The CO2 emissions tax targets environmental impact by charging vehicles based on their carbon footprint, encouraging cleaner transportation choices. Road usage tax is primarily designed to fund infrastructure maintenance and varies according to distance traveled or vehicle type. Balancing these taxes can lead to both reduced emissions and sustainable road funding.

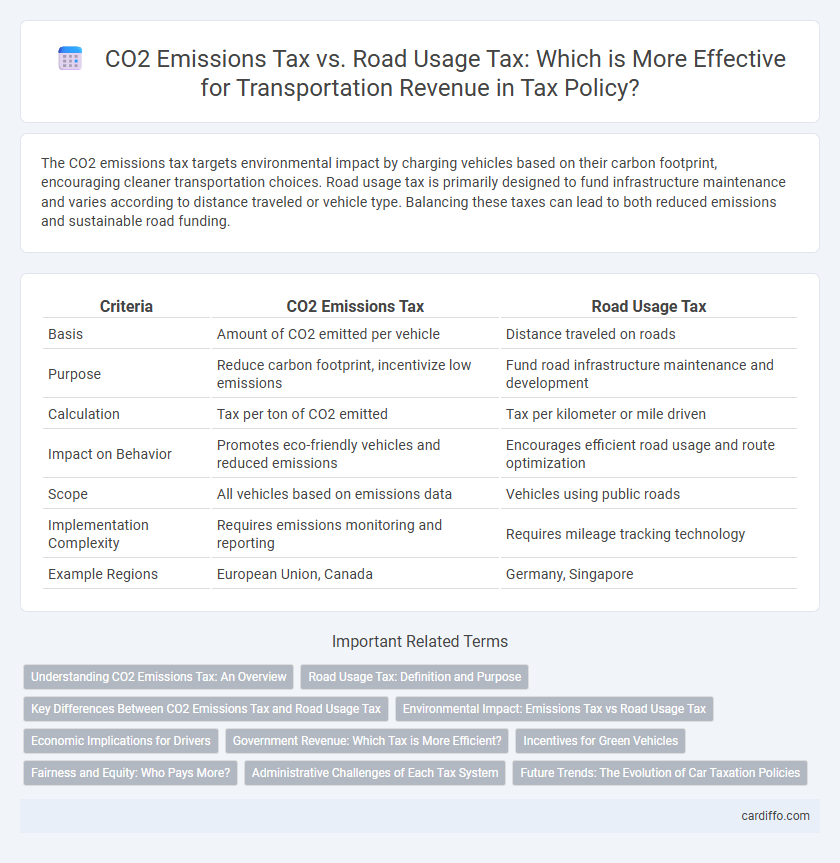

Table of Comparison

| Criteria | CO2 Emissions Tax | Road Usage Tax |

|---|---|---|

| Basis | Amount of CO2 emitted per vehicle | Distance traveled on roads |

| Purpose | Reduce carbon footprint, incentivize low emissions | Fund road infrastructure maintenance and development |

| Calculation | Tax per ton of CO2 emitted | Tax per kilometer or mile driven |

| Impact on Behavior | Promotes eco-friendly vehicles and reduced emissions | Encourages efficient road usage and route optimization |

| Scope | All vehicles based on emissions data | Vehicles using public roads |

| Implementation Complexity | Requires emissions monitoring and reporting | Requires mileage tracking technology |

| Example Regions | European Union, Canada | Germany, Singapore |

Understanding CO2 Emissions Tax: An Overview

CO2 emissions tax directly targets the carbon dioxide output of vehicles, incentivizing cleaner transportation choices and reducing environmental impact. Unlike road usage tax, which charges based on distance traveled regardless of emissions, CO2 emissions tax promotes sustainable behavior by linking costs to pollution levels. This tax mechanism supports national climate goals by encouraging lower emissions and fostering the adoption of electric and hybrid vehicles.

Road Usage Tax: Definition and Purpose

Road usage tax is a fee imposed on motorists based on the distance traveled or the weight of their vehicle, aiming to fund infrastructure maintenance and reduce traffic congestion. This tax incentivizes efficient vehicle use while directly linking road wear and emissions to the taxpayer, addressing environmental impacts tied to transportation. Unlike CO2 emissions tax, road usage tax targets road consumption, ensuring sustainable financing for transportation networks.

Key Differences Between CO2 Emissions Tax and Road Usage Tax

CO2 emissions tax directly targets the environmental impact of vehicles by charging based on the amount of carbon dioxide emitted, incentivizing lower emissions and cleaner technology adoption. Road usage tax, however, is primarily levied on distance traveled or time spent on roads, focusing on infrastructure funding and traffic regulation without directly addressing emissions. The key difference lies in their objectives: CO2 emissions tax aims to reduce pollution and combat climate change, while road usage tax ensures road maintenance and equitable cost distribution among all drivers.

Environmental Impact: Emissions Tax vs Road Usage Tax

CO2 emissions tax directly targets the environmental impact by charging based on the amount of greenhouse gases released, incentivizing businesses and individuals to adopt cleaner technologies and reduce carbon footprints. In contrast, road usage tax primarily generates revenue from vehicle usage regardless of emissions levels, offering limited direct influence on reducing pollution or promoting sustainable transportation. Emissions tax aligns more effectively with climate goals by encouraging behavioral changes that lower overall carbon emissions.

Economic Implications for Drivers

CO2 emissions tax directly incentivizes drivers to reduce carbon footprints by increasing costs on fuel consumption based on emission levels, promoting environmentally conscious vehicle choices and behaviors. Road usage tax, typically calculated on distance traveled or vehicle type, generates stable infrastructure funding but may not effectively encourage lower emissions or fuel efficiency. Economic implications for drivers include higher ongoing expenses under CO2 taxes tied to fuel efficiency improvements, while road usage taxes ensure predictable costs linked to road wear and use patterns without directly impacting emissions.

Government Revenue: Which Tax is More Efficient?

CO2 emissions tax directly targets environmental pollution by charging based on the carbon output of vehicles, generating revenue aligned with sustainability goals. Road usage tax collects fees based on distance traveled or vehicle type, offering a stable and predictable income source for infrastructure maintenance. Comparing efficiency, CO2 emissions tax incentivizes lower emissions but may yield variable revenues, while road usage tax provides consistent funding independent of environmental impact.

Incentives for Green Vehicles

CO2 emissions tax directly incentivizes green vehicles by linking tax rates to the environmental impact, encouraging the adoption of low-emission or electric cars. Road usage tax, typically based on distance traveled or vehicle weight, lacks a direct connection to emissions and may not effectively promote cleaner transportation choices. Targeted CO2 taxes create financial benefits for energy-efficient vehicles, accelerating the transition to sustainable mobility.

Fairness and Equity: Who Pays More?

CO2 emissions tax targets vehicle owners based on environmental impact, charging higher fees to those with higher emissions, promoting fairness by incentivizing cleaner transportation choices. Road usage tax charges drivers based on distance traveled, regardless of emissions, which may disproportionately affect low-income individuals relying on longer commutes or older, less efficient vehicles. Equity concerns arise as CO2 taxes reward greener behavior, while road usage taxes may impose greater financial burdens on vulnerable populations without directly addressing environmental impact.

Administrative Challenges of Each Tax System

CO2 emissions tax faces administrative challenges such as accurately measuring and verifying vehicle emissions data, requiring sophisticated monitoring systems and regular updates to emission standards. Road usage tax implementation struggles with tracking individual mileage, especially for vehicles traveling across jurisdictions, necessitating complex GPS-based reporting or physical checkpoints. Both tax systems demand robust data collection infrastructure, but CO2 emissions tax emphasizes environmental data accuracy, while road usage tax prioritizes real-time distance monitoring and user compliance enforcement.

Future Trends: The Evolution of Car Taxation Policies

Emerging tax policies are increasingly shifting from traditional road usage taxes to CO2 emissions-based taxation, reflecting growing environmental concerns and commitments to reducing carbon footprints. Governments are leveraging advanced telematics and emissions data to implement dynamic, usage-sensitive CO2 taxes that incentivize low-emission vehicles and sustainable driving behaviors. This evolution signals a transformative approach in car taxation, promoting cleaner transportation and aligning fiscal measures with climate change mitigation goals.

CO2 emissions tax vs road usage tax Infographic

cardiffo.com

cardiffo.com