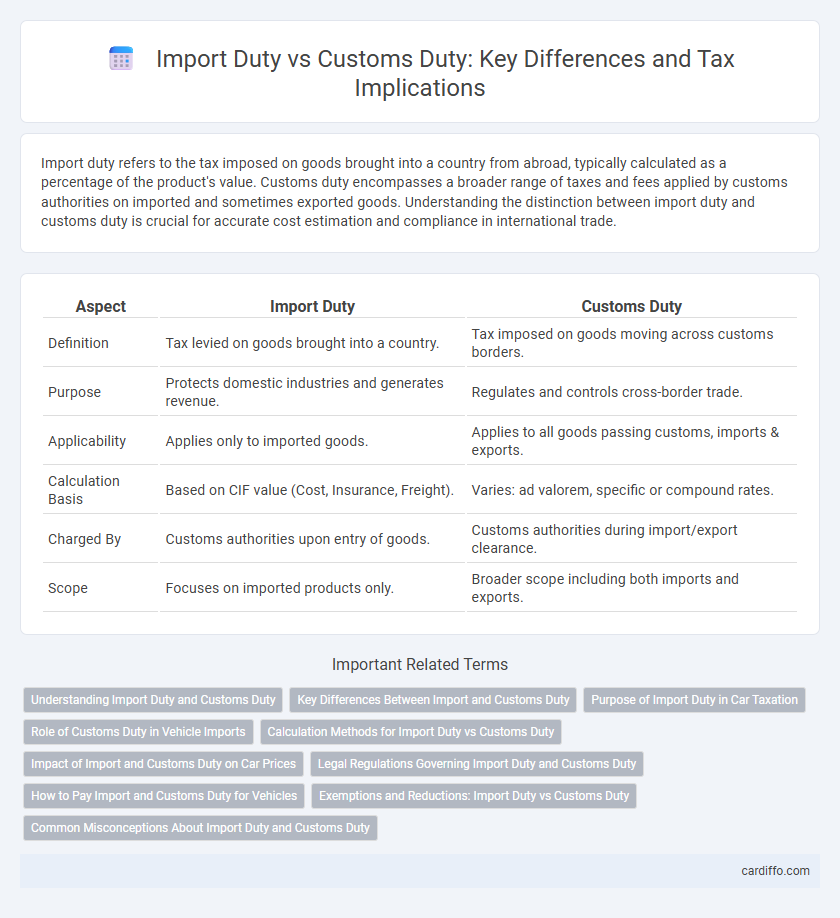

Import duty refers to the tax imposed on goods brought into a country from abroad, typically calculated as a percentage of the product's value. Customs duty encompasses a broader range of taxes and fees applied by customs authorities on imported and sometimes exported goods. Understanding the distinction between import duty and customs duty is crucial for accurate cost estimation and compliance in international trade.

Table of Comparison

| Aspect | Import Duty | Customs Duty |

|---|---|---|

| Definition | Tax levied on goods brought into a country. | Tax imposed on goods moving across customs borders. |

| Purpose | Protects domestic industries and generates revenue. | Regulates and controls cross-border trade. |

| Applicability | Applies only to imported goods. | Applies to all goods passing customs, imports & exports. |

| Calculation Basis | Based on CIF value (Cost, Insurance, Freight). | Varies: ad valorem, specific or compound rates. |

| Charged By | Customs authorities upon entry of goods. | Customs authorities during import/export clearance. |

| Scope | Focuses on imported products only. | Broader scope including both imports and exports. |

Understanding Import Duty and Customs Duty

Import duty is a tax imposed on goods entering a country, calculated based on the product's value, type, and origin, designed to protect domestic industries and generate government revenue. Customs duty encompasses import duty and other fees collected by customs authorities during the clearance process, including excise taxes and service charges. Understanding the distinction helps businesses accurately estimate costs and comply with international trade regulations.

Key Differences Between Import and Customs Duty

Import duty specifically refers to the tax imposed on goods brought into a country, calculated based on the type, value, and quantity of the imported items. Customs duty encompasses all tariffs and taxes levied by customs authorities on goods entering or leaving a country, including import duty, export duty, and other applicable charges. The key difference lies in import duty being a subset of customs duty, primarily focused on inbound goods, whereas customs duty covers a broader scope of taxation related to cross-border trade.

Purpose of Import Duty in Car Taxation

Import duty in car taxation primarily functions to generate government revenue and protect domestic automotive industries by imposing taxes on vehicles brought into a country. It helps regulate market competition by making imported cars relatively more expensive compared to locally manufactured ones. This duty encourages the growth of local manufacturing and reduces dependency on foreign vehicle imports.

Role of Customs Duty in Vehicle Imports

Customs duty plays a crucial role in regulating vehicle imports by imposing taxes based on the vehicle's value, type, and engine capacity, thereby protecting domestic automobile industries from foreign competition. This duty ensures proper revenue collection for governments and supports policies aiming to control the quality and safety standards of imported vehicles. Distinct from import duty, customs duty specifically addresses border control measures and adherence to import regulations related to vehicles.

Calculation Methods for Import Duty vs Customs Duty

Import duty is calculated based on the assessable value of the goods, which typically includes the cost, insurance, and freight (CIF) value, multiplied by the applicable tariff rate specified by the importing country's regulations. Customs duty calculation may involve additional factors such as quantity, weight, or volume, and can include specific duties or ad valorem duties depending on the classification assigned by the harmonized system code. Both import duty and customs duty calculations require accurate valuation and classification to determine the precise amount payable at the point of entry.

Impact of Import and Customs Duty on Car Prices

Import duty directly increases the cost of vehicles by adding a percentage fee on the car's value at the time of entry, raising the final retail price for consumers. Customs duty involves government-imposed taxes on goods crossing international borders, which can significantly affect the pricing structure of imported cars by increasing landed costs. Both import and customs duties contribute to higher car prices, influencing consumer demand and potentially shifting buyer preference toward domestically produced vehicles.

Legal Regulations Governing Import Duty and Customs Duty

Import duty and customs duty are regulated under international trade laws and national legal frameworks such as the Harmonized System (HS) codes and the World Trade Organization (WTO) agreements. Legal regulations mandate specific tariff classifications, valuation methods, and procedural compliance requirements for determining the applicable import duty or customs duty on goods crossing borders. Enforcement agencies rely on customs laws and import duty regulations to ensure proper tax collection, prevent smuggling, and protect domestic industries.

How to Pay Import and Customs Duty for Vehicles

To pay import duty and customs duty for vehicles, first determine the applicable rates based on the vehicle's category, engine size, and country of origin using the customs tariff schedule. Submit the necessary documentation including the bill of lading, vehicle registration, and invoice to the customs authority, then calculate the total duty payable through their online portal or designated payment centers. Ensure timely payment of assessed duties to avoid penalties, often facilitated through electronic funds transfer or bank draft at authorized institutions.

Exemptions and Reductions: Import Duty vs Customs Duty

Import duty and customs duty often overlap, but exemptions and reductions vary significantly depending on the jurisdiction and type of goods imported. Import duty exemptions commonly apply to diplomatic shipments, humanitarian aid, and goods temporarily imported for repair or exhibition, whereas customs duty reductions are frequently offered under free trade agreements or for goods qualifying as essential or for manufacturing inputs. Understanding these nuances allows businesses to optimize import costs by leveraging specific exemption eligibility and preferential tariff rates tied to customs regulations.

Common Misconceptions About Import Duty and Customs Duty

Common misconceptions about import duty and customs duty often confuse their definitions and applications, with many believing they are interchangeable terms. Import duty specifically refers to taxes imposed on goods brought into a country, whereas customs duty encompasses a broader range of taxes and fees collected by customs authorities during the import or export processes. Understanding the distinct roles and regulations governing import duty and customs duty is essential for accurate tax compliance and avoiding penalties in international trade.

Import Duty vs Customs Duty Infographic

cardiffo.com

cardiffo.com