promotes sustainable transportation choices.

Road Tax Explained: Paying for Road Usage

Road tax is a mandatory fee charged to vehicle owners based on factors such as vehicle type, engine size, and emissions, ensuring drivers contribute to the maintenance and development of road infrastructure. Unlike CO2 tax, which targets carbon emissions for environmental impact reduction, road tax focuses specifically on funding transport networks and managing traffic-related costs. Payment of road tax helps cover expenses related to road repairs, safety improvements, and infrastructure upgrades essential for efficient transportation systems.

Environmental Impact: CO2 Tax vs Road Tax

The CO2 tax directly targets greenhouse gas emissions by imposing fees based on carbon output, incentivizing individuals and businesses to reduce their carbon footprint and adopt cleaner technologies. Road tax primarily funds infrastructure maintenance but does not differentiate by vehicle emissions, offering limited environmental benefits. By aligning tax rates with emission levels, the CO2 tax promotes sustainable transportation choices and significantly contributes to climate change mitigation.

Financial Implications for Car Owners

CO2 tax directly impacts car owners by increasing costs based on their vehicle's carbon emissions, incentivizing the use of fuel-efficient or electric vehicles to reduce overall tax burden. Road tax is typically a fixed annual fee calculated by vehicle type or engine size, affecting cash flow predictability but less sensitive to individual driving behavior. Financial planning for car owners must balance the fluctuating CO2 tax tied to emissions with the steady expense of road tax to optimize total vehicle ownership costs.

Government Revenue: Comparing Tax Contributions

CO2 tax directly targets emissions by charging based on carbon output, generating substantial government revenue aligned with environmental goals. Road tax is typically a fixed fee on vehicle ownership or usage, providing steady but less environmentally driven income streams. Comparing tax contributions, CO2 tax promotes sustainability while enhancing government funds through incentive-based pricing.

Encouraging Green Vehicles: Which Tax Is More Effective?

CO2 tax directly incentivizes the adoption of green vehicles by imposing higher fees on cars with greater carbon emissions, effectively encouraging consumers to choose low-emission options. Road tax typically charges based on vehicle weight or engine size, which may not align closely with environmental impact, resulting in less targeted motivation for reducing carbon footprints. Studies indicate that CO2 tax is more effective in promoting electric and hybrid vehicles, accelerating the shift toward sustainable transportation.

International Approaches to Vehicle Taxation

International approaches to vehicle taxation vary significantly, with CO2 taxes targeting emissions to incentivize eco-friendly driving, while road taxes primarily generate revenue for infrastructure maintenance. Countries like Sweden and Norway implement CO2-based vehicle taxes to reduce carbon footprints, contrasting with nations such as Germany and the UK where road taxes depend on vehicle weight or engine size. This dual system reflects a growing trend to balance environmental goals with traditional taxation models in transport policy.

Future Trends: The Shift Toward Emissions-Based Taxation

Emissions-based taxation is gaining momentum as governments worldwide prioritize climate change mitigation, with CO2 tax frameworks designed to directly link road usage fees to vehicle emissions levels. Future tax policies are expected to phase out traditional road tax systems in favor of dynamic models that adjust charges based on carbon output, encouraging cleaner transportation choices. This shift aligns with international commitments to reduce greenhouse gas emissions through economic incentives targeting higher-polluting vehicles.

Choosing the Right Tax System for Sustainable Mobility

CO2 tax targets vehicle emissions by charging based on carbon output, promoting reduced pollution and incentivizing electric vehicle adoption, whereas road tax is typically a fixed fee based on vehicle registration or weight, regardless of environmental impact. Choosing the right tax system for sustainable mobility involves prioritizing mechanisms that directly encourage lower emissions and support green transportation infrastructure investments. Implementing a CO2-based tax system aligns financial incentives with climate goals, while road tax alone may fail to drive significant behavioral changes toward sustainability.

CO2 Tax vs Road Tax Infographic

cardiffo.com

cardiffo.com