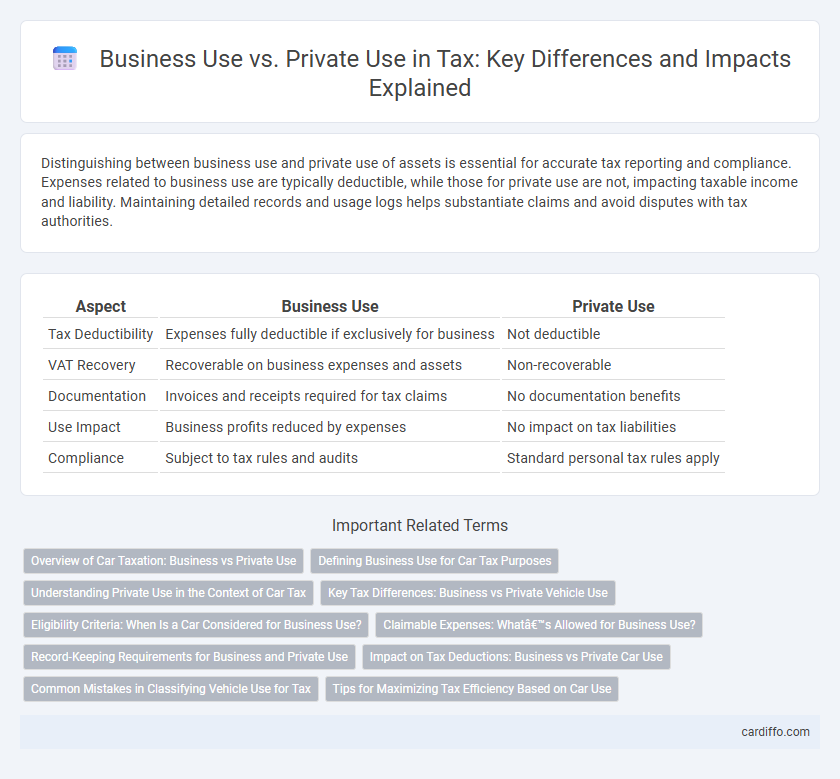

Distinguishing between business use and private use of assets is essential for accurate tax reporting and compliance. Expenses related to business use are typically deductible, while those for private use are not, impacting taxable income and liability. Maintaining detailed records and usage logs helps substantiate claims and avoid disputes with tax authorities.

Table of Comparison

| Aspect | Business Use | Private Use |

|---|---|---|

| Tax Deductibility | Expenses fully deductible if exclusively for business | Not deductible |

| VAT Recovery | Recoverable on business expenses and assets | Non-recoverable |

| Documentation | Invoices and receipts required for tax claims | No documentation benefits |

| Use Impact | Business profits reduced by expenses | No impact on tax liabilities |

| Compliance | Subject to tax rules and audits | Standard personal tax rules apply |

Overview of Car Taxation: Business vs Private Use

Car taxation differentiates significantly between business use and private use, impacting deductible expenses and tax liabilities. Vehicles used primarily for business purposes qualify for tax deductions on depreciation, fuel, maintenance, and insurance, while private use typically disallows such deductions, with some exceptions for mixed-use cases requiring precise mileage logging. Understanding the distinction is crucial to optimize tax benefits and ensure compliance with tax authorities like the IRS or HMRC.

Defining Business Use for Car Tax Purposes

Business use for car tax purposes refers to any mileage driven exclusively for work-related activities, such as traveling between job sites, client meetings, or transporting goods. The distinction between business and private use is essential because only the business portion of vehicle expenses can be claimed as tax-deductible. Accurate records of mileage, including dates, destinations, and business purpose, are required to substantiate claims and comply with tax regulations.

Understanding Private Use in the Context of Car Tax

Private use of a vehicle for car tax purposes refers to any non-business-related driving, such as commuting or personal errands, which must be accurately recorded to avoid tax penalties. HMRC requires detailed logs distinguishing between business mileage and private mileage to correctly calculate taxable benefits and allowable expenses. Misclassifying private use can lead to understated taxable benefits and potential fines, emphasizing the importance of precise documentation.

Key Tax Differences: Business vs Private Vehicle Use

Business vehicle use allows for tax deductions on expenses like fuel, maintenance, and depreciation, reducing taxable income. Private vehicle use does not qualify for such deductions and may result in higher taxable income due to lack of expense claims. Accurate record-keeping of mileage and purpose is essential to differentiate between business and private use for tax compliance and audit purposes.

Eligibility Criteria: When Is a Car Considered for Business Use?

A car is considered for business use when it is primarily employed for activities such as client meetings, transporting goods, or traveling between multiple work locations. Eligibility criteria include maintaining detailed mileage logs to distinguish between business and private travel, with business use typically exceeding 50% of total mileage. Tax authorities require supporting documentation to validate business-related expenses and ensure compliance with deductible vehicle use rules.

Claimable Expenses: What’s Allowed for Business Use?

Claimable expenses for business use include costs directly related to generating income, such as office supplies, travel expenses, and utilities proportional to business activity. When assets like vehicles or home office equipment are used for both business and private purposes, only the business-use percentage of these expenses is deductible. Accurate record-keeping, such as mileage logs and invoices, is essential to substantiate claims and comply with tax regulations.

Record-Keeping Requirements for Business and Private Use

Accurate record-keeping is essential for distinguishing business use from private use of assets, particularly for tax deductions and compliance. Businesses must maintain detailed logs, receipts, and usage records to substantiate claims and calculate the deductible portion accurately. Failure to keep thorough documentation can result in denied deductions and potential audits by tax authorities.

Impact on Tax Deductions: Business vs Private Car Use

Tax deductions differ significantly between business and private car use, with expenses related to business use generally being deductible, including fuel, maintenance, and depreciation. Private car use expenses are typically non-deductible, limiting the ability to reduce taxable income. Accurate logbooks or mileage tracking are essential to substantiate business use claims and maximize allowable deductions under tax regulations.

Common Mistakes in Classifying Vehicle Use for Tax

Misclassifying vehicle use for tax purposes often leads to incorrect deduction claims, with many taxpayers failing to accurately separate business mileage from private travel. Failure to maintain detailed mileage logs and mixing personal trips with business activity commonly results in audit adjustments and potential penalties. Proper classification requires consistent record-keeping and adherence to IRS guidelines on business versus private use to optimize tax benefits and compliance.

Tips for Maximizing Tax Efficiency Based on Car Use

Track all mileage meticulously to distinguish between business and private use, ensuring accurate tax deductions and preventing audits. Utilize a mileage log app or maintain a physical logbook to document trip purpose, dates, and distances. Allocate expenses proportionally based on business use percentage, optimizing deductible costs while complying with IRS guidelines.

Business Use vs Private Use Infographic

cardiffo.com

cardiffo.com