The Green Car Tax Discount offers a significant reduction in vehicle registration fees for electric and low-emission cars compared to the Standard Rate applied to traditional gasoline or diesel vehicles. This tax incentive encourages eco-friendly choices by lowering the overall cost of ownership for green vehicles. Consumers can save money upfront and contribute to environmental sustainability through reduced carbon emissions.

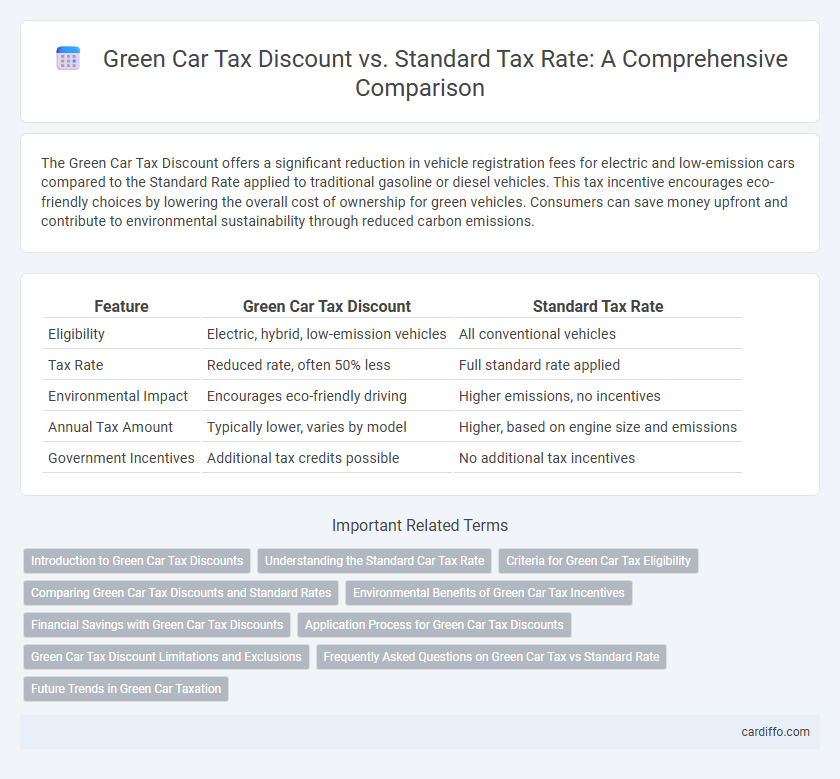

Table of Comparison

| Feature | Green Car Tax Discount | Standard Tax Rate |

|---|---|---|

| Eligibility | Electric, hybrid, low-emission vehicles | All conventional vehicles |

| Tax Rate | Reduced rate, often 50% less | Full standard rate applied |

| Environmental Impact | Encourages eco-friendly driving | Higher emissions, no incentives |

| Annual Tax Amount | Typically lower, varies by model | Higher, based on engine size and emissions |

| Government Incentives | Additional tax credits possible | No additional tax incentives |

Introduction to Green Car Tax Discounts

Green car tax discounts reduce the Standard Rate vehicle tax for low-emission vehicles, promoting environmentally friendly transportation choices. These discounts apply to electric, hybrid, and alternative fuel vehicles with significantly lower carbon emissions compared to traditional petrol or diesel cars. Tax incentives encourage the adoption of green cars by lowering annual road tax costs, supporting government efforts to reduce air pollution and combat climate change.

Understanding the Standard Car Tax Rate

The standard car tax rate applies to most vehicles based on engine size, emissions, and fuel type, often resulting in higher costs compared to the Green Car Tax Discount. This rate helps fund environmental initiatives but penalizes cars with higher CO2 emissions, encouraging consumers to choose cleaner, more efficient models. Understanding this system clarifies the financial benefits of adopting vehicles eligible for the Green Car Tax Discount and highlights the environmental impact tied to tax categories.

Criteria for Green Car Tax Eligibility

Green Car Tax Discount eligibility requires vehicles to meet specific emissions standards, typically producing CO2 emissions below a set threshold, such as 75 grams per kilometer. Eligible vehicles often include fully electric, plug-in hybrid, and hydrogen fuel cell models that demonstrate reduced environmental impact. Compliance with these criteria ensures drivers benefit from reduced tax rates compared to the Standard Rate applied to higher-emission vehicles.

Comparing Green Car Tax Discounts and Standard Rates

Green car tax discounts significantly reduce the taxable amount on environmentally friendly vehicles, often lowering the rate by 15-20% compared to the standard rate applicable to conventional cars. These discounts incentivize the adoption of electric and hybrid cars by providing tax relief that directly correlates with reduced emissions and fuel efficiency. In contrast, the standard rate applies to traditional combustion engine vehicles, resulting in higher tax liabilities due to their greater environmental impact.

Environmental Benefits of Green Car Tax Incentives

Green Car Tax Discounts significantly reduce carbon emissions by promoting the adoption of low-emission and electric vehicles, which contribute to cleaner air and lower greenhouse gas levels. These incentives encourage consumers to choose fuel-efficient and eco-friendly cars over standard gasoline vehicles, leading to decreased reliance on fossil fuels. As a result, green car tax policies help advance national sustainability goals and support a transition to a greener transportation sector.

Financial Savings with Green Car Tax Discounts

Green Car Tax Discounts provide significant financial savings by reducing or eliminating Vehicle Excise Duty compared to the Standard Rate applied to conventional vehicles. These discounts can lower annual tax costs by up to 100%, making electric and hybrid cars more affordable over time. Tax incentives encourage environmentally friendly choices while delivering measurable benefits to individual budgets.

Application Process for Green Car Tax Discounts

The application process for Green Car Tax Discounts requires submitting specific documentation proving vehicle eligibility, such as electric or hybrid certification and registration details to the tax authority. Taxpayers must complete designated forms and provide purchase invoices or lease agreements within specified deadlines to qualify. Verification steps include timely submission through online portals or authorized tax centers to expedite approval and discount application.

Green Car Tax Discount Limitations and Exclusions

Green Car Tax Discount limitations include eligibility criteria based on vehicle emissions and engine type, excluding hybrids with emissions above the set threshold from qualifying. Certain models may be excluded due to insufficient electric range or failure to meet environmental standards, limiting the discount's applicability. Standard rate taxpayers do not benefit from these exclusions but face higher tax liabilities, impacting overall vehicle ownership costs.

Frequently Asked Questions on Green Car Tax vs Standard Rate

Green Car Tax Discount offers reduced Vehicle Excise Duty rates compared to the Standard Rate, incentivizing low-emission vehicles with savings up to 100% on first-year tax and significantly lower rates thereafter. Frequently asked questions often address eligibility criteria, emission thresholds for discounts, and how the tax difference impacts long-term ownership costs. Understanding these details helps taxpayers maximize benefits by selecting vehicles that qualify under green tax schemes versus standard tax liabilities.

Future Trends in Green Car Taxation

Green car tax discounts are expected to expand as governments worldwide implement stricter emission regulations to encourage electric and hybrid vehicle adoption. Future trends indicate increasing differentiation in tax rates based on vehicle emissions, battery range, and energy efficiency, incentivizing cleaner technologies. Standard rates on traditional combustion engine vehicles are likely to rise, reflecting carbon pricing policies and climate goals.

Green Car Tax Discount vs Standard Rate Infographic

cardiffo.com

cardiffo.com