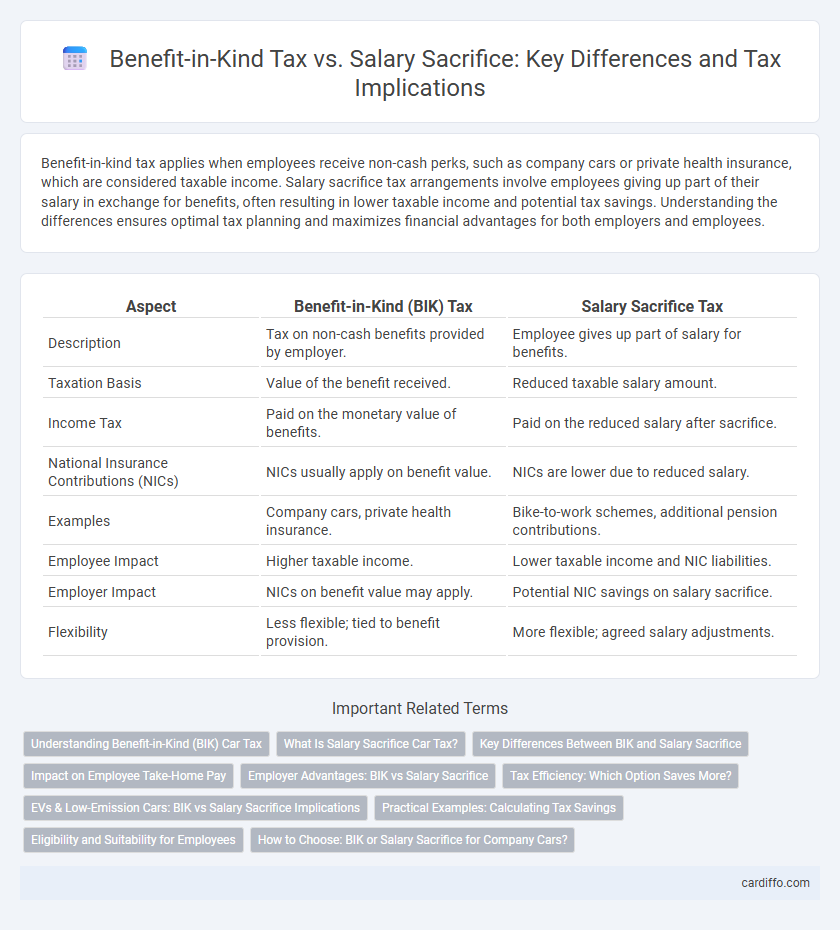

Benefit-in-kind tax applies when employees receive non-cash perks, such as company cars or private health insurance, which are considered taxable income. Salary sacrifice tax arrangements involve employees giving up part of their salary in exchange for benefits, often resulting in lower taxable income and potential tax savings. Understanding the differences ensures optimal tax planning and maximizes financial advantages for both employers and employees.

Table of Comparison

| Aspect | Benefit-in-Kind (BIK) Tax | Salary Sacrifice Tax |

|---|---|---|

| Description | Tax on non-cash benefits provided by employer. | Employee gives up part of salary for benefits. |

| Taxation Basis | Value of the benefit received. | Reduced taxable salary amount. |

| Income Tax | Paid on the monetary value of benefits. | Paid on the reduced salary after sacrifice. |

| National Insurance Contributions (NICs) | NICs usually apply on benefit value. | NICs are lower due to reduced salary. |

| Examples | Company cars, private health insurance. | Bike-to-work schemes, additional pension contributions. |

| Employee Impact | Higher taxable income. | Lower taxable income and NIC liabilities. |

| Employer Impact | NICs on benefit value may apply. | Potential NIC savings on salary sacrifice. |

| Flexibility | Less flexible; tied to benefit provision. | More flexible; agreed salary adjustments. |

Understanding Benefit-in-Kind (BIK) Car Tax

Benefit-in-Kind (BIK) car tax is calculated based on the vehicle's list price, CO2 emissions, and fuel type, reflecting the taxable benefit an employee receives from using a company car for personal purposes. Salary sacrifice tax schemes allow employees to exchange part of their gross salary for a company car, typically reducing income tax and National Insurance contributions by lowering taxable earnings. Understanding the interplay between BIK rates and salary sacrifice arrangements is crucial for optimizing tax efficiency when acquiring a company car through employer benefits.

What Is Salary Sacrifice Car Tax?

Salary sacrifice car tax is a tax-efficient scheme where employees agree to reduce their salary in exchange for a company car, lowering their taxable income and National Insurance contributions. This arrangement shifts the tax liability from Benefit-in-Kind (BIK) tax on the car's value to reduced income tax via a lowered salary, often resulting in substantial savings. The taxable benefit is based on the car's CO2 emissions and list price, making electric or low-emission vehicles especially advantageous under salary sacrifice schemes.

Key Differences Between BIK and Salary Sacrifice

Benefit-in-kind (BIK) tax applies to non-cash perks provided by an employer, such as company cars or private healthcare, and is calculated based on the taxable value of the benefit. Salary sacrifice reduces an employee's gross salary in exchange for specific benefits, lowering income tax and National Insurance Contributions by decreasing taxable earnings. Key differences include BIK tax being charged on the benefit's value while salary sacrifice adjusts salary before tax, impacting tax efficiency and take-home pay differently.

Impact on Employee Take-Home Pay

Benefit-in-kind tax reduces employee take-home pay by taxing non-cash benefits based on their monetary value, often resulting in a higher tax liability compared to direct salary. Salary sacrifice tax schemes lower taxable income as employees exchange part of their salary for benefits, decreasing overall income tax and National Insurance contributions. Employees using salary sacrifice typically experience increased net pay due to these tax savings, whereas benefit-in-kind amendments may reduce disposable income depending on the benefit's assessed value.

Employer Advantages: BIK vs Salary Sacrifice

Employers benefit from Benefit-in-Kind (BIK) tax by offering non-cash perks that enhance employee satisfaction without increasing payroll taxes, while salary sacrifice schemes reduce employer National Insurance contributions by lowering employees' gross salaries. BIK arrangements simplify tax administration and improve workforce retention through attractive perks, whereas salary sacrifice agreements provide employers with cost savings and greater flexibility in remuneration structures. Choosing between BIK and salary sacrifice depends on cash flow considerations, administration efficiency, and long-term cost advantages for the employer.

Tax Efficiency: Which Option Saves More?

Benefit-in-kind (BIK) tax typically applies to non-cash perks provided by employers, often taxed at higher rates depending on the asset's value, whereas salary sacrifice reduces taxable income by exchanging salary for benefits, leading to direct National Insurance and income tax savings. Salary sacrifice schemes are generally more tax-efficient, especially for high earners, as they lower gross pay subject to tax, enhancing take-home pay without increasing tax liability. Employers and employees must consider personal tax bands and specific benefit rules to maximize savings, with salary sacrifice often preferred for pension contributions and childcare vouchers.

EVs & Low-Emission Cars: BIK vs Salary Sacrifice Implications

Benefit-in-kind (BIK) tax on electric vehicles (EVs) and low-emission cars offers significant savings due to lower rates compared to conventional vehicles, reflecting government incentives for greener transportation. Salary sacrifice schemes enable employees to lease EVs or low-emission cars with pre-tax salary deductions, reducing taxable income and offering combined savings on both income tax and National Insurance contributions. Comparing BIK and salary sacrifice reveals that salary sacrifice can often provide greater overall tax efficiency, especially as BIK rates for fully electric vehicles remain low or zero in many tax years.

Practical Examples: Calculating Tax Savings

Benefit-in-kind tax on company cars typically charges employees based on the car's list price, CO2 emissions, and fuel type, often resulting in higher taxable amounts compared to salary sacrifice schemes where employees exchange part of their gross salary for the car, reducing their taxable income. For example, an employee with a PS40,000 salary sacrificing PS5,000 for a company car can pay less income tax and National Insurance contributions compared to receiving a car as a benefit with a PS7,000 taxable value. Calculating tax savings involves comparing the employer's National Insurance costs and the employee's marginal tax rate to determine if salary sacrifice leads to greater net savings than paying Benefit-in-kind tax.

Eligibility and Suitability for Employees

Benefit-in-kind tax applies to non-cash employee benefits such as company cars or private healthcare and is typically suitable for employees receiving substantial perks alongside their salary. Salary sacrifice schemes, where employees agree to reduce their salary in exchange for benefits, require employer participation and are most beneficial for employees in higher tax brackets seeking to reduce taxable income. Eligibility for salary sacrifice often depends on the employer's policy and the specific benefit offered, while benefit-in-kind tax applies broadly to all employees receiving taxable benefits.

How to Choose: BIK or Salary Sacrifice for Company Cars?

Choosing between Benefit-in-Kind (BIK) tax and salary sacrifice for company cars depends on factors such as the employee's tax bracket, the car's CO2 emissions, and the employer's National Insurance contributions. BIK tax applies to the car's taxable value, calculated based on the vehicle's list price and emissions, which can be costly for high-emission vehicles, whereas salary sacrifice reduces taxable income by exchanging a portion of salary for the car, lowering Income Tax and National Insurance liabilities. Employers and employees should analyze total tax savings by comparing BIK rates with potential salary sacrifice deductions and consider the impact on other benefits linked to salary levels.

Benefit-in-kind tax vs salary sacrifice tax Infographic

cardiffo.com

cardiffo.com