The Certificate of Entitlement (COE) and Additional Registration Fee (ARF) are critical components in vehicle taxation, especially in Singapore. COE determines the right to vehicle ownership and directly affects the initial cost, while ARF is a tax imposed on the vehicle's Open Market Value, significantly influencing the total purchase price. Understanding the interplay between COE and ARF is essential for accurate tax planning and cost estimation in the automotive sector.

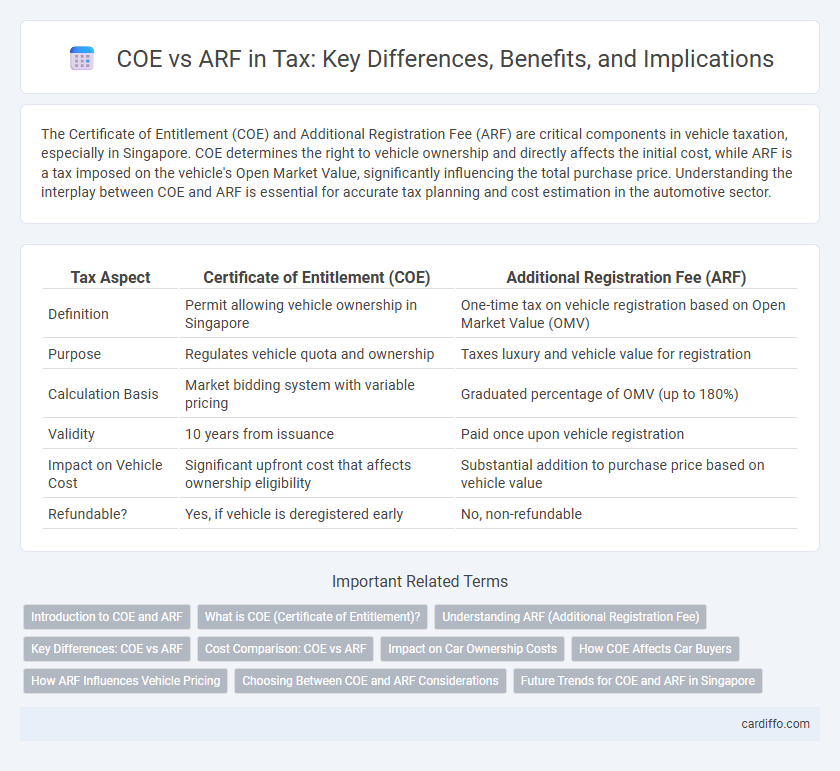

Table of Comparison

| Tax Aspect | Certificate of Entitlement (COE) | Additional Registration Fee (ARF) |

|---|---|---|

| Definition | Permit allowing vehicle ownership in Singapore | One-time tax on vehicle registration based on Open Market Value (OMV) |

| Purpose | Regulates vehicle quota and ownership | Taxes luxury and vehicle value for registration |

| Calculation Basis | Market bidding system with variable pricing | Graduated percentage of OMV (up to 180%) |

| Validity | 10 years from issuance | Paid once upon vehicle registration |

| Impact on Vehicle Cost | Significant upfront cost that affects ownership eligibility | Substantial addition to purchase price based on vehicle value |

| Refundable? | Yes, if vehicle is deregistered early | No, non-refundable |

Introduction to COE and ARF

Certificate of Entitlement (COE) and Additional Registration Fee (ARF) are key components in Singapore's vehicle ownership framework. COE is a license that permits vehicle ownership for a fixed period, with prices determined through competitive bidding, reflecting demand and quota restrictions. ARF is a tax imposed on the open market value of the vehicle, calculated as a percentage that increases with the vehicle's value bracket, aimed at regulating vehicle ownership costs.

What is COE (Certificate of Entitlement)?

Certificate of Entitlement (COE) is a government-issued license required in Singapore to own and operate a vehicle, regulating the total number of vehicles on the road. The COE system helps control vehicle population, reduce congestion, and manage environmental impact by requiring bidders to secure a COE through a competitive auction. COE costs vary based on demand and vehicle category, significantly affecting the overall price of car ownership.

Understanding ARF (Additional Registration Fee)

The Additional Registration Fee (ARF) is a significant tax imposed on the registration of new vehicles in several countries, calculated based on the vehicle's Open Market Value (OMV) to discourage excessive car ownership and promote environmental awareness. Unlike the Certificate of Entitlement (COE), which limits the number of vehicles on the road by granting the right to own a vehicle for a fixed period, ARF directly increases the upfront cost of vehicle ownership through a tiered percentage system applied to the OMV. Understanding the ARF structure is crucial for taxpayers to accurately estimate total vehicle registration costs and make informed decisions about vehicle purchases.

Key Differences: COE vs ARF

Certificate of Entitlement (COE) and Additional Registration Fee (ARF) are crucial components in Singapore's vehicle tax system. COE is a bidding system granting vehicle ownership rights for a fixed period, influencing vehicle prices and ownership costs directly. ARF is a tax levied on vehicle registration, calculated as a percentage of the vehicle's Open Market Value (OMV), significantly impacting total vehicle acquisition expenses.

Cost Comparison: COE vs ARF

The Certificate of Entitlement (COE) and Additional Registration Fee (ARF) represent significant cost factors in vehicle ownership in Singapore, with the COE price fluctuating based on demand and directly impacting the initial purchase cost. ARF is calculated as a percentage of the Open Market Value (OMV) of the vehicle, adding a fixed proportionate tax that consistently increases the overall cost regardless of market conditions. Comparing the two, COE often constitutes a larger variable expense that buyers must factor in when budgeting for new vehicles, while ARF remains a more predictable and stable tax element.

Impact on Car Ownership Costs

Certificate of Entitlement (COE) significantly increases the initial cost of car ownership in Singapore by requiring buyers to bid for a limited quota to legally own a vehicle. The Additional Registration Fee (ARF) further raises costs by imposing a tiered tax based on the vehicle's Open Market Value, often exceeding 100% of the price. Together, COE and ARF constitute the major expenses that elevate the total cost of owning a car, impacting affordability and ownership frequency.

How COE Affects Car Buyers

The Certificate of Entitlement (COE) significantly impacts car buyers in Singapore by determining the right to own and use a vehicle for a fixed period, typically 10 years, influencing the total ownership cost. COE prices fluctuate based on quota supply and demand, often increasing the overall expense of acquiring a car, thereby affecting affordability and budgeting decisions. This system encourages buyers to consider vehicle type and usage, promoting more efficient automobile ownership aligned with government transportation policies.

How ARF Influences Vehicle Pricing

The Additional Registration Fee (ARF) significantly influences vehicle pricing by imposing a tiered tax based on the vehicle's Open Market Value (OMV), often doubling the base cost for higher-value vehicles. Unlike the Certificate of Entitlement (COE), which controls vehicle ownership through bidding, the ARF directly increases the upfront purchase price, affecting affordability and market demand. Manufacturers and buyers must account for ARF tiers when pricing or selecting vehicles, as this tax mechanism shifts market dynamics and consumer behavior.

Choosing Between COE and ARF Considerations

Choosing between Certificate of Entitlement (COE) and Additional Registration Fee (ARF) requires evaluating long-term financial impact on vehicle ownership costs. COE determines eligibility to own a vehicle within a quota system, affecting initial vehicle acquisition, while ARF is a tiered tax based on the vehicle's Open Market Value, influencing total registration expenses. Assessing budget constraints, vehicle usage duration, and future resale value helps optimize tax liabilities and compliance with regulatory measures.

Future Trends for COE and ARF in Singapore

Future trends for Certificate of Entitlement (COE) and Additional Registration Fee (ARF) in Singapore indicate a gradual shift towards more sustainable vehicle policies, emphasizing electric and hybrid vehicles to reduce carbon emissions. The government is expected to adjust COE quotas and ARF rates to incentivize greener car ownership while balancing road congestion and revenue needs. Advances in technology and environmental regulations will likely drive increased use of dynamic pricing models for COE and tiered ARF structures based on vehicle emissions and engine capacity.

COE vs ARF Infographic

cardiffo.com

cardiffo.com