Section 179 deduction allows businesses to immediately expense the cost of qualifying property, up to a set limit, reducing taxable income in the year of purchase. Bonus depreciation enables businesses to deduct a significant percentage of the asset's cost, often 100%, without an annual limit, and can create or increase a net operating loss. Understanding the differences between Section 179 and bonus depreciation is essential for optimizing tax savings and managing cash flow effectively.

Table of Comparison

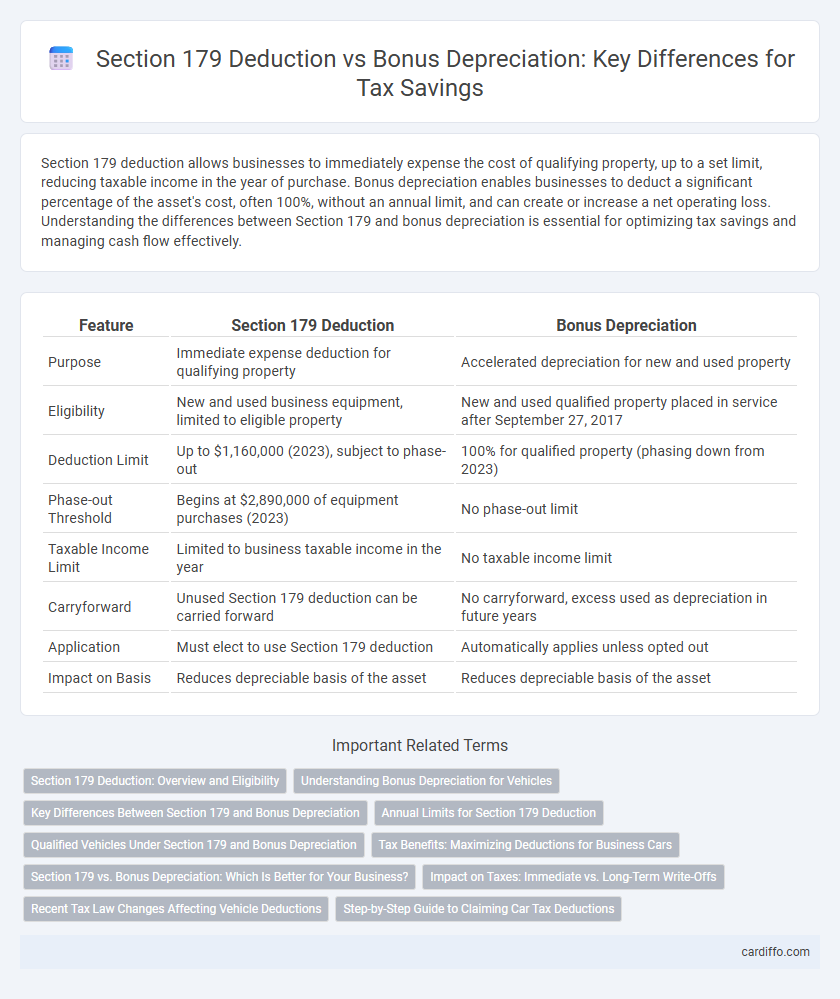

| Feature | Section 179 Deduction | Bonus Depreciation |

|---|---|---|

| Purpose | Immediate expense deduction for qualifying property | Accelerated depreciation for new and used property |

| Eligibility | New and used business equipment, limited to eligible property | New and used qualified property placed in service after September 27, 2017 |

| Deduction Limit | Up to $1,160,000 (2023), subject to phase-out | 100% for qualified property (phasing down from 2023) |

| Phase-out Threshold | Begins at $2,890,000 of equipment purchases (2023) | No phase-out limit |

| Taxable Income Limit | Limited to business taxable income in the year | No taxable income limit |

| Carryforward | Unused Section 179 deduction can be carried forward | No carryforward, excess used as depreciation in future years |

| Application | Must elect to use Section 179 deduction | Automatically applies unless opted out |

| Impact on Basis | Reduces depreciable basis of the asset | Reduces depreciable basis of the asset |

Section 179 Deduction: Overview and Eligibility

Section 179 deduction allows businesses to immediately expense the full cost of qualifying property up to a limit of $1,160,000 for the 2023 tax year, reducing taxable income. Eligible property includes tangible personal property, certain improvements to nonresidential real property, and specific business equipment used more than 50% for business purposes. Eligibility requires the total equipment purchased not to exceed $2,890,000, with the deduction phased out dollar-for-dollar beyond this amount.

Understanding Bonus Depreciation for Vehicles

Bonus depreciation allows businesses to immediately deduct a significant percentage of the cost of qualifying new and used vehicles in the year they are placed in service, subject to specific limits set by the IRS. Unlike the Section 179 deduction, which has a maximum deduction cap and vehicle eligibility criteria based on weight and use, bonus depreciation applies automatically and can be used for multiple qualifying vehicles without an annual dollar limit. Understanding IRS guidelines on luxury automobile limits and the phase-out rules is crucial for optimizing tax benefits when applying bonus depreciation for business vehicles.

Key Differences Between Section 179 and Bonus Depreciation

Section 179 allows businesses to immediately expense the cost of qualifying property up to a specified limit, benefiting small to medium-sized enterprises with annual caps, while bonus depreciation offers 100% immediate expensing with no dollar limit, primarily favoring larger businesses. Unlike Section 179, bonus depreciation can create a net operating loss by exceeding taxable income and applies to new and used property purchased after September 27, 2017. Section 179 deductions must be applied to property placed in service during the tax year and are subject to income limitations, whereas bonus depreciation is automatically applied unless the taxpayer elects out.

Annual Limits for Section 179 Deduction

Section 179 Deduction allows businesses to expense up to $1,160,000 in qualifying property purchases for the 2023 tax year, with a phase-out threshold beginning at $2,890,000 of total equipment acquisition. Bonus Depreciation has no annual dollar limit and permits businesses to immediately deduct 80% of the cost of eligible assets placed in service during 2023. These differing limits impact strategic tax planning by influencing how much depreciation can be applied in a single tax year.

Qualified Vehicles Under Section 179 and Bonus Depreciation

Qualified vehicles under Section 179 include SUVs, trucks, and vans that meet specific weight and usage criteria, allowing businesses to deduct up to $27,000 for passenger vehicles and higher limits for heavier vehicles. Bonus depreciation permits 100% immediate expensing of qualified new and used vehicles placed in service, with no dollar limit, but applies mainly to vehicles exceeding the Section 179 weight thresholds. Understanding the distinctions in eligibility and deduction limits for passenger cars versus heavier vehicles is crucial for optimizing tax benefits under both Section 179 and bonus depreciation provisions.

Tax Benefits: Maximizing Deductions for Business Cars

Section 179 deduction allows businesses to immediately expense the full purchase price of qualifying business vehicles up to a certain limit, providing significant upfront tax benefits. Bonus depreciation permits a 100% first-year write-off on new and used vehicles without the same limits as Section 179, enabling greater flexibility for high-value purchases. Combining both strategies can maximize tax deductions, reducing taxable income and improving cash flow for vehicle investments in business operations.

Section 179 vs. Bonus Depreciation: Which Is Better for Your Business?

Section 179 deduction allows businesses to immediately expense the full cost of qualifying equipment up to $1,160,000 in 2023, promoting significant upfront tax savings. Bonus depreciation offers 80% immediate expensing for new and used assets placed in service, with no limit on the purchase amount but phases down after 2023. Choosing between Section 179 and bonus depreciation depends on factors like business income, asset cost, and long-term tax strategy, where Section 179 benefits smaller businesses with limited asset acquisition and bonus depreciation suits large investments for maximum current-year deductions.

Impact on Taxes: Immediate vs. Long-Term Write-Offs

Section 179 deduction allows businesses to immediately expense the full cost of qualifying assets, reducing taxable income in the year of purchase and providing immediate tax relief. Bonus depreciation also offers immediate write-offs but applies at a set percentage of the asset's cost, often 100%, and can be applied even if the business does not have taxable income to offset. While Section 179 limits the total deduction based on business income, bonus depreciation allows for larger upfront deductions that can create net operating losses to be carried forward, impacting long-term tax strategies and cash flow management.

Recent Tax Law Changes Affecting Vehicle Deductions

Recent tax law changes have modified Section 179 deduction limits, allowing businesses to expense up to $1,160,000 on qualifying vehicles, with phase-out beginning at $2,890,000 in total equipment purchases for 2024. Bonus depreciation now permits a 100% immediate write-off on new and used vehicles acquired and placed in service, including SUVs and trucks meeting specific weight requirements, through 2023 before phasing down. These updates offer significant tax advantages for businesses investing in vehicles, optimizing cash flow and reducing taxable income under current IRS guidelines.

Step-by-Step Guide to Claiming Car Tax Deductions

Claiming car tax deductions involves understanding Section 179 Deduction and Bonus Depreciation, which allow businesses to recover vehicle costs quickly. Start by determining the car's business use percentage, then choose between deducting up to $1,160,000 under Section 179 or using 100% Bonus Depreciation for qualifying new and used vehicles. Ensure proper documentation, including mileage logs and purchase invoices, to support your deduction when filing taxes.

Section 179 Deduction vs Bonus Depreciation Infographic

cardiffo.com

cardiffo.com