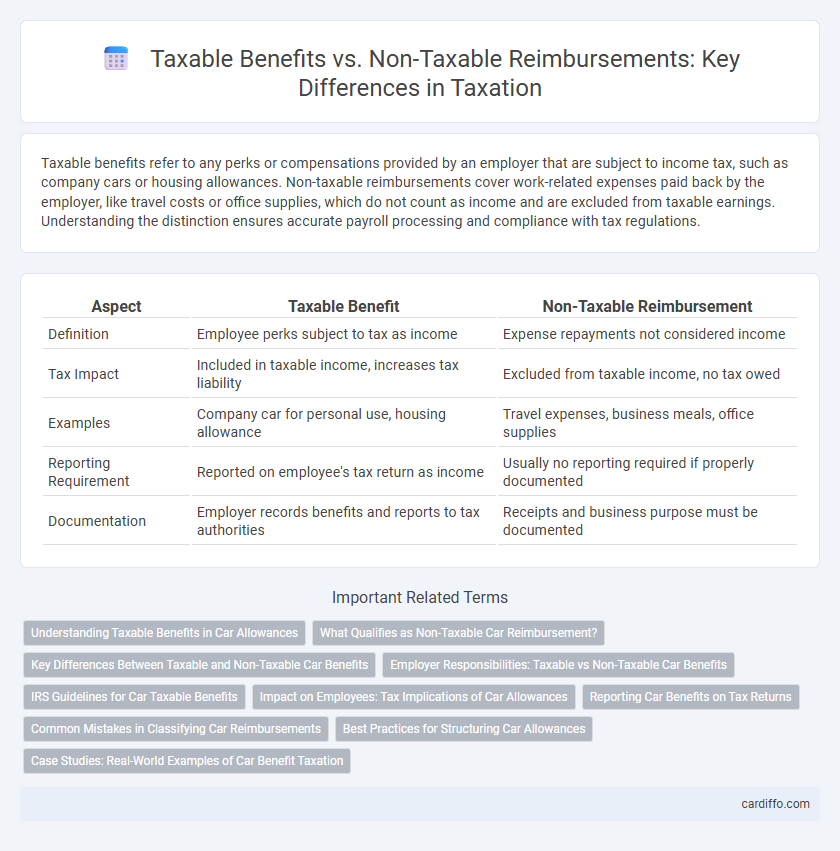

Taxable benefits refer to any perks or compensations provided by an employer that are subject to income tax, such as company cars or housing allowances. Non-taxable reimbursements cover work-related expenses paid back by the employer, like travel costs or office supplies, which do not count as income and are excluded from taxable earnings. Understanding the distinction ensures accurate payroll processing and compliance with tax regulations.

Table of Comparison

| Aspect | Taxable Benefit | Non-Taxable Reimbursement |

|---|---|---|

| Definition | Employee perks subject to tax as income | Expense repayments not considered income |

| Tax Impact | Included in taxable income, increases tax liability | Excluded from taxable income, no tax owed |

| Examples | Company car for personal use, housing allowance | Travel expenses, business meals, office supplies |

| Reporting Requirement | Reported on employee's tax return as income | Usually no reporting required if properly documented |

| Documentation | Employer records benefits and reports to tax authorities | Receipts and business purpose must be documented |

Understanding Taxable Benefits in Car Allowances

Car allowances provided by employers are often considered taxable benefits because they represent additional income subject to payroll and income tax regulations. Taxable benefits in car allowances typically include any fixed cash payments given to cover vehicle expenses without requiring detailed proof of expenditure. Non-taxable reimbursements, by contrast, involve repayments for actual business-related car expenses supported by receipts, such as fuel or maintenance costs incurred during work duties.

What Qualifies as Non-Taxable Car Reimbursement?

Non-taxable car reimbursement qualifies when an employer reimburses employees for business-related vehicle expenses such as fuel, maintenance, and mileage at or below the IRS standard mileage rates. Reimbursements must be substantiated with detailed records including date, purpose, and distance traveled to avoid being classified as taxable income. Personal use of the vehicle or reimbursements exceeding IRS limits typically result in taxable benefits subject to income and employment taxes.

Key Differences Between Taxable and Non-Taxable Car Benefits

Taxable car benefits include employer-provided vehicles used for personal purposes, which are considered a reportable fringe benefit subject to income tax. Non-taxable car reimbursements cover business-related expenses such as fuel or maintenance costs reimbursed at fair market value, exempt from taxation. The key difference lies in personal use inclusion, which triggers taxable benefits, whereas strictly business-use reimbursements remain non-taxable.

Employer Responsibilities: Taxable vs Non-Taxable Car Benefits

Employers must accurately classify car benefits to ensure compliance with tax regulations, distinguishing between taxable benefits such as personal use of a company vehicle and non-taxable reimbursements like mileage for business travel. Proper documentation and reporting are essential to avoid penalties and to correctly calculate payroll taxes and employee tax obligations. Failure to correctly manage these classifications can lead to audits, fines, and increased administrative burden for the employer.

IRS Guidelines for Car Taxable Benefits

IRS guidelines classify car taxable benefits as personal use of a company vehicle that must be included in an employee's gross income, subject to federal income tax withholding and employment taxes. Non-taxable reimbursements generally cover business-related car expenses reimbursed under an accountable plan, requiring substantiation of mileage, expenses, and business purpose. To comply with IRS rules, employers must accurately differentiate between personal use benefits and business reimbursements to avoid tax liabilities and penalties.

Impact on Employees: Tax Implications of Car Allowances

Car allowances classified as taxable benefits increase an employee's taxable income, leading to higher income tax and National Insurance contributions. Non-taxable reimbursements for actual business expenses do not affect taxable income, minimizing the employee's tax liability. Understanding the distinction helps employees optimize their tax position and avoid unexpected financial burdens.

Reporting Car Benefits on Tax Returns

Reporting car benefits on tax returns requires distinguishing between taxable benefits and non-taxable reimbursements based on employer-provided car usage. Taxable benefits include personal use of company vehicles valued using the IRS's annual lease value or cents-per-mile method, which must be reported as income. Non-taxable reimbursements, such as mileage allowances for business use reimbursed at or below the IRS standard mileage rate, are excluded from gross income and do not require reporting.

Common Mistakes in Classifying Car Reimbursements

Misclassifying car reimbursements often results from misunderstanding the distinction between taxable benefits and non-taxable reimbursements, especially when employers fail to document business versus personal use adequately. A common mistake is treating all mileage reimbursements as non-taxable without applying the standard mileage rates set by tax authorities, leading to potential IRS penalties or audits. Accurate record-keeping and adherence to specific tax codes, such as IRS Publication 15-B, are essential to correctly classify car reimbursements and avoid costly misclassification errors.

Best Practices for Structuring Car Allowances

Structuring car allowances effectively requires distinguishing between taxable benefits and non-taxable reimbursements to optimize tax efficiency and compliance. Employers should implement clear policies that define allowable expenses reimbursed on an actual cost basis to qualify as non-taxable, while fixed monthly car allowances often constitute taxable benefits subject to payroll taxes. Maintaining detailed mileage logs and using per-kilometer reimbursement rates aligned with tax authority guidelines ensures reimbursements remain non-taxable and reduces audit risks.

Case Studies: Real-World Examples of Car Benefit Taxation

Case studies reveal that when employees receive company cars for personal use, the value is often treated as a taxable benefit, increasing their taxable income based on the vehicle's list price and CO2 emissions. Conversely, reimbursements for business-related mileage incur no tax liability as long as they adhere to established per-kilometer rates and proper documentation. Examining variations across jurisdictions highlights the importance of compliance in differentiating taxable car benefits from non-taxable reimbursements to optimize tax outcomes for both employers and employees.

Taxable Benefit vs Non-Taxable Reimbursement Infographic

cardiffo.com

cardiffo.com