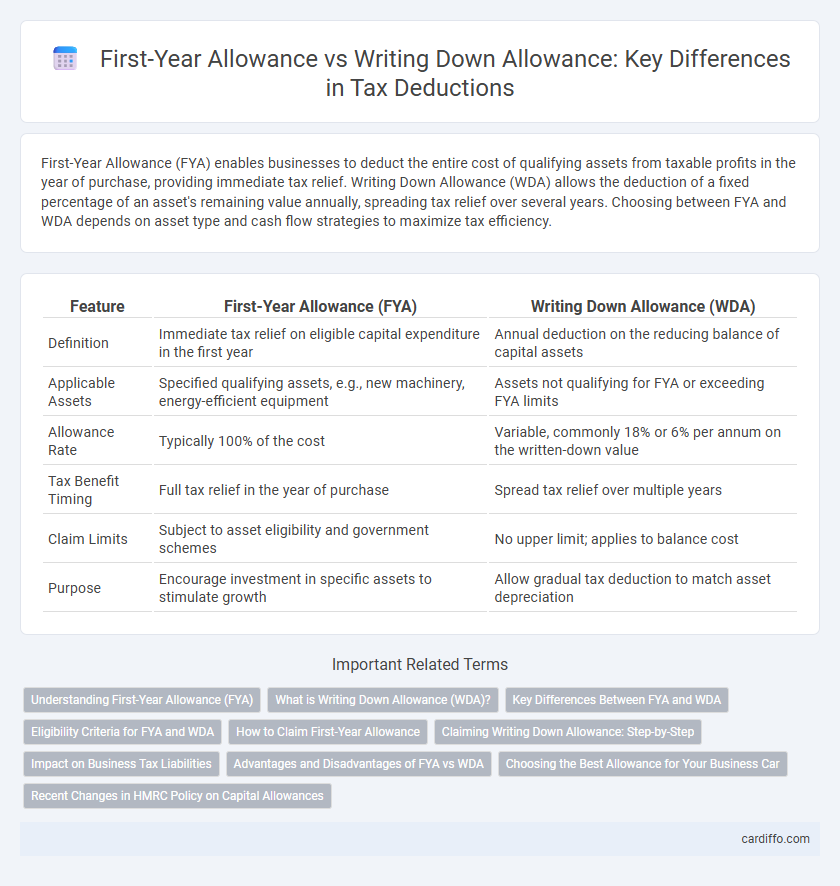

First-Year Allowance (FYA) enables businesses to deduct the entire cost of qualifying assets from taxable profits in the year of purchase, providing immediate tax relief. Writing Down Allowance (WDA) allows the deduction of a fixed percentage of an asset's remaining value annually, spreading tax relief over several years. Choosing between FYA and WDA depends on asset type and cash flow strategies to maximize tax efficiency.

Table of Comparison

| Feature | First-Year Allowance (FYA) | Writing Down Allowance (WDA) |

|---|---|---|

| Definition | Immediate tax relief on eligible capital expenditure in the first year | Annual deduction on the reducing balance of capital assets |

| Applicable Assets | Specified qualifying assets, e.g., new machinery, energy-efficient equipment | Assets not qualifying for FYA or exceeding FYA limits |

| Allowance Rate | Typically 100% of the cost | Variable, commonly 18% or 6% per annum on the written-down value |

| Tax Benefit Timing | Full tax relief in the year of purchase | Spread tax relief over multiple years |

| Claim Limits | Subject to asset eligibility and government schemes | No upper limit; applies to balance cost |

| Purpose | Encourage investment in specific assets to stimulate growth | Allow gradual tax deduction to match asset depreciation |

Understanding First-Year Allowance (FYA)

First-Year Allowance (FYA) allows businesses to deduct a significant portion or the entire cost of qualifying capital assets from taxable profits in the year of purchase, accelerating tax relief compared to the gradual reduction offered by Writing Down Allowance (WDA). Qualifying assets for FYA typically include energy-efficient equipment, low-emission vehicles, and certain plant and machinery, aligning with government incentives for green investments. Claiming FYA reduces taxable income immediately, improving cash flow and incentivizing rapid asset reinvestment.

What is Writing Down Allowance (WDA)?

Writing Down Allowance (WDA) is a tax relief allowing businesses to deduct a fixed percentage of the value of capital assets from their taxable profits annually. It applies to assets that do not qualify for First-Year Allowance, spreading the expense over several years based on specified rates. WDAs help businesses reduce their tax liability while accounting for asset depreciation in a systematic manner.

Key Differences Between FYA and WDA

First-Year Allowance (FYA) enables businesses to claim a significant percentage of the cost of qualifying assets in the year of purchase, accelerating tax relief, while Writing Down Allowance (WDA) spreads the deduction over several years based on a fixed percentage of the asset's remaining value. FYA is applicable to specific types of assets such as energy-efficient equipment, whereas WDA applies broadly to most tangible capital assets not eligible for FYA. The key difference lies in the timing and rate of tax relief, with FYA providing immediate larger deductions and WDA offering gradual tax relief over the asset's useful life.

Eligibility Criteria for FYA and WDA

First-Year Allowance (FYA) eligibility requires qualifying expenditure on new, unused plant and machinery, including energy-efficient equipment that meets specific carbon-saving criteria. Writing Down Allowance (WDA) applies to the remaining value of plant and machinery that do not qualify for FYA, allowing tax relief spread over several years. FYA accelerates tax relief within the first year, while WDA provides a gradual deduction based on defined pool rates and usage.

How to Claim First-Year Allowance

To claim First-Year Allowance (FYA), businesses must ensure the asset qualifies under the specified categories such as energy-efficient equipment or low-emission vehicles and include the claim in their annual capital allowances tax return. The FYA allows for an immediate deduction of the entire cost of the asset in the first year, accelerating tax relief compared to the Writing Down Allowance (WDA), which spreads the deduction over several years. Proper documentation and clear allocation of expenditure are essential for HMRC compliance and to avoid delays in processing tax relief claims.

Claiming Writing Down Allowance: Step-by-Step

Claiming Writing Down Allowance (WDA) requires identifying qualifying capital assets and determining the appropriate pool--either main or special rate. Calculate the allowance by applying the statutory percentage, typically 18% for the main pool or 6% for the special rate pool, to the opening balance after accounting for disposals and additions. Ensure records of transactions and balances are accurately maintained for submission with the corporation tax return or personal tax computations.

Impact on Business Tax Liabilities

First-Year Allowance (FYA) enables businesses to deduct the full cost of qualifying assets from their taxable profits in the year of purchase, significantly reducing immediate tax liabilities. Writing Down Allowance (WDA) spreads these deductions over several years, resulting in gradual tax relief that smooths out cash flow impacts. Choosing between FYA and WDA directly affects a company's tax planning strategy by influencing the timing and amount of taxable profit reductions.

Advantages and Disadvantages of FYA vs WDA

First-Year Allowance (FYA) allows businesses to deduct the full cost of qualifying assets from their taxable profits in the year of purchase, providing immediate tax relief and improved cash flow, while Writing Down Allowance (WDA) spreads the deduction over several years, aligning tax relief with asset depreciation. FYA advantages include accelerated tax relief and simplified accounting, but its limitation is eligibility restricted to specific assets and thresholds, risking lower overall tax efficiency if assets don't qualify. WDA advantages involve gradual expense matching with income, supporting long-term tax planning, although it can delay cash flow benefits and complicate record-keeping compared to FYA.

Choosing the Best Allowance for Your Business Car

First-Year Allowance (FYA) allows businesses to claim a significant portion of the cost of new low-emission cars against taxable profits in the year of purchase, offering immediate tax relief. Writing Down Allowance (WDA) spreads the deduction for more expensive or higher-emission vehicles over several years, typically at rates of 18% or 6% depending on the car's CO2 emissions. Selecting the best allowance depends on your vehicle's emission levels and cash flow needs, with FYA beneficial for quicker tax savings on environmentally friendly cars, while WDA suits higher-value vehicles that do not qualify for FYA.

Recent Changes in HMRC Policy on Capital Allowances

Recent changes in HMRC policy on capital allowances have introduced stricter criteria for claiming First-Year Allowance (FYA), emphasizing environmental efficiency and energy-saving investments. Writing Down Allowance (WDA) rates have been adjusted to reflect these changes, with reduced percentages for certain asset pools, impacting long-term tax relief on depreciating assets. Businesses must carefully assess asset classifications to optimize capital allowance claims under updated HMRC guidelines.

First-Year Allowance vs Writing Down Allowance Infographic

cardiffo.com

cardiffo.com