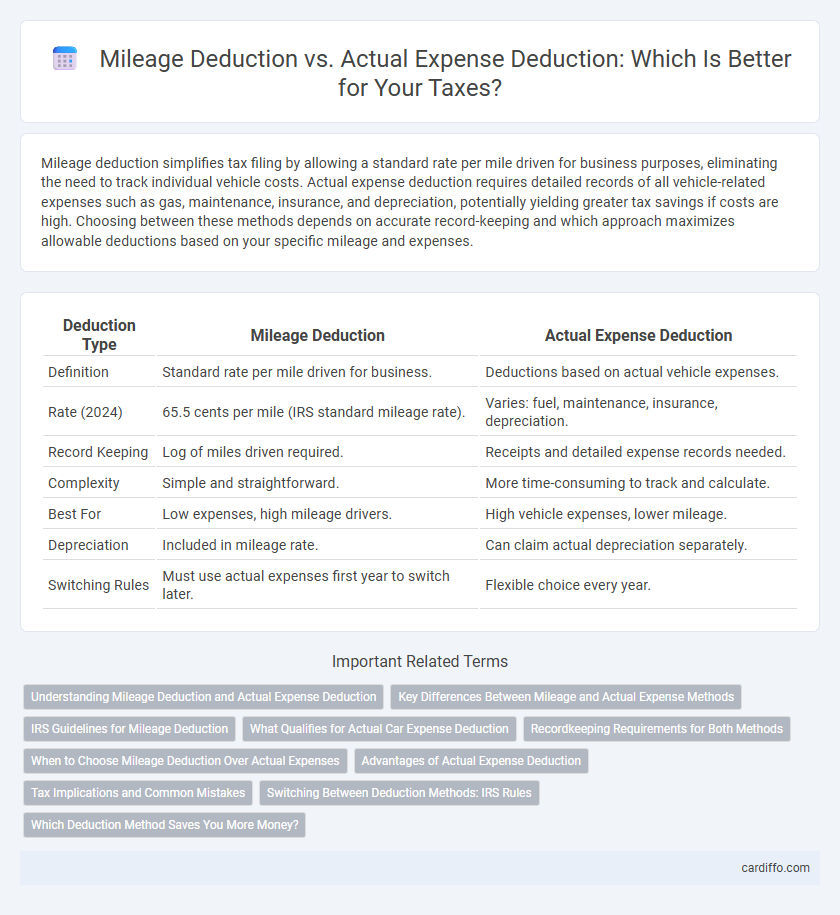

Mileage deduction simplifies tax filing by allowing a standard rate per mile driven for business purposes, eliminating the need to track individual vehicle costs. Actual expense deduction requires detailed records of all vehicle-related expenses such as gas, maintenance, insurance, and depreciation, potentially yielding greater tax savings if costs are high. Choosing between these methods depends on accurate record-keeping and which approach maximizes allowable deductions based on your specific mileage and expenses.

Table of Comparison

| Deduction Type | Mileage Deduction | Actual Expense Deduction |

|---|---|---|

| Definition | Standard rate per mile driven for business. | Deductions based on actual vehicle expenses. |

| Rate (2024) | 65.5 cents per mile (IRS standard mileage rate). | Varies: fuel, maintenance, insurance, depreciation. |

| Record Keeping | Log of miles driven required. | Receipts and detailed expense records needed. |

| Complexity | Simple and straightforward. | More time-consuming to track and calculate. |

| Best For | Low expenses, high mileage drivers. | High vehicle expenses, lower mileage. |

| Depreciation | Included in mileage rate. | Can claim actual depreciation separately. |

| Switching Rules | Must use actual expenses first year to switch later. | Flexible choice every year. |

Understanding Mileage Deduction and Actual Expense Deduction

Mileage deduction allows taxpayers to deduct a standard rate per mile driven for business purposes, simplifying record-keeping with IRS-set rates updated annually. Actual expense deduction requires tracking and totaling all vehicle-related costs such as gas, repairs, insurance, and depreciation to calculate the deductible amount. Choosing between mileage deduction and actual expense deduction depends on which method yields a greater tax benefit based on precise vehicle usage and expenses.

Key Differences Between Mileage and Actual Expense Methods

Mileage deduction allows taxpayers to deduct a standard rate per mile driven for business purposes, simplifying record-keeping by requiring only mileage logs. Actual expense deduction involves tracking all vehicle-related expenses such as gas, maintenance, insurance, and depreciation to determine the deductible amount, often resulting in a higher deduction but necessitating detailed documentation. Choosing between these methods depends on factors like total vehicle expenses, mileage driven annually, and record-keeping preferences to maximize tax benefits.

IRS Guidelines for Mileage Deduction

The IRS allows taxpayers to choose between the standard mileage deduction and actual expense deduction for vehicle use related to business. For the mileage deduction, the IRS sets an annual standard mileage rate, which simplifies recordkeeping by requiring drivers to track only business miles driven instead of detailed vehicle expenses. To qualify for the IRS mileage deduction, taxpayers must maintain contemporaneous logs documenting the date, mileage, and business purpose of each trip in accordance with IRS guidelines.

What Qualifies for Actual Car Expense Deduction

Qualifying for the Actual Car Expense Deduction requires detailed records of all vehicle-related costs including fuel, maintenance, repairs, insurance, registration fees, and depreciation or lease payments. Taxpayers must differentiate personal and business use by maintaining mileage logs to calculate the percentage of business use accurately. The IRS mandates thorough documentation to support claims for actual expenses, ensuring only the business-use portion is deductible.

Recordkeeping Requirements for Both Methods

Mileage deduction requires maintaining a detailed log of miles driven for business purposes, including dates, destinations, and reasons for each trip, to ensure accurate claims. Actual expense deduction demands comprehensive records of all vehicle-related costs such as gas, maintenance, repairs, insurance, and depreciation, supported by receipts and invoices. Both methods must be substantiated with thorough documentation to comply with IRS regulations and maximize allowable deductions.

When to Choose Mileage Deduction Over Actual Expenses

Mileage deduction offers a simpler record-keeping process and is often the optimal choice for taxpayers who drive fewer miles or have lower vehicle operating costs. IRS allows a standard mileage rate that covers fuel, maintenance, depreciation, and insurance, making it beneficial when actual expenses are high or unpredictable. Choosing mileage deduction over actual expenses can reduce audit risk and save time on detailed expense tracking for business mileage.

Advantages of Actual Expense Deduction

Actual expense deduction allows taxpayers to deduct the precise costs of operating a vehicle, including gas, maintenance, insurance, and depreciation, which can result in a higher overall deduction compared to the fixed mileage rate. This method is especially advantageous for individuals with high vehicle expenses or those who drive older, less fuel-efficient cars. Keeping detailed records and receipts enables accurate claim substantiation and maximizes tax savings.

Tax Implications and Common Mistakes

Mileage deduction simplifies tax reporting by allowing a fixed rate per mile driven for business, reducing the need to track detailed expenses, while actual expense deduction requires precise documentation of all vehicle-related costs such as gas, maintenance, and depreciation. Tax implications vary as the mileage rate often results in lower deduction amounts compared to actual expenses, but under-reporting mileage or inaccuracies in expense records can trigger IRS audits and penalties. Common mistakes include failing to keep a mileage log, mixing personal and business miles, and neglecting to retain receipts, which can lead to disallowed deductions and increased tax liabilities.

Switching Between Deduction Methods: IRS Rules

The IRS allows taxpayers to switch between the standard mileage deduction and actual expense deduction methods, but strict rules apply. Taxpayers must use the standard mileage rate the first year a vehicle is placed in service and can opt for actual expenses in later years, though switching back to mileage may be restricted. Accurate record-keeping of mileage logs and vehicle expenses is crucial to comply with IRS regulations and maximize tax benefits.

Which Deduction Method Saves You More Money?

Mileage deduction provides a standardized rate set annually by the IRS, simplifying record-keeping and often yielding higher savings for drivers with low vehicle expenses and high mileage. Actual expense deduction allows taxpayers to deduct all vehicle-related costs, including gas, maintenance, insurance, and depreciation, which benefits those with higher car expenses or luxury vehicles. Choosing the optimal method depends on comparing total actual costs against the IRS mileage rate to maximize tax savings.

Mileage Deduction vs Actual Expense Deduction Infographic

cardiffo.com

cardiffo.com