Ad Valorem tax is calculated as a percentage of the item's value, making it proportional to the price, while specific tax is a fixed amount charged per unit regardless of price. Businesses often struggle with forecasting revenues from Ad Valorem taxes due to fluctuating prices, whereas specific taxes provide predictable income but may not keep pace with inflation. Policymakers choose between these taxes based on objectives such as fairness, simplicity, and administrative efficiency.

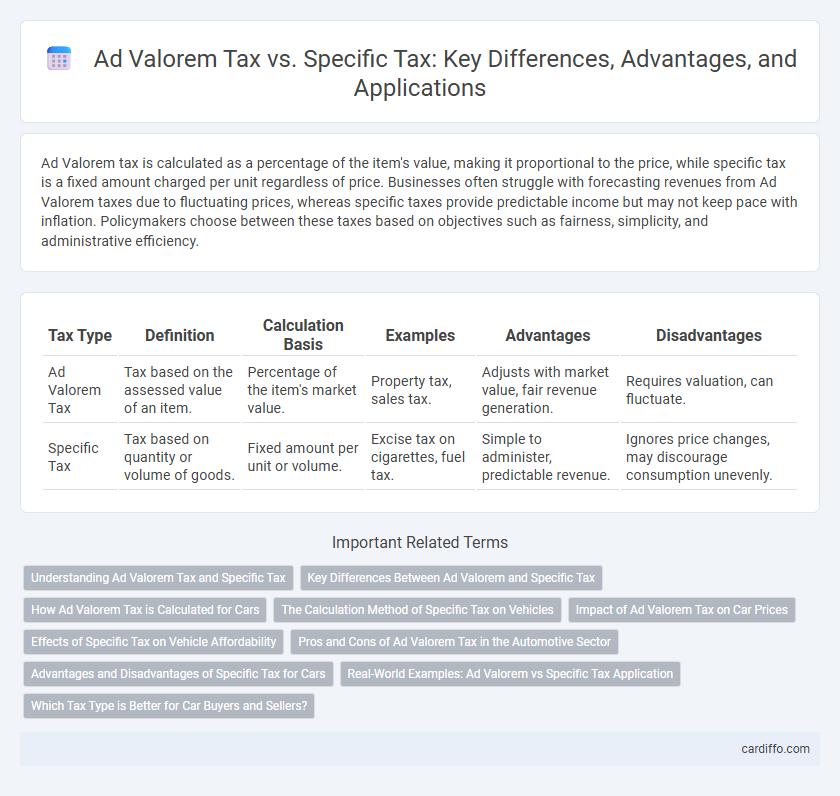

Table of Comparison

| Tax Type | Definition | Calculation Basis | Examples | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Ad Valorem Tax | Tax based on the assessed value of an item. | Percentage of the item's market value. | Property tax, sales tax. | Adjusts with market value, fair revenue generation. | Requires valuation, can fluctuate. |

| Specific Tax | Tax based on quantity or volume of goods. | Fixed amount per unit or volume. | Excise tax on cigarettes, fuel tax. | Simple to administer, predictable revenue. | Ignores price changes, may discourage consumption unevenly. |

Understanding Ad Valorem Tax and Specific Tax

Ad Valorem tax is calculated based on the assessed value of an item, such as property or goods, which means the tax amount fluctuates with the market value. Specific tax is a fixed amount imposed per unit, like per liter of fuel or per pack of cigarettes, regardless of the product's price. Understanding these two tax types highlights how Ad Valorem taxes adjust with value changes, promoting equity, while Specific taxes provide predictable revenue streams for governments.

Key Differences Between Ad Valorem and Specific Tax

Ad valorem tax is calculated as a percentage of the value of the item, making it sensitive to price fluctuations and directly tied to the market value, whereas specific tax is a fixed amount per unit regardless of price, providing predictable revenue. Ad valorem tax is commonly applied to property and sales taxes, ensuring higher-value items are taxed more, while specific tax is often used in excise taxes on goods like tobacco and alcohol. The key differences lie in their calculation methods and impact on consumer pricing, with ad valorem adjusting with value and specific tax remaining constant per unit.

How Ad Valorem Tax is Calculated for Cars

Ad Valorem tax on cars is calculated based on the vehicle's assessed market value, typically determined by factors such as make, model, age, and condition. The tax rate, expressed as a percentage of the car's value, is applied annually or at the time of purchase, resulting in a variable tax amount that fluctuates with the vehicle's worth. This contrasts with specific tax, which is a fixed amount per unit regardless of value.

The Calculation Method of Specific Tax on Vehicles

Specific tax on vehicles is calculated based on a fixed amount per unit, such as a certain sum per horsepower or engine displacement, regardless of the vehicle's market value. This method provides predictability in revenue collection and simplifies administration compared to ad valorem tax, which depends on the vehicle's assessed value. Governments often apply specific taxes to ensure consistent tax revenue from vehicle registrations and to target particular types of vehicles for fiscal or environmental policy reasons.

Impact of Ad Valorem Tax on Car Prices

Ad valorem tax on cars is calculated as a percentage of the vehicle's market value, resulting in higher taxes for more expensive models. This pricing structure incentivizes consumers to opt for lower-priced vehicles, effectively reducing demand for luxury models. Car manufacturers may adjust production and pricing strategies to accommodate the variable tax burden imposed by ad valorem taxation.

Effects of Specific Tax on Vehicle Affordability

Specific tax on vehicles increases the upfront cost by applying a fixed amount per unit, which can disproportionately impact affordability, especially for lower-priced models. This tax structure reduces consumer purchasing power, leading to decreased demand and potentially slower vehicle sales in price-sensitive segments. Unlike ad valorem tax, specific tax does not fluctuate with vehicle price, making it less flexible in reflecting market value changes but more predictable for revenue forecasting.

Pros and Cons of Ad Valorem Tax in the Automotive Sector

Ad valorem tax in the automotive sector is calculated based on the vehicle's value, ensuring higher-value cars contribute more revenue, which can support progressive taxation principles and better fund public infrastructure. This tax type adapts to market fluctuations, providing government revenue stability during inflation but can increase administrative costs due to the need for frequent vehicle appraisals and valuation accuracy. However, the variability in tax amounts may discourage the purchase of luxury vehicles, potentially impacting automobile market dynamics and consumer behavior.

Advantages and Disadvantages of Specific Tax for Cars

Specific tax on cars offers predictability in revenue collection by imposing a fixed amount per unit, simplifying administration and compliance. However, it may not keep pace with inflation or changes in car value, potentially leading to revenue shortfalls over time. This tax structure can also disproportionately burden lower-priced vehicles, reducing fairness in taxation.

Real-World Examples: Ad Valorem vs Specific Tax Application

Ad valorem tax is commonly applied to property taxes where the tax amount is determined by the assessed value of real estate, such as residential home taxes in the United States based on market value. Specific tax is frequently used in excise taxes on goods like gasoline, where a fixed amount is charged per gallon regardless of price fluctuations. In real-world scenarios, countries like India employ ad valorem taxes on imported goods calculated as a percentage of their value, while specific taxes are used on tobacco products to control consumption through fixed levies per unit sold.

Which Tax Type is Better for Car Buyers and Sellers?

Ad valorem tax, calculated as a percentage of the vehicle's value, provides a fairer tax burden for car buyers and sellers by aligning tax liability with the car's market price. Specific tax, a fixed amount based on quantity or units, may simplify administration but can disproportionately affect buyers of cheaper or luxury vehicles. For car buyers seeking equity and sellers wanting accurate valuation-based taxation, ad valorem tax is generally the better choice.

Ad Valorem Tax vs Specific Tax Infographic

cardiffo.com

cardiffo.com