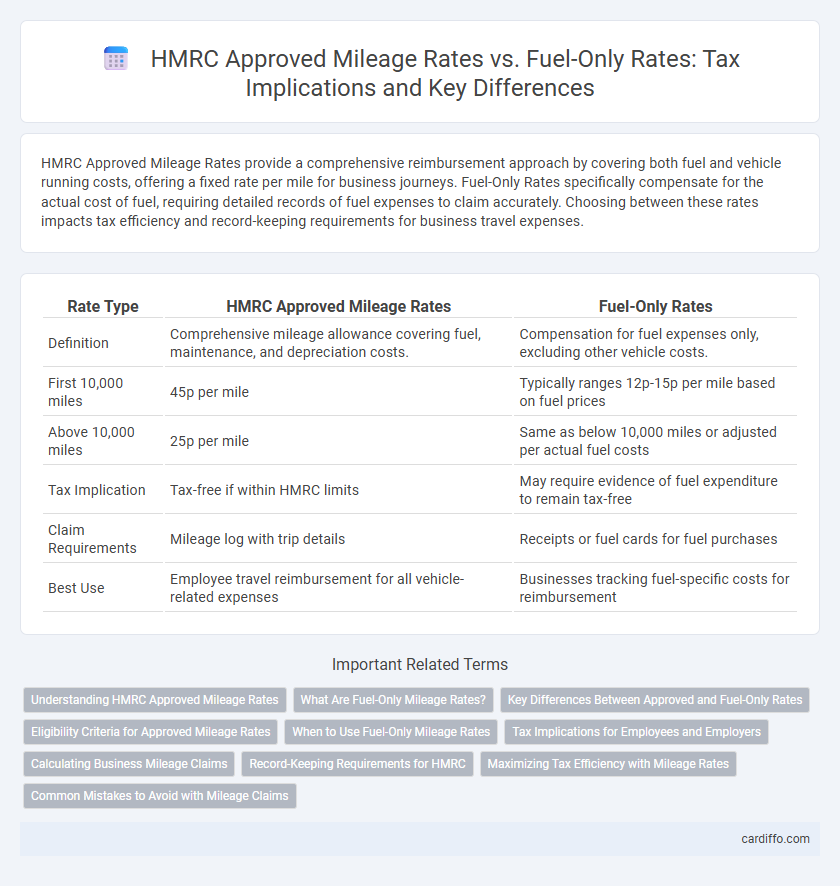

HMRC Approved Mileage Rates provide a comprehensive reimbursement approach by covering both fuel and vehicle running costs, offering a fixed rate per mile for business journeys. Fuel-Only Rates specifically compensate for the actual cost of fuel, requiring detailed records of fuel expenses to claim accurately. Choosing between these rates impacts tax efficiency and record-keeping requirements for business travel expenses.

Table of Comparison

| Rate Type | HMRC Approved Mileage Rates | Fuel-Only Rates |

|---|---|---|

| Definition | Comprehensive mileage allowance covering fuel, maintenance, and depreciation costs. | Compensation for fuel expenses only, excluding other vehicle costs. |

| First 10,000 miles | 45p per mile | Typically ranges 12p-15p per mile based on fuel prices |

| Above 10,000 miles | 25p per mile | Same as below 10,000 miles or adjusted per actual fuel costs |

| Tax Implication | Tax-free if within HMRC limits | May require evidence of fuel expenditure to remain tax-free |

| Claim Requirements | Mileage log with trip details | Receipts or fuel cards for fuel purchases |

| Best Use | Employee travel reimbursement for all vehicle-related expenses | Businesses tracking fuel-specific costs for reimbursement |

Understanding HMRC Approved Mileage Rates

HMRC Approved Mileage Rates allow employees to claim tax-free reimbursements per mile for business travel using their personal vehicles, with rates set at 45p per mile for the first 10,000 miles and 25p for subsequent miles. These rates cover fuel, wear and tear, insurance, and other running costs, offering comprehensive compensation compared to fuel-only rates that reimburse just the cost of fuel. Understanding these rates ensures accurate expense claims and compliance with HMRC guidelines to avoid tax liabilities.

What Are Fuel-Only Mileage Rates?

Fuel-only mileage rates are specific reimbursement rates set by HMRC to cover the actual fuel expenses incurred during business travel, excluding other vehicle costs such as depreciation, insurance, or maintenance. These rates apply when an employer reimburses employees based solely on fuel consumption, ensuring accurate compensation for fuel costs without overpaying for additional vehicle expenses. HMRC's fuel-only rates help maintain compliance with tax regulations by distinguishing fuel reimbursements from broader mileage allowances.

Key Differences Between Approved and Fuel-Only Rates

HMRC Approved Mileage Rates cover a comprehensive allowance for business travel expenses, including costs for fuel, maintenance, insurance, and depreciation, whereas Fuel-Only Rates reimburse solely for the fuel consumed during business trips. Approved Mileage Rates vary according to vehicle engine size and travel distance, providing a fixed pence-per-mile amount, while Fuel-Only Rates are calculated based on actual fuel expenditure using receipts or a fuel log. The key difference lies in the scope of coverage: Approved Mileage Rates offer a simplified, all-inclusive reimbursement method, whereas Fuel-Only Rates require detailed fuel cost tracking and do not account for other vehicle-related expenses.

Eligibility Criteria for Approved Mileage Rates

Eligible employees can claim HMRC Approved Mileage Rates when using their personal vehicle for business purposes, including cars, vans, motorcycles, and bicycles. The rates apply only if the vehicle is not provided by the employer and covers the entire journey's fuel and running costs. Specific conditions include maintaining accurate mileage records and ensuring the claim does not exceed the approved per-mile allowance set by HMRC.

When to Use Fuel-Only Mileage Rates

Use HMRC fuel-only mileage rates when an employer reimburses only the cost of fuel for business travel, excluding other vehicle expenses like insurance or depreciation. These rates apply primarily when employees provide a vehicle and the employer covers fuel costs separately rather than paying a fixed mileage allowance. Claiming fuel-only rates ensures accurate tax compliance and prevents overpayment of taxable benefits or expenses.

Tax Implications for Employees and Employers

HMRC Approved Mileage Rates provide tax-free reimbursement to employees for business mileage using personal vehicles, covering both fuel and vehicle running costs, at 45p per mile for the first 10,000 miles and 25p thereafter. Fuel-Only Rates reimburse solely the fuel expenses incurred, requiring employees to pay tax and National Insurance contributions on the difference if standard Approved Mileage Rates are exceeded. Employers benefit from simplified record-keeping and potential National Insurance savings when reimbursing at HMRC Approved Mileage Rates rather than Fuel-Only Rates, ensuring compliance and minimizing tax liabilities for both parties.

Calculating Business Mileage Claims

HMRC Approved Mileage Rates provide fixed allowances for business mileage claims, including specific rates per mile for cars, vans, and motorcycles, which simplify reimbursement by covering fuel, maintenance, and depreciation. Fuel-Only Rates apply solely to fuel costs and require detailed fuel purchase records to support claims, making them suited for employees reimbursed through fuel cards or pay-as-you-go fuel tracking. Accurate calculation of business mileage claims using HMRC rates ensures compliance and maximizes allowable expenses, avoiding potential tax discrepancies.

Record-Keeping Requirements for HMRC

HMRC requires precise record-keeping for both Approved Mileage Rates and Fuel-Only Rates, including date, destination, purpose, and miles traveled to ensure compliance. Maintaining detailed logs with fuel receipts or mileage logs is essential to support claims and avoid disputes during audits. Failure to adequately document travel details can result in disallowed expenses and potential penalties under HMRC regulations.

Maximizing Tax Efficiency with Mileage Rates

HMRC Approved Mileage Rates provide a tax-efficient method for reimbursing business travel, allowing employees to claim a fixed rate per mile that covers fuel, maintenance, and depreciation costs. Fuel-only rates, in contrast, reimburse solely for fuel expenses, often leading to undercompensation for total vehicle use and missed tax relief opportunities. Choosing HMRC Approved Mileage Rates maximizes tax efficiency by simplifying expense claims, ensuring full cost recovery, and reducing the risk of HMRC penalties during compliance checks.

Common Mistakes to Avoid with Mileage Claims

Claiming mileage using HMRC approved mileage rates instead of fuel-only rates often leads to over-claiming expenses by including fuel costs twice or misapplying the wrong rates for different vehicle categories. Failure to maintain accurate, contemporaneous mileage records and mixing personal with business mileage can result in non-compliance and potential penalties. Ensuring the correct application of the approved rates for cars, motorcycles, or vans and keeping detailed logs eliminates common errors and supports HMRC audit requirements.

HMRC Approved Mileage Rates vs Fuel-Only Rates Infographic

cardiffo.com

cardiffo.com