Annual vehicle tax requires yearly payments based on the vehicle's age, engine size, or emissions, ensuring continuous revenue for road maintenance and environmental initiatives. One-time vehicle tax is a single payment made at the time of vehicle registration, simplifying ownership costs but potentially limiting funds for ongoing infrastructure upkeep. Choosing between these tax models impacts long-term financial planning and environmental policy effectiveness.

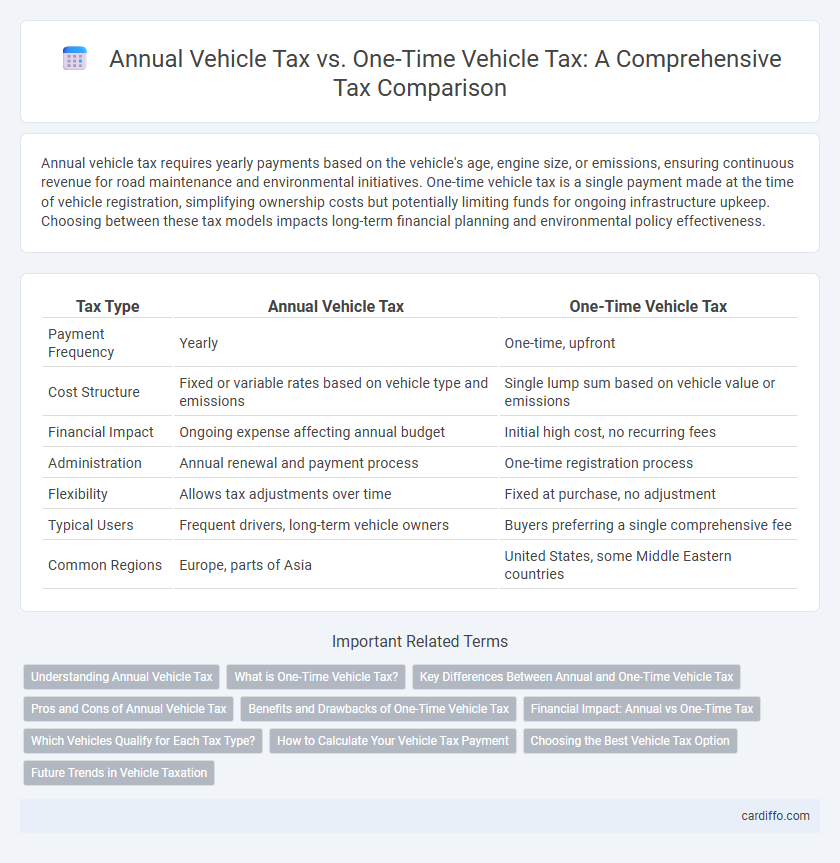

Table of Comparison

| Tax Type | Annual Vehicle Tax | One-Time Vehicle Tax |

|---|---|---|

| Payment Frequency | Yearly | One-time, upfront |

| Cost Structure | Fixed or variable rates based on vehicle type and emissions | Single lump sum based on vehicle value or emissions |

| Financial Impact | Ongoing expense affecting annual budget | Initial high cost, no recurring fees |

| Administration | Annual renewal and payment process | One-time registration process |

| Flexibility | Allows tax adjustments over time | Fixed at purchase, no adjustment |

| Typical Users | Frequent drivers, long-term vehicle owners | Buyers preferring a single comprehensive fee |

| Common Regions | Europe, parts of Asia | United States, some Middle Eastern countries |

Understanding Annual Vehicle Tax

Annual Vehicle Tax requires regular yearly payments based on factors such as vehicle type, engine size, and emissions, ensuring continuous legal compliance and road usage. This recurring tax helps fund road maintenance, public transportation, and environmental initiatives in most regions. Understanding the calculation methods and deadlines for Annual Vehicle Tax is crucial for avoiding penalties and managing long-term vehicle ownership costs effectively.

What is One-Time Vehicle Tax?

One-Time Vehicle Tax is a single payment required upon the initial registration or importation of a vehicle, covering the entire period of ownership without recurring charges. This tax simplifies the process by eliminating annual payments, impacting long-term cost calculations for vehicle owners. Unlike Annual Vehicle Tax, which demands yearly fees based on vehicle type and usage, the One-Time Vehicle Tax provides upfront cost certainty and can influence buying decisions.

Key Differences Between Annual and One-Time Vehicle Tax

Annual vehicle tax requires yearly payments based on factors like vehicle type, engine size, and emissions, ensuring continuous revenue for road maintenance and environmental policies. One-time vehicle tax involves a single payment upon vehicle registration or purchase, often calculated based on vehicle value or weight, eliminating the need for recurring fees. The key difference lies in payment frequency and duration, where annual tax imposes ongoing financial obligations, while one-time tax offers a lump-sum approach, affecting cash flow and long-term cost planning for vehicle owners.

Pros and Cons of Annual Vehicle Tax

Annual vehicle tax provides continuous revenue for infrastructure maintenance and environmental programs, supporting road safety and upkeep. It promotes regular vehicle compliance and incentivizes owners to maintain emissions standards, but can be costly and burdensome for infrequent drivers or those with older vehicles. The ongoing nature of annual tax payments may deter vehicle ownership or usage for low-mileage drivers, contrasting with the simpler, upfront cost of a one-time vehicle tax.

Benefits and Drawbacks of One-Time Vehicle Tax

One-Time Vehicle Tax offers the benefit of a single payment that eliminates the need for annual renewals, simplifying budgeting and reducing administrative burdens. However, it can require a substantial upfront cost that may not be affordable for all vehicle owners, potentially discouraging vehicle purchases. Additionally, this tax structure may reduce government revenue predictability and limit funds available for ongoing road maintenance and infrastructure projects.

Financial Impact: Annual vs One-Time Tax

Annual vehicle tax imposes a recurring financial obligation, requiring consistent budget allocation each year, which can accumulate significantly over time. One-time vehicle tax demands a single, larger payment upfront, offering long-term cost certainty without future fiscal surprises. Evaluating these options involves comparing the cumulative annual payments against the immediate impact of a lump-sum expense to determine which aligns better with individual financial planning and cash flow preferences.

Which Vehicles Qualify for Each Tax Type?

Annual Vehicle Tax typically applies to passenger cars, trucks, motorcycles, and commercial vehicles registered for regular use, with rates often based on engine size, weight, or emissions. One-Time Vehicle Tax generally covers imported or newly purchased vehicles subject to a single payment upon registration, including classic or specialty cars exempt from annual fees. Vehicle classification criteria, such as usage purpose and registration status, determine eligibility for either tax type.

How to Calculate Your Vehicle Tax Payment

To calculate your vehicle tax payment, first determine whether your jurisdiction requires an annual vehicle tax or a one-time vehicle tax, as rates and methods vary significantly. Annual vehicle tax is typically calculated based on factors such as vehicle type, engine size, emissions, and registration duration, while one-time vehicle tax often considers vehicle value and age at the time of purchase or registration. Access your local tax authority's official online calculator or rate tables to ensure accurate computation according to current regulations and any applicable exemptions or discounts.

Choosing the Best Vehicle Tax Option

Choosing between annual vehicle tax and one-time vehicle tax depends on factors such as vehicle usage, ownership duration, and financial planning. Annual vehicle tax offers flexibility for short-term ownership and budget management, while one-time vehicle tax provides long-term cost savings and convenience for extended use without recurring payments. Evaluating total tax costs, vehicle depreciation, and expected ownership period enables informed decisions for optimal tax efficiency.

Future Trends in Vehicle Taxation

Future trends in vehicle taxation indicate a shift from traditional annual vehicle tax models towards one-time vehicle tax frameworks, driven by advancements in electric and autonomous vehicle technologies. Governments are exploring usage-based taxation systems that leverage telematics data to impose charges reflecting actual road usage and environmental impact, promoting sustainability. This transition aims to streamline tax administration while encouraging the adoption of eco-friendly vehicle options.

Annual Vehicle Tax vs One-Time Vehicle Tax Infographic

cardiffo.com

cardiffo.com