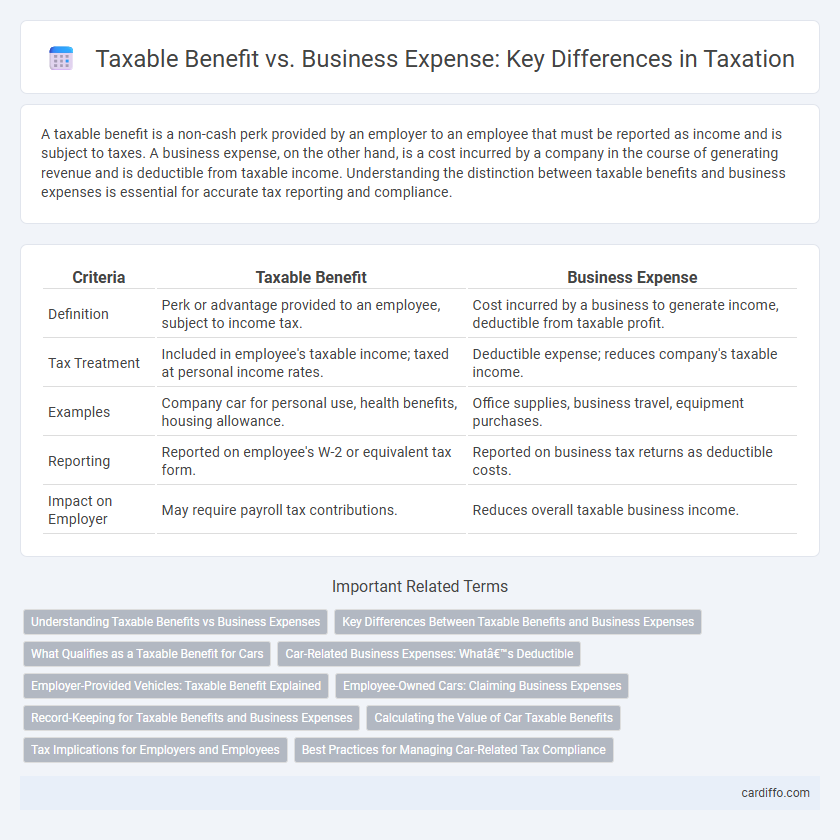

A taxable benefit is a non-cash perk provided by an employer to an employee that must be reported as income and is subject to taxes. A business expense, on the other hand, is a cost incurred by a company in the course of generating revenue and is deductible from taxable income. Understanding the distinction between taxable benefits and business expenses is essential for accurate tax reporting and compliance.

Table of Comparison

| Criteria | Taxable Benefit | Business Expense |

|---|---|---|

| Definition | Perk or advantage provided to an employee, subject to income tax. | Cost incurred by a business to generate income, deductible from taxable profit. |

| Tax Treatment | Included in employee's taxable income; taxed at personal income rates. | Deductible expense; reduces company's taxable income. |

| Examples | Company car for personal use, health benefits, housing allowance. | Office supplies, business travel, equipment purchases. |

| Reporting | Reported on employee's W-2 or equivalent tax form. | Reported on business tax returns as deductible costs. |

| Impact on Employer | May require payroll tax contributions. | Reduces overall taxable business income. |

Understanding Taxable Benefits vs Business Expenses

Taxable benefits refer to non-cash compensations provided to employees that must be included in their taxable income, such as company cars or health insurance. Business expenses are costs directly related to operating a business, like office supplies and travel expenses, which can be deducted to reduce taxable income. Differentiating between taxable benefits and business expenses is essential for accurate tax reporting and compliance with IRS regulations.

Key Differences Between Taxable Benefits and Business Expenses

Taxable benefits represent non-cash compensation provided to employees, such as company cars or housing, which are included in taxable income and subject to payroll taxes. Business expenses, including costs for office supplies and travel directly related to business operations, are deductible against gross income, reducing overall taxable income for the business. Understanding the distinction is critical for accurate tax reporting, compliance with IRS regulations, and optimizing tax liabilities.

What Qualifies as a Taxable Benefit for Cars

A taxable benefit for cars includes any personal use of a company vehicle, such as commuting or private trips, which is not directly related to business purposes. The value of this benefit is generally calculated based on the vehicle's lease value or mileage rates, subject to specific tax authority guidelines. Expenses solely incurred for business activities, like fuel for client meetings or maintenance during work use, qualify as deductible business expenses and are not treated as taxable benefits.

Car-Related Business Expenses: What’s Deductible

Car-related business expenses that are deductible typically include fuel costs, maintenance, insurance, and lease payments when the vehicle is used solely for business purposes. Personal use of the vehicle may result in a taxable benefit, which must be reported as income and adjusted accordingly. Accurate record-keeping of mileage and expenses is essential to differentiate between deductible business expenses and taxable benefits.

Employer-Provided Vehicles: Taxable Benefit Explained

Employer-provided vehicles are often classified as a taxable benefit, meaning employees must report the personal use value of the vehicle as part of their income for tax purposes. The value of this benefit is calculated based on factors such as the vehicle's original cost, running expenses, and the proportion of personal versus business use. In contrast, business expenses related to the vehicle used solely for company purposes are deductible for the employer and do not constitute a taxable benefit for the employee.

Employee-Owned Cars: Claiming Business Expenses

Employee-owned cars used for work purposes can generate taxable benefits if personal use is involved, impacting the employee's tax liability. Business expenses for these vehicles, such as fuel, maintenance, and depreciation, must be carefully documented and claimed accurately to comply with tax regulations. Proper distinction between personal and business use ensures correct reporting and maximizes legitimate deductions.

Record-Keeping for Taxable Benefits and Business Expenses

Accurate record-keeping for taxable benefits requires detailed documentation of the benefit's nature, value, and recipient to ensure proper reporting and compliance with tax regulations. Business expenses must be supported by receipts, invoices, and proof of payment to substantiate deductions and avoid audits or penalties from tax authorities. Maintaining organized and complete records improves accuracy in tax filings and facilitates easier preparation of financial statements.

Calculating the Value of Car Taxable Benefits

Calculating the value of car taxable benefits involves determining the cash equivalent of personal use of a company vehicle based on its original cost, age, and CO2 emissions. HMRC provides specific rates for different vehicle categories, including percentages applied to the car's list price to assess the taxable benefit. Accurate calculation ensures compliance with tax regulations and affects both employee taxable income and employer National Insurance contributions.

Tax Implications for Employers and Employees

Taxable benefits increase an employee's gross income, resulting in higher personal income tax liabilities, while employers must report these benefits accurately to avoid penalties and ensure compliance with tax regulations. Business expenses, when properly documented and directly related to company operations, reduce taxable income for employers without affecting employees' personal taxes. Misclassification between taxable benefits and business expenses can lead to audits, fines, and increased tax burdens for both parties.

Best Practices for Managing Car-Related Tax Compliance

Accurately distinguishing between taxable benefits and business expenses for company vehicles is crucial to avoid IRS penalties and optimize tax deductions. Maintaining detailed mileage logs, documenting business use percentages, and regularly updating vehicle valuation records ensure compliance with regulations on car-related benefits. Implementing software solutions for automated tracking can enhance transparency and streamline audit preparedness, reducing the risk of misclassification.

Taxable Benefit vs Business Expense Infographic

cardiffo.com

cardiffo.com