Vehicle Excise Duty (VED) and Road Fund Licence are often mistaken as separate charges, but they refer to the same tax levied on vehicles used on public roads in the UK. VED is the current official term replacing the older Road Fund Licence, which was abolished in 1937 but the concept remains as the tax ensures funding for road maintenance. Understanding this distinction helps vehicle owners comply with legal requirements while contributing to transportation infrastructure costs.

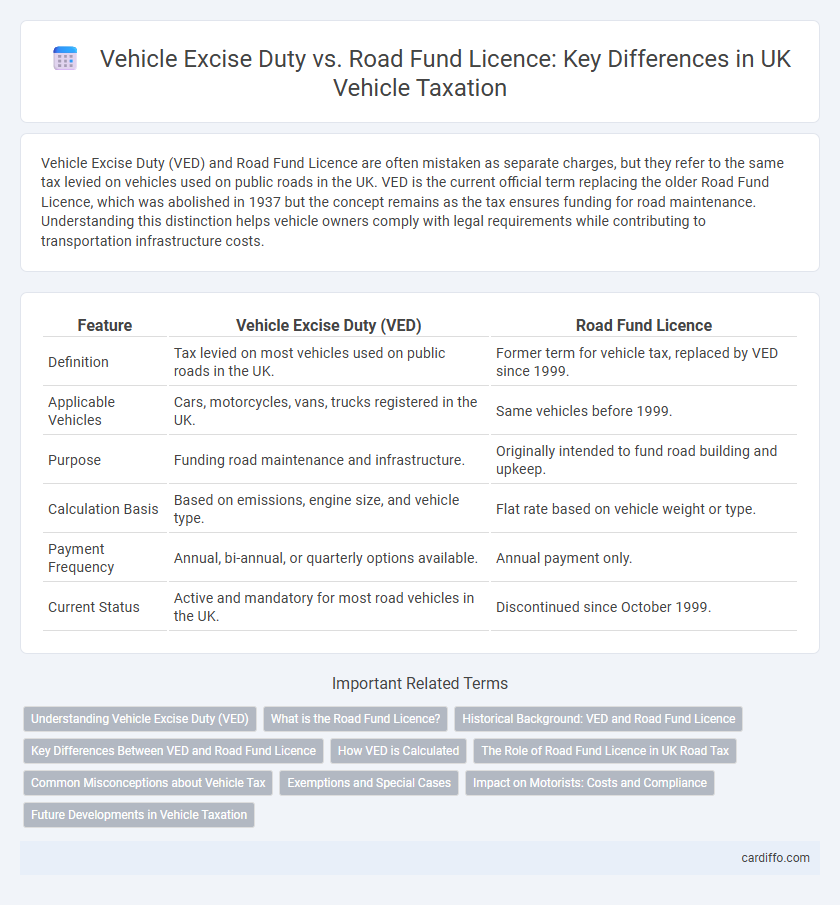

Table of Comparison

| Feature | Vehicle Excise Duty (VED) | Road Fund Licence |

|---|---|---|

| Definition | Tax levied on most vehicles used on public roads in the UK. | Former term for vehicle tax, replaced by VED since 1999. |

| Applicable Vehicles | Cars, motorcycles, vans, trucks registered in the UK. | Same vehicles before 1999. |

| Purpose | Funding road maintenance and infrastructure. | Originally intended to fund road building and upkeep. |

| Calculation Basis | Based on emissions, engine size, and vehicle type. | Flat rate based on vehicle weight or type. |

| Payment Frequency | Annual, bi-annual, or quarterly options available. | Annual payment only. |

| Current Status | Active and mandatory for most road vehicles in the UK. | Discontinued since October 1999. |

Understanding Vehicle Excise Duty (VED)

Vehicle Excise Duty (VED) is a mandatory tax levied on most vehicles used or kept on public roads in the UK, calculated based on factors such as vehicle type, engine size, and CO2 emissions. Unlike the outdated Road Fund Licence, which was originally intended to finance road construction, VED revenue now contributes to general government funds and road maintenance. Understanding VED rates and payment deadlines is crucial for vehicle owners to avoid penalties and ensure legal compliance.

What is the Road Fund Licence?

The Road Fund Licence, historically known as the vehicle tax, was a mandatory payment required for all motor vehicles used on public roads in the UK. It primarily funded road maintenance and infrastructure improvements but was replaced by Vehicle Excise Duty (VED) in 1994 to streamline tax collection and enforcement. Today, Vehicle Excise Duty serves as the official road tax, while the term Road Fund Licence is largely obsolete yet still recognized in some legal and historical contexts.

Historical Background: VED and Road Fund Licence

Vehicle Excise Duty (VED) originated in 1920 as a replacement for the Road Fund Licence, which was initially introduced in 1923 to finance road construction and maintenance through a dedicated fund. The Road Fund Licence operated on a user-pays principle, collecting fees from vehicle owners to directly support road infrastructure, but was eventually merged into general taxation in 1937, leading to the modern VED system. The shift from the Road Fund Licence to VED marked a transition from a ring-fenced funding model to a broader tax-based approach, influencing current vehicle taxation policies in the UK.

Key Differences Between VED and Road Fund Licence

Vehicle Excise Duty (VED) is a mandatory tax levied on vehicles used or kept on public roads in the UK, calculated based on factors such as engine size, CO2 emissions, and vehicle type. The Road Fund Licence was the precursor to VED, originally introduced in 1921 to finance road construction and maintenance but has since been replaced and is no longer issued. Unlike the Road Fund Licence, VED revenue contributes to the general government budget rather than being ring-fenced exclusively for road infrastructure.

How VED is Calculated

Vehicle Excise Duty (VED) is calculated based on factors such as vehicle type, engine size, fuel type, and CO2 emissions. For example, cars registered after March 2001 are taxed primarily according to their CO2 emissions, with higher polluting vehicles incurring higher rates. Diesel vehicles may attract a surcharge, and electric or ultra-low emission vehicles often qualify for reduced or zero rates under current UK tax rules.

The Role of Road Fund Licence in UK Road Tax

The Road Fund Licence historically served as the UK's primary vehicle tax, introduced in 1921 to finance road maintenance through vehicle owners' contributions. It functioned as a mandatory fee specifically linked to the use of motor vehicles on public roads, essentially funding the Road Fund. Although replaced in 1994 by Vehicle Excise Duty (VED), the Road Fund Licence remains a significant term reflecting the origins and evolution of UK road tax legislation.

Common Misconceptions about Vehicle Tax

Vehicle Excise Duty (VED) is often confused with the Road Fund Licence, but the latter was abolished in 1937 and is no longer applicable. Many believe that the tax directly funds road maintenance, yet VED revenue is allocated to the general Treasury budget rather than specific road infrastructure projects. Understanding these distinctions is crucial for accurate knowledge about vehicle taxation and its purpose.

Exemptions and Special Cases

Vehicle Excise Duty (VED) and Road Fund Licence historically represented the same tax but differ in terminology and administration since 1997. Exemptions for VED include classic vehicles over 40 years old, agricultural vehicles, and disabled badges holders, which align closely with previous Road Fund Licence exemptions. Special cases like electric vehicles benefit from zero-rated VED, while certain commercial and military vehicles claim exemption under specific government provisions.

Impact on Motorists: Costs and Compliance

Vehicle Excise Duty (VED) directly affects motorists by determining annual taxation costs based on vehicle emissions, engine size, and fuel type, influencing ownership expenses. Road Fund Licence, historically used interchangeably with VED, was superseded, but misunderstanding its status can cause compliance issues and potential fines for drivers. Clear awareness of current VED regulations ensures motorists accurately budget for costs and meet legal obligations, avoiding penalties and contributing to road maintenance funding.

Future Developments in Vehicle Taxation

Future developments in vehicle taxation focus on phasing out the traditional Vehicle Excise Duty (VED) system in favor of more dynamic, emissions-based charges aligned with environmental goals. The outdated Road Fund Licence has been replaced by digital tax systems integrating real-time data for accurate mileage and emissions reporting. Governments plan to implement smarter tax models leveraging telematics and automated enforcement to incentivize low-emission vehicles and support sustainable transport infrastructure.

Vehicle Excise Duty vs Road Fund Licence Infographic

cardiffo.com

cardiffo.com