Road tax is an annual fee levied on vehicle owners to fund road maintenance and infrastructure, while congestion charges are daily fees imposed on drivers entering busy urban zones during peak hours to reduce traffic and pollution. Road tax applies broadly to all registered vehicles, regardless of location or usage, whereas congestion charges target specific areas with high traffic density to encourage alternative transportation. Choosing between the two depends on your driving patterns, location, and frequency of travel in congested city centers.

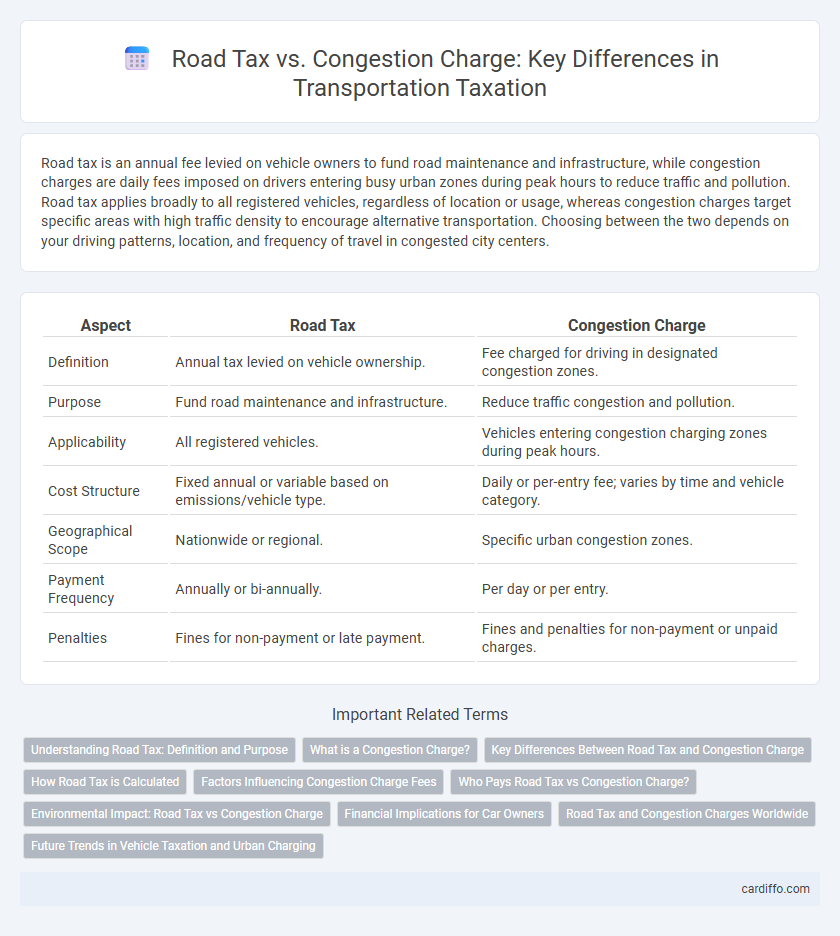

Table of Comparison

| Aspect | Road Tax | Congestion Charge |

|---|---|---|

| Definition | Annual tax levied on vehicle ownership. | Fee charged for driving in designated congestion zones. |

| Purpose | Fund road maintenance and infrastructure. | Reduce traffic congestion and pollution. |

| Applicability | All registered vehicles. | Vehicles entering congestion charging zones during peak hours. |

| Cost Structure | Fixed annual or variable based on emissions/vehicle type. | Daily or per-entry fee; varies by time and vehicle category. |

| Geographical Scope | Nationwide or regional. | Specific urban congestion zones. |

| Payment Frequency | Annually or bi-annually. | Per day or per entry. |

| Penalties | Fines for non-payment or late payment. | Fines and penalties for non-payment or unpaid charges. |

Understanding Road Tax: Definition and Purpose

Road tax, also known as vehicle excise duty, is a mandatory government levy imposed on motor vehicles to fund road maintenance and infrastructure development. Its primary purpose is to generate revenue for the upkeep of public roads, ensuring safety and efficiency for all road users. Unlike congestion charges, which aim to reduce traffic in specific urban areas, road tax applies broadly based on vehicle type, engine size, and emissions.

What is a Congestion Charge?

A Congestion Charge is a fee imposed on vehicles entering designated high-traffic urban areas to reduce congestion and pollution. Unlike road tax, which is an annual charge based on vehicle ownership, the congestion charge is applied per entry and targets specific zones during peak times. This system encourages the use of public transport and eco-friendly alternatives to decrease traffic density and improve air quality.

Key Differences Between Road Tax and Congestion Charge

Road tax is a mandatory annual fee imposed on vehicle owners based on factors like engine size, emissions, and vehicle type, funding road maintenance and infrastructure. Congestion charge is a dynamic fee applied to vehicles entering designated urban zones during peak hours to reduce traffic congestion and pollution. Unlike road tax, congestion charges vary by time and location, targeting traffic management rather than vehicle ownership.

How Road Tax is Calculated

Road tax is calculated based on vehicle emissions, engine size, fuel type, and the vehicle's weight in some jurisdictions, ensuring a direct correlation with environmental impact and road wear. Emission-based bands assign a specific charge, incentivizing low-emission vehicles with reduced rates or exemptions. This contrasts with the congestion charge, which is a flat fee applied when driving within designated urban zones during peak times to reduce traffic congestion.

Factors Influencing Congestion Charge Fees

Congestion charge fees vary based on location, time of day, and vehicle type to manage urban traffic flow effectively. Factors such as emission standards and vehicle weight directly impact the fee structure, encouraging the use of low-emission and lighter vehicles. Dynamic pricing models adjust charges in real-time according to traffic density and pollution levels, optimizing congestion management and environmental benefits.

Who Pays Road Tax vs Congestion Charge?

Vehicle owners registered in the UK are required to pay Road Tax based on factors such as vehicle type, emissions, and engine size, applicable annually or biannually. Congestion Charge payments are imposed on drivers entering specific congestion zones, primarily in central London, with daily charges applicable regardless of vehicle ownership. Exemptions and discounts vary for both schemes, often including residents, electric vehicles, and disabled drivers.

Environmental Impact: Road Tax vs Congestion Charge

Road tax primarily generates revenue based on vehicle ownership and engine size, with limited direct influence on reducing emissions, whereas congestion charges specifically target high-pollution urban areas to discourage vehicle use and improve air quality. Congestion charges have demonstrated significant reductions in nitrogen oxides (NOx) and particulate matter (PM2.5) by incentivizing the use of public transport, cycling, and electric vehicles. The environmental impact of road tax remains indirect, while congestion charging directly contributes to lower carbon footprints and healthier urban environments.

Financial Implications for Car Owners

Road tax directly affects car owners through annual or biannual payments based on vehicle type, engine size, and emissions, influencing ownership costs and budgeting. The Congestion Charge imposes daily fees for driving in designated urban zones during peak hours, targeting reduced traffic congestion and incentivizing alternate transport modes. Understanding these financial implications helps car owners balance routine tax expenses against potential congestion fees when planning commuting costs.

Road Tax and Congestion Charges Worldwide

Road tax, often based on vehicle emissions or engine size, serves as a primary funding source for infrastructure maintenance across multiple countries, including the UK, Germany, and Australia. Congestion charges aim to reduce urban traffic by imposing fees on vehicles entering designated high-traffic zones, with notable implementations in London, Singapore, and Milan. Globally, these schemes impact commuter behavior and urban air quality differently, reflecting diverse policy goals and regional transportation challenges.

Future Trends in Vehicle Taxation and Urban Charging

Future vehicle taxation and urban charging will increasingly prioritize environmental impact and traffic management through dynamic pricing models. Road tax systems are evolving to incorporate emissions-based criteria, incentivizing electric and low-emission vehicles, while congestion charges are expanding with smart technology to adjust fees based on real-time traffic density. Integration of GPS tracking and AI-driven analytics will enhance precision in urban tolling, creating more efficient revenue streams and encouraging sustainable urban mobility.

Road Tax vs Congestion Charge Infographic

cardiffo.com

cardiffo.com