Registration tax is a one-time fee paid when a vehicle is first registered, based on factors such as vehicle type, value, and emissions. Road tax, also known as vehicle excise duty, is an ongoing annual charge for the legal use of a vehicle on public roads, calculated according to engine size or CO2 emissions. Understanding the distinction between registration tax and road tax is essential for budgeting and compliance with tax regulations.

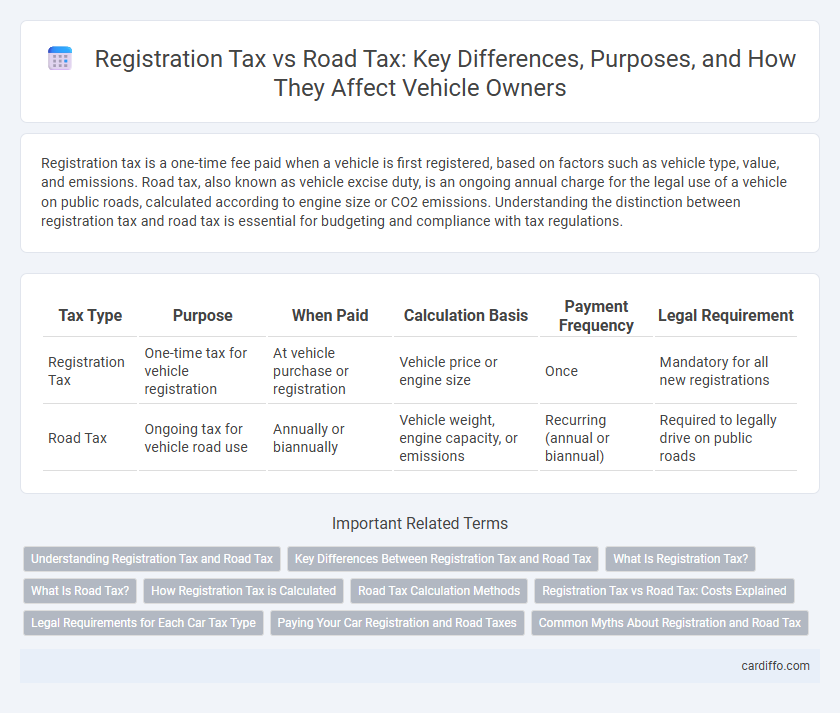

Table of Comparison

| Tax Type | Purpose | When Paid | Calculation Basis | Payment Frequency | Legal Requirement |

|---|---|---|---|---|---|

| Registration Tax | One-time tax for vehicle registration | At vehicle purchase or registration | Vehicle price or engine size | Once | Mandatory for all new registrations |

| Road Tax | Ongoing tax for vehicle road use | Annually or biannually | Vehicle weight, engine capacity, or emissions | Recurring (annual or biannual) | Required to legally drive on public roads |

Understanding Registration Tax and Road Tax

Registration Tax is a one-time fee levied when a vehicle is first registered, often calculated based on the vehicle's CO2 emissions, engine size, or value, serving as a significant source of revenue for governments. Road Tax, also known as Vehicle Excise Duty, is an annual tax required to legally drive a vehicle on public roads, with rates varying according to vehicle type, emissions, and weight. Understanding the distinction helps vehicle owners comply with legal obligations and anticipate the financial costs associated with vehicle ownership and usage.

Key Differences Between Registration Tax and Road Tax

Registration Tax is a one-time fee imposed during the vehicle registration process, calculated based on factors such as vehicle type, engine size, and emissions. Road Tax, also known as Vehicle Excise Duty, is a recurring annual or biannual charge required to legally operate a vehicle on public roads, often varying by vehicle weight, fuel type, and CO2 emissions. The primary difference lies in Registration Tax being a conditional setup cost, whereas Road Tax functions as ongoing financial compliance for vehicle use.

What Is Registration Tax?

Registration tax is a one-time fee levied when a vehicle is first registered or imported into a country, calculated based on factors such as vehicle value, engine size, or emissions. This tax differs from road tax, which is a recurring charge imposed for the ongoing use of public roads and typically depends on vehicle weight or fuel type. Understanding registration tax is essential for vehicle owners to accurately budget initial acquisition costs.

What Is Road Tax?

Road tax is a mandatory fee imposed by governments on vehicle owners to fund road maintenance and infrastructure development. It is typically calculated based on vehicle type, engine size, and emissions, varying annually depending on jurisdiction. Unlike registration tax paid once upon vehicle acquisition, road tax must be renewed regularly to legally operate the vehicle on public roads.

How Registration Tax is Calculated

Registration Tax is typically calculated based on the vehicle's purchase price, engine size, CO2 emissions, or a combination of these factors, depending on the jurisdiction. Some regions apply a flat rate while others use progressive scales tied to emission levels or vehicle value. Understanding the specific formula used by local authorities is crucial for accurate tax estimation and compliance.

Road Tax Calculation Methods

Road tax calculation methods vary significantly based on vehicle type, engine size, and emission standards, with many jurisdictions using weight-based or CO2 emission-based formulas to determine fees. In contrast to one-time registration tax imposed during vehicle purchase, road tax is an annual or periodic fee required for vehicle use on public roads. Accurate calculation of road tax promotes environmental goals and ensures equitable taxation aligned with vehicle impact and road maintenance costs.

Registration Tax vs Road Tax: Costs Explained

Registration tax is a one-time fee paid when a vehicle is first registered, often calculated based on the vehicle's value, engine size, or CO2 emissions. Road tax, also known as vehicle excise duty, is an ongoing annual charge required for legally driving a vehicle on public roads, typically determined by factors like weight, fuel type, and emissions. Understanding these distinct costs helps vehicle owners budget accurately for both initial purchase expenses and recurring maintenance obligations.

Legal Requirements for Each Car Tax Type

Registration Tax is a mandatory one-time fee levied on vehicle owners upon initial registration, determined by factors such as vehicle value, engine size, and emissions. Road Tax, or vehicle excise duty, requires periodic payment to legally operate the vehicle on public roads and varies based on vehicle type, weight, and emission standards. Compliance with both taxes ensures adherence to national legal frameworks governing vehicle ownership and usage.

Paying Your Car Registration and Road Taxes

Paying your car registration tax involves a one-time or annual fee based on the vehicle's value or age, ensuring legal ownership and compliance with local regulations. Road tax, often called vehicle excise duty, is typically an annual charge calculated according to factors like engine size, emissions, and vehicle type, aimed at funding road maintenance and infrastructure. Understanding the distinction between registration tax and road tax helps vehicle owners allocate their payments accurately and avoid penalties or legal issues.

Common Myths About Registration and Road Tax

Common myths about registration tax and road tax often confuse vehicle owners regarding their purposes and payment obligations; registration tax is a one-time fee paid during vehicle registration to cover administrative and ownership transfer costs, while road tax is a recurring fee collected to fund road maintenance and infrastructure. Many believe that road tax varies with fuel type or engine size universally, but actual rates depend on local jurisdictions and specific regulations. Misunderstandings about exemptions, such as electric vehicle benefits or vintage car reliefs, further complicate compliance and financial planning for drivers.

Registration Tax vs Road Tax Infographic

cardiffo.com

cardiffo.com