Electric vehicle exemption offers significant tax relief by reducing or eliminating registration fees and annual taxes, encouraging environmentally friendly transportation. In contrast, diesel surcharge imposes additional charges on diesel vehicle owners to offset pollution and promote cleaner alternatives. These fiscal policies aim to balance environmental goals with revenue needs, incentivizing electric vehicle adoption while discouraging diesel usage.

Table of Comparison

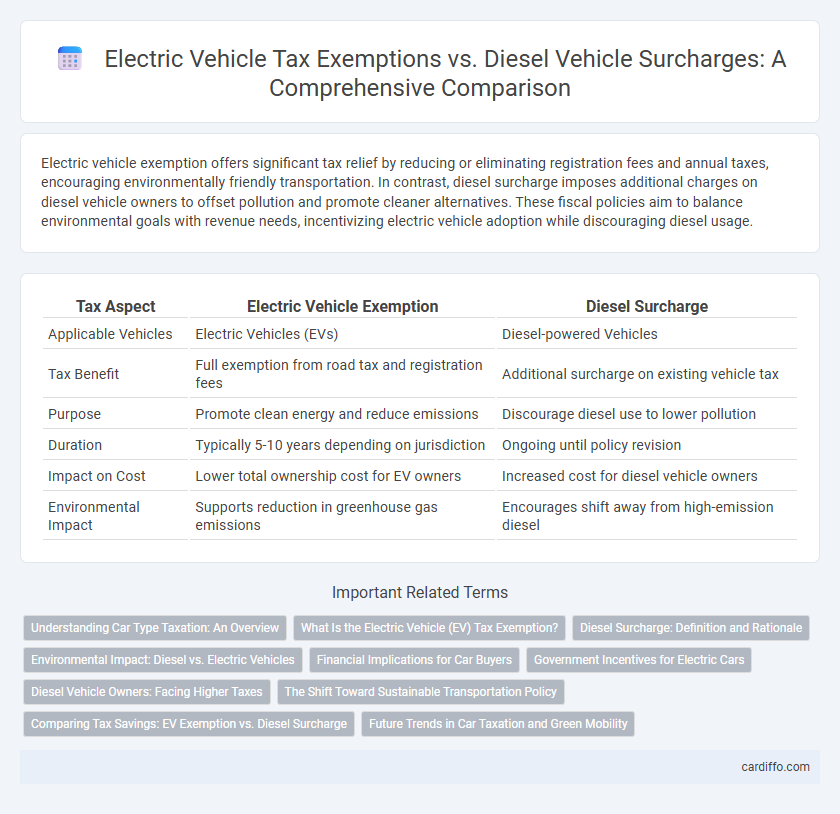

| Tax Aspect | Electric Vehicle Exemption | Diesel Surcharge |

|---|---|---|

| Applicable Vehicles | Electric Vehicles (EVs) | Diesel-powered Vehicles |

| Tax Benefit | Full exemption from road tax and registration fees | Additional surcharge on existing vehicle tax |

| Purpose | Promote clean energy and reduce emissions | Discourage diesel use to lower pollution |

| Duration | Typically 5-10 years depending on jurisdiction | Ongoing until policy revision |

| Impact on Cost | Lower total ownership cost for EV owners | Increased cost for diesel vehicle owners |

| Environmental Impact | Supports reduction in greenhouse gas emissions | Encourages shift away from high-emission diesel |

Understanding Car Type Taxation: An Overview

Electric vehicle exemption policies reduce or eliminate road and registration taxes, promoting eco-friendly transportation by incentivizing zero-emission cars. Diesel surcharges impose additional fees on diesel-powered vehicles to offset higher environmental and health costs linked to emissions. Understanding these taxation approaches highlights the financial impact on vehicle ownership and supports informed decisions based on environmental regulations and economic benefits.

What Is the Electric Vehicle (EV) Tax Exemption?

The Electric Vehicle (EV) Tax Exemption allows qualifying electric vehicles to be exempt from specific federal and state taxes, reducing the overall cost of ownership. This incentive typically applies to purchase price, registration fees, or road use taxes, encouraging consumers to choose environmentally friendly transportation. By contrast, diesel vehicles often face surcharges aimed at offsetting their higher emissions, making EV tax exemptions a key financial advantage in promoting clean energy adoption.

Diesel Surcharge: Definition and Rationale

The diesel surcharge is an additional tax imposed on diesel fuel to offset its higher environmental and health costs compared to cleaner alternatives. This surcharge aims to discourage diesel consumption by internalizing the external costs of air pollution, greenhouse gas emissions, and public health impacts associated with diesel engines. By increasing the cost of diesel, policymakers encourage a shift towards electric vehicles and other low-emission transportation options, promoting sustainable mobility and reducing overall carbon footprints.

Environmental Impact: Diesel vs. Electric Vehicles

Electric vehicles (EVs) produce zero tailpipe emissions, significantly reducing air pollutants like nitrogen oxides (NOx) and particulate matter compared to diesel vehicles, which emit high levels of these harmful substances contributing to air quality degradation and respiratory issues. Tax incentives such as electric vehicle exemptions encourage adoption of cleaner transportation, mitigating greenhouse gas emissions and supporting climate goals by lowering carbon footprints. In contrast, diesel surcharges reflect the environmental cost of continued diesel vehicle usage, factoring in long-term health impacts and ecosystem damage from fossil fuel combustion.

Financial Implications for Car Buyers

Electric vehicle exemption offers significant financial benefits for car buyers, including reduced purchase taxes and eligibility for government incentives that lower overall ownership costs. In contrast, diesel surcharge policies impose additional fees on diesel vehicles, increasing the total cost of acquisition and long-term expenses such as road taxes. These fiscal measures influence consumer behavior by making electric vehicles more attractive through immediate tax relief and ongoing savings compared to diesel-powered cars.

Government Incentives for Electric Cars

Government incentives for electric vehicles (EVs) include tax exemptions that significantly reduce the overall cost of ownership, encouraging consumers to switch from traditional diesel cars. Diesel vehicles often face surcharges or higher taxes aimed at curbing pollution, making EV exemptions more financially attractive. These policies drive adoption of cleaner transportation by offering direct fiscal benefits such as reduced registration fees, tax credits, and exemption from road taxes.

Diesel Vehicle Owners: Facing Higher Taxes

Diesel vehicle owners face significantly higher taxes due to surcharges aimed at reducing pollution and promoting cleaner energy. These surcharges increase the cost of owning and operating diesel vehicles, encouraging a shift toward electric vehicles eligible for various tax exemptions. Tax policies increasingly favor electric vehicle incentives, creating a notable financial disadvantage for diesel vehicle owners in terms of annual registration fees and fuel taxes.

The Shift Toward Sustainable Transportation Policy

Electric vehicle exemption policies reduce tax burdens on electric cars, promoting cleaner transportation and lowering greenhouse gas emissions. Diesel surcharges increase operational costs for diesel vehicles, discouraging their use and encouraging a transition to greener alternatives. These fiscal measures reflect a global shift toward sustainable transportation policies aimed at reducing air pollution and achieving climate targets.

Comparing Tax Savings: EV Exemption vs. Diesel Surcharge

Electric vehicles (EVs) benefit from significant tax savings through exemptions on registration fees and reduced road taxes, often amounting to thousands of dollars annually compared to diesel vehicles. In contrast, diesel-powered vehicles incur surcharges designed to offset environmental and health costs, increasing overall tax liabilities by up to 20% more than their EV counterparts. This disparity highlights substantial fiscal incentives favoring EV adoption while penalizing diesel usage to promote cleaner transportation options.

Future Trends in Car Taxation and Green Mobility

Electric vehicle exemptions are becoming a key component in future car taxation frameworks, encouraging zero-emission transportation through reduced or eliminated road taxes. Diesel surcharges are expected to increase progressively as governments aim to discourage high-pollution vehicles, aligning tax policies with climate targets and urban air quality standards. Green mobility incentives, including tax rebates and congestion charge reductions, will drive broader EV adoption and support sustainable transportation infrastructure development.

Electric Vehicle Exemption vs Diesel Surcharge Infographic

cardiffo.com

cardiffo.com