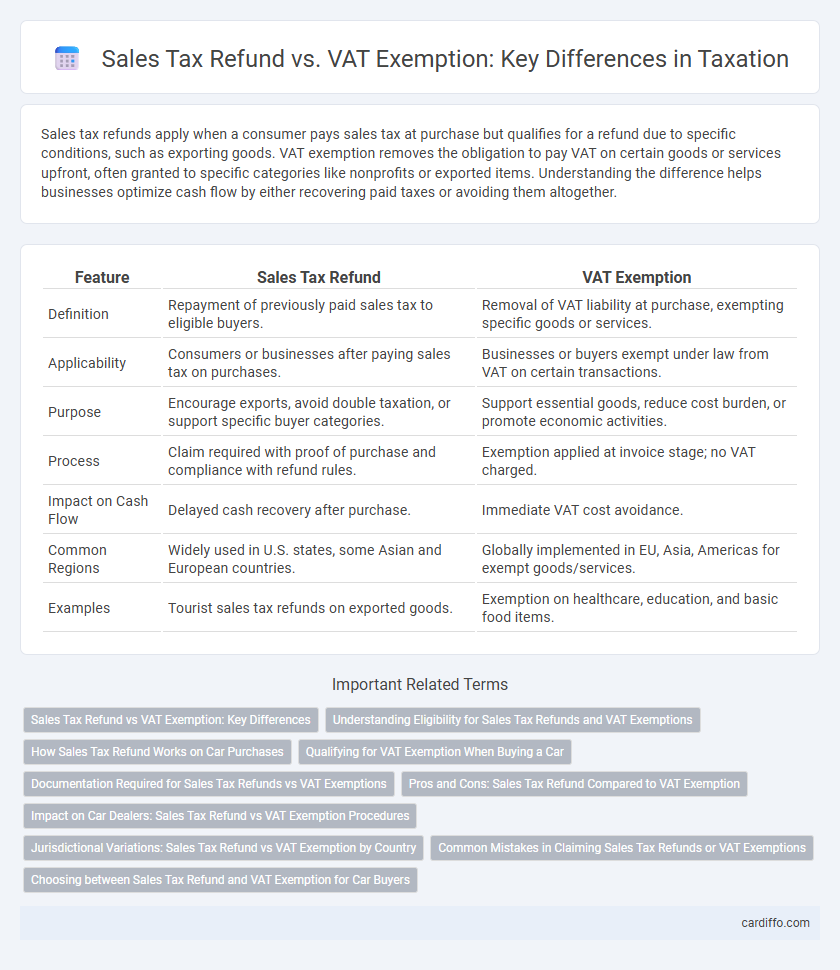

Sales tax refunds apply when a consumer pays sales tax at purchase but qualifies for a refund due to specific conditions, such as exporting goods. VAT exemption removes the obligation to pay VAT on certain goods or services upfront, often granted to specific categories like nonprofits or exported items. Understanding the difference helps businesses optimize cash flow by either recovering paid taxes or avoiding them altogether.

Table of Comparison

| Feature | Sales Tax Refund | VAT Exemption |

|---|---|---|

| Definition | Repayment of previously paid sales tax to eligible buyers. | Removal of VAT liability at purchase, exempting specific goods or services. |

| Applicability | Consumers or businesses after paying sales tax on purchases. | Businesses or buyers exempt under law from VAT on certain transactions. |

| Purpose | Encourage exports, avoid double taxation, or support specific buyer categories. | Support essential goods, reduce cost burden, or promote economic activities. |

| Process | Claim required with proof of purchase and compliance with refund rules. | Exemption applied at invoice stage; no VAT charged. |

| Impact on Cash Flow | Delayed cash recovery after purchase. | Immediate VAT cost avoidance. |

| Common Regions | Widely used in U.S. states, some Asian and European countries. | Globally implemented in EU, Asia, Americas for exempt goods/services. |

| Examples | Tourist sales tax refunds on exported goods. | Exemption on healthcare, education, and basic food items. |

Sales Tax Refund vs VAT Exemption: Key Differences

Sales tax refund allows businesses or consumers to reclaim sales tax already paid on eligible purchases, whereas VAT exemption means certain goods or services are not subject to VAT from the outset. Sales tax refunds are typically claimed after a transaction, requiring documentation and approval, while VAT exemptions reduce tax liability by excluding specific items from VAT charges. Understanding these distinctions is crucial for accurate tax compliance and maximizing financial benefits in cross-border trade and domestic transactions.

Understanding Eligibility for Sales Tax Refunds and VAT Exemptions

Eligibility for sales tax refunds typically requires proof of purchase and evidence that the goods or services qualify under specific local regulations, such as items intended for resale or for use outside the jurisdiction. VAT exemptions often apply to particular categories like exports, educational materials, or healthcare products, necessitating compliance with predefined criteria established by tax authorities. Accurate documentation and clear understanding of qualifying conditions are essential to secure benefits from both sales tax refunds and VAT exemptions.

How Sales Tax Refund Works on Car Purchases

Sales tax refunds on car purchases allow buyers to reclaim the sales tax paid when the vehicle is used for specific purposes or exported outside the taxing jurisdiction, subject to state or local regulations. To qualify, buyers typically must provide proof of purchase, export documentation, and submit a refund claim within a designated time frame. This process contrasts with VAT exemption, where sales tax or VAT is not charged at the point of sale under qualifying conditions, such as business use or diplomatic status.

Qualifying for VAT Exemption When Buying a Car

Qualifying for VAT exemption when buying a car typically requires meeting specific criteria such as commercial use, eligibility under government schemes, or status as a diplomatic entity. Unlike sales tax refunds, which involve reclaiming taxes paid, VAT exemption prevents the tax from being charged at the point of purchase. Understanding the legal requirements and documentation needed ensures eligibility and maximizes cost savings during vehicle acquisition.

Documentation Required for Sales Tax Refunds vs VAT Exemptions

Sales tax refunds require original purchase invoices, proof of payment, and completed refund claim forms to verify eligible transactions. VAT exemptions demand valid exemption certificates or authorization letters from relevant tax authorities, along with detailed sales documentation indicating the exempt status. Accurate and comprehensive documentation ensures compliance and smooth processing for both sales tax refunds and VAT exemptions.

Pros and Cons: Sales Tax Refund Compared to VAT Exemption

Sales tax refund allows businesses to recover taxes paid on purchases, improving cash flow but often involves complex documentation and lengthy processing times. VAT exemption eliminates the tax liability upfront, reducing costs on qualifying goods or services but may limit input tax credit claims and require strict compliance with exemption criteria. Choosing between sales tax refund and VAT exemption depends on the business's cash flow needs and administrative capacity to manage tax recovery procedures.

Impact on Car Dealers: Sales Tax Refund vs VAT Exemption Procedures

Car dealers face distinct operational impacts when navigating sales tax refund versus VAT exemption procedures, with sales tax refunds often requiring detailed documentation submission and longer processing times, affecting cash flow and inventory turnover. VAT exemptions reduce the tax burden upfront, simplifying accounting processes but may limit eligibility to specific transactions or customer types, influencing pricing strategies. Understanding the regulatory nuances and compliance requirements in these tax mechanisms is critical for optimizing financial management within the automotive sales sector.

Jurisdictional Variations: Sales Tax Refund vs VAT Exemption by Country

Jurisdictional variations in sales tax refund and VAT exemption policies significantly impact cross-border transactions and business compliance strategies. Countries like the United States primarily use sales tax refunds for non-resident consumers, while EU member states implement VAT exemptions for specific goods and services, reflecting differing regulatory frameworks. Understanding these distinctions aids businesses in optimizing tax benefits and adhering to local laws effectively.

Common Mistakes in Claiming Sales Tax Refunds or VAT Exemptions

Common mistakes in claiming sales tax refunds or VAT exemptions include submitting incomplete documentation, failing to meet eligibility criteria, and missing strict filing deadlines. Many businesses overlook the specific regulations for different jurisdictions, leading to denied claims or delays. Ensuring accurate records and understanding local tax laws significantly reduces errors in the refund or exemption process.

Choosing between Sales Tax Refund and VAT Exemption for Car Buyers

Car buyers should evaluate eligibility criteria and jurisdictional regulations when choosing between sales tax refund and VAT exemption to optimize cost savings. Sales tax refund often requires proof of export or resale, while VAT exemption depends on buyer status, such as diplomats or certain organizations. Understanding local tax laws and required documentation ensures compliance and maximizes financial benefits.

Sales tax refund vs VAT exemption Infographic

cardiffo.com

cardiffo.com