Choosing between the flat rate mileage method and the actual cost method impacts tax deductions for vehicle expenses. The flat rate mileage method simplifies record-keeping by applying a fixed per-mile rate set by the IRS, while the actual cost method requires detailed tracking of all vehicle-related expenses such as fuel, maintenance, and depreciation. Taxpayers must evaluate which approach maximizes their deductions based on their driving habits and expense patterns.

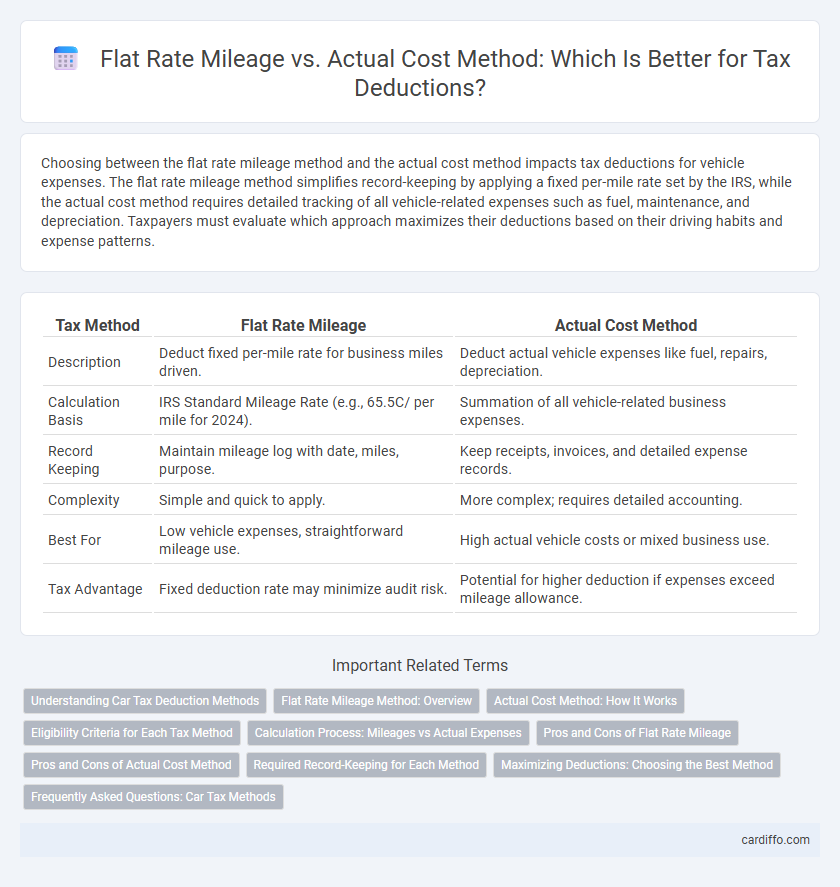

Table of Comparison

| Tax Method | Flat Rate Mileage | Actual Cost Method |

|---|---|---|

| Description | Deduct fixed per-mile rate for business miles driven. | Deduct actual vehicle expenses like fuel, repairs, depreciation. |

| Calculation Basis | IRS Standard Mileage Rate (e.g., 65.5C/ per mile for 2024). | Summation of all vehicle-related business expenses. |

| Record Keeping | Maintain mileage log with date, miles, purpose. | Keep receipts, invoices, and detailed expense records. |

| Complexity | Simple and quick to apply. | More complex; requires detailed accounting. |

| Best For | Low vehicle expenses, straightforward mileage use. | High actual vehicle costs or mixed business use. |

| Tax Advantage | Fixed deduction rate may minimize audit risk. | Potential for higher deduction if expenses exceed mileage allowance. |

Understanding Car Tax Deduction Methods

Understanding car tax deduction methods involves comparing the Flat Rate Mileage method and the Actual Cost method for maximizing tax benefits. The Flat Rate Mileage method allows taxpayers to deduct a standardized rate per mile driven, simplifying record-keeping and providing consistent deductions. The Actual Cost method requires tracking all vehicle-related expenses, such as fuel, maintenance, insurance, and depreciation, enabling potentially larger deductions based on precise costs.

Flat Rate Mileage Method: Overview

The Flat Rate Mileage Method allows taxpayers to deduct a standard mileage rate set by the IRS for business miles driven, simplifying record-keeping by eliminating the need to track actual vehicle expenses. For 2024, the IRS standard mileage rate is 65.5 cents per mile for business use. This method is especially advantageous for individuals seeking straightforward calculations and fewer documentation requirements compared to the Actual Cost Method.

Actual Cost Method: How It Works

The Actual Cost Method requires meticulous tracking of all vehicle-related expenses, including fuel, maintenance, insurance, and depreciation, to accurately calculate deductible business mileage costs. Taxpayers must maintain detailed records and receipts to substantiate their claims, ensuring compliance with IRS requirements. This method often results in higher deductions when operating costs exceed the standard mile rate, especially for vehicles with significant expenses.

Eligibility Criteria for Each Tax Method

The Flat Rate Mileage method applies to taxpayers who use a personal vehicle for business purposes and have simplified record-keeping requirements, typically available for vehicles with fewer than 5,000 miles driven annually for business. The Actual Cost method requires detailed documentation of all vehicle-related expenses, including fuel, maintenance, insurance, and depreciation, making it suitable for those who can maintain thorough records and have higher business mileage. Eligibility for the Actual Cost method is limited to taxpayers who choose this method in the first year the vehicle is used and must consistently apply it for that vehicle unless IRS permission for change is obtained.

Calculation Process: Mileages vs Actual Expenses

The Flat Rate Mileage method calculates deductible expenses by multiplying the total business miles driven by the IRS-approved standard mileage rate, simplifying record-keeping and reducing documentation requirements. In contrast, the Actual Cost method requires detailed tracking and totaling of all vehicle-related expenses such as fuel, maintenance, insurance, depreciation, and lease payments, allowing for a potentially higher deduction based on actual expenditures. Taxpayers must maintain accurate logs and receipts to substantiate deductions with the Actual Cost method, while Flat Rate Mileage relies primarily on mileage logs verified against a fixed rate.

Pros and Cons of Flat Rate Mileage

The Flat Rate Mileage method simplifies tax deductions by allowing a fixed rate per mile driven, eliminating the need to track actual vehicle expenses, which saves time and reduces administrative burden for taxpayers. However, this method may result in lower deductions compared to the Actual Cost method if vehicle operating expenses, such as depreciation, gas, and maintenance, are high. Taxpayers with fuel-efficient or low-cost vehicles might benefit more from the flat rate, while those with expensive or high-mileage vehicles often maximize deductions using the Actual Cost method.

Pros and Cons of Actual Cost Method

The Actual Cost Method allows taxpayers to deduct the exact expenses related to vehicle use, including fuel, maintenance, insurance, and depreciation, providing potentially higher deductions for high-cost or frequently used vehicles. However, this method requires meticulous record-keeping and organization of receipts, which can be time-consuming and prone to errors. It is less straightforward than the Flat Rate Mileage Method and may result in more complex tax filings and increased audit risk due to detailed expense documentation.

Required Record-Keeping for Each Method

The Flat Rate Mileage method requires detailed mileage logs documenting the date, purpose, and miles driven for business purposes to substantiate deduction claims during tax filing. The Actual Cost Method demands comprehensive records of all expenses related to vehicle operation, including fuel, maintenance, insurance, depreciation, and repairs, along with mileage logs to differentiate business from personal use. Proper and accurate record-keeping for both methods ensures compliance with IRS regulations and maximizes allowable tax deductions.

Maximizing Deductions: Choosing the Best Method

Maximizing deductions requires evaluating the benefits of the flat rate mileage method versus the actual cost method based on vehicle usage and expenses. The flat rate mileage method simplifies record-keeping with a standard per-mile rate set by the IRS, ideal for low maintenance and fuel costs. The actual cost method allows deductions for all vehicle-related expenses, maximizing deductions when fuel, repairs, and depreciation are high, but demands thorough documentation.

Frequently Asked Questions: Car Tax Methods

The Flat Rate Mileage method allows taxpayers to deduct a standard mileage rate set by the IRS, simplifying record-keeping without the need to track individual expenses. In contrast, the Actual Cost method requires detailed documentation of all vehicle-related expenses, including gas, maintenance, insurance, and depreciation, potentially yielding higher deductions. Choosing between these car tax methods depends on factors such as mileage driven, vehicle expenses, and record accuracy, influencing overall tax savings.

Flat Rate Mileage vs Actual Cost Method Infographic

cardiffo.com

cardiffo.com