Leasing companies face tax liabilities that include corporate income tax on rental income and possible depreciation deductions on leased assets, whereas private owners typically report rental income on personal tax returns and may qualify for different deductions such as mortgage interest and maintenance costs. Leasing companies must also comply with specific tax regulations related to commercial leases, which can affect their overall tax burden. Private owners often benefit from lower tax rates and simplified reporting but have limited opportunities for expense deductions compared to leasing companies.

Table of Comparison

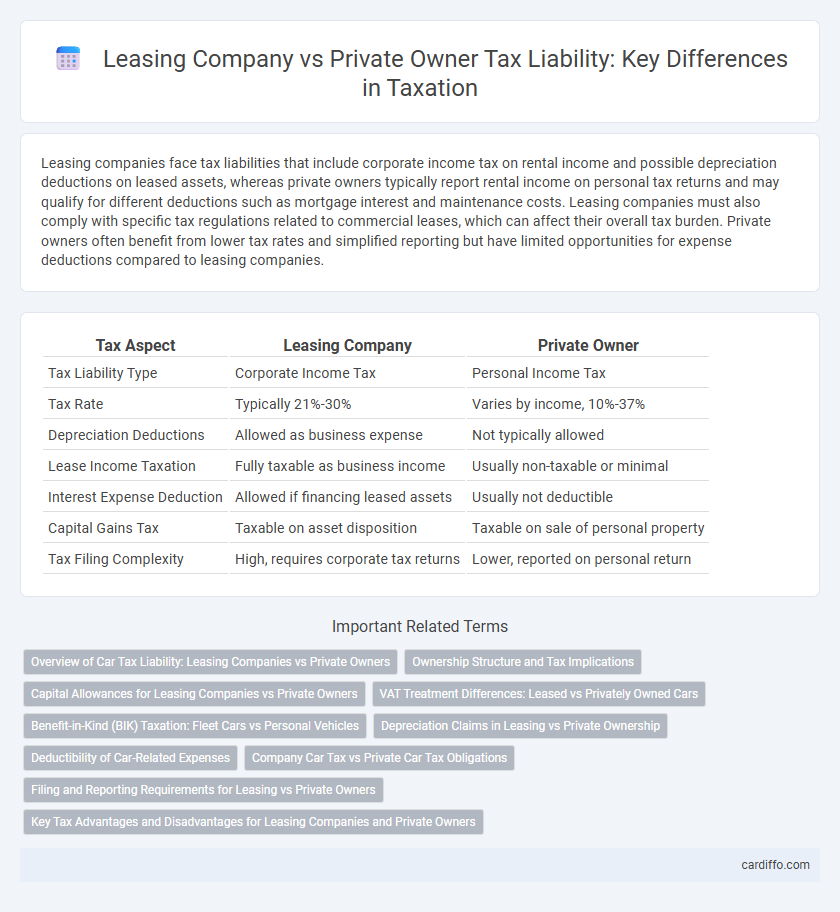

| Tax Aspect | Leasing Company | Private Owner |

|---|---|---|

| Tax Liability Type | Corporate Income Tax | Personal Income Tax |

| Tax Rate | Typically 21%-30% | Varies by income, 10%-37% |

| Depreciation Deductions | Allowed as business expense | Not typically allowed |

| Lease Income Taxation | Fully taxable as business income | Usually non-taxable or minimal |

| Interest Expense Deduction | Allowed if financing leased assets | Usually not deductible |

| Capital Gains Tax | Taxable on asset disposition | Taxable on sale of personal property |

| Tax Filing Complexity | High, requires corporate tax returns | Lower, reported on personal return |

Overview of Car Tax Liability: Leasing Companies vs Private Owners

Leasing companies bear tax liabilities including corporate income tax, VAT on lease payments, and vehicle registration taxes based on fleet size and usage, while private owners primarily face personal income taxes related to vehicle usage benefits and annual vehicle tax. Leasing companies can often deduct VAT and claim depreciation on leased vehicles, reducing taxable income compared to private owners who do not benefit from such deductions. The tax treatment of leasing companies reflects commercial use, whereas private owners are liable for standard road taxes and potential capital gains or usage taxation.

Ownership Structure and Tax Implications

Leasing companies benefit from tax deductions on asset depreciation and interest expenses due to corporate ownership structures, reducing overall taxable income. Private owners face direct taxation on rental income and capital gains without the ability to spread depreciation benefits over multiple entities. Ownership structure significantly influences tax liabilities, where leasing companies often access more favorable tax treatment compared to individual private owners.

Capital Allowances for Leasing Companies vs Private Owners

Leasing companies benefit from capital allowances by claiming depreciation on leased assets as business expenses, reducing taxable profits more effectively than private owners who typically cannot claim such allowances on personally owned assets. Private owners face limited or no capital allowance claims on leased or owned assets used for personal purposes, resulting in higher taxable income compared to leasing companies exploiting capital allowances in commercial use. The tax liability for leasing companies is consequently lower due to allowable writing down allowances and initial allowances on qualifying plant and machinery, whereas private owners experience minimal tax relief under capital allowance regimes.

VAT Treatment Differences: Leased vs Privately Owned Cars

Leasing companies are typically classified as VAT-registered businesses, allowing them to recover input VAT on vehicle acquisitions and charge VAT on lease rentals, while private owners cannot reclaim VAT on vehicle purchases. The VAT treatment of leased cars involves output VAT on lease payments, making leasing an option with potential VAT efficiency for businesses. In contrast, private owners bear the full VAT cost upfront without the ability to offset, resulting in higher effective tax liability on car ownership.

Benefit-in-Kind (BIK) Taxation: Fleet Cars vs Personal Vehicles

Leasing companies are subject to distinct tax regulations compared to private owners, particularly in relation to Benefit-in-Kind (BIK) taxation on fleet cars versus personal vehicles. For fleet cars leased by companies, BIK tax rates are influenced by factors such as CO2 emissions, vehicle list price, and fuel type, often resulting in more favorable tax treatments due to bulk leasing arrangements. In contrast, private vehicle owners incur BIK tax based solely on the private use portion of their vehicle, which typically reflects higher taxable amounts relative to the commercial use deductions available to leasing firms.

Depreciation Claims in Leasing vs Private Ownership

Leasing companies benefit from higher depreciation claims on leased assets, accelerating tax deductions and reducing taxable income more effectively than private owners. Private owners typically claim depreciation based on standardized schedules, resulting in slower tax relief over the asset's useful life. This difference in depreciation treatment significantly impacts the net tax liability between leasing companies and private owners.

Deductibility of Car-Related Expenses

Leasing companies can deduct a broader range of car-related expenses, including lease payments, maintenance, and depreciation, directly reducing taxable income. Private owners are limited to deducting expenses only when the vehicle is used for business purposes, typically requiring detailed mileage logs and proportional expense calculations. These differences significantly impact the overall tax liability and cash flow for leasing companies compared to private vehicle owners.

Company Car Tax vs Private Car Tax Obligations

Leasing companies are subject to corporation tax on their profits derived from leasing activities, while private owners face personal income tax obligations on any income generated from leased vehicles. For company cars, employers must account for Benefit-in-Kind (BIK) tax, which is calculated based on the car's value, CO2 emissions, and fuel type, creating a tax liability for employees who use the vehicle privately. Private car owners leasing their vehicles generally report rental income as part of their taxable income and are responsible for vehicle-related taxes such as road tax and insurance without the BIK implications faced by company employees.

Filing and Reporting Requirements for Leasing vs Private Owners

Leasing companies face stringent tax filing and reporting requirements, including detailed quarterly income reports, depreciation schedules, and compliance with IRS Form 4797 for gains or losses on asset dispositions. Private owners typically report lease income annually on Schedule E, with fewer mandatory disclosures and simplified depreciation tracking. Leasing companies must also adhere to additional state and local tax regulations due to their business classification, increasing their overall tax compliance complexity compared to private owners.

Key Tax Advantages and Disadvantages for Leasing Companies and Private Owners

Leasing companies benefit from tax deductions on depreciation and interest expenses, reducing taxable income significantly, whereas private owners primarily deduct mortgage interest and property taxes. Leasing companies face more complex tax reporting requirements and potential tax on lease income, while private owners have simpler tax filings but limited deductions. Both parties must consider capital gains implications, though leasing companies often leverage tax incentives and accelerated depreciation to optimize their tax liabilities.

Leasing company tax liability vs private owner tax liability Infographic

cardiffo.com

cardiffo.com