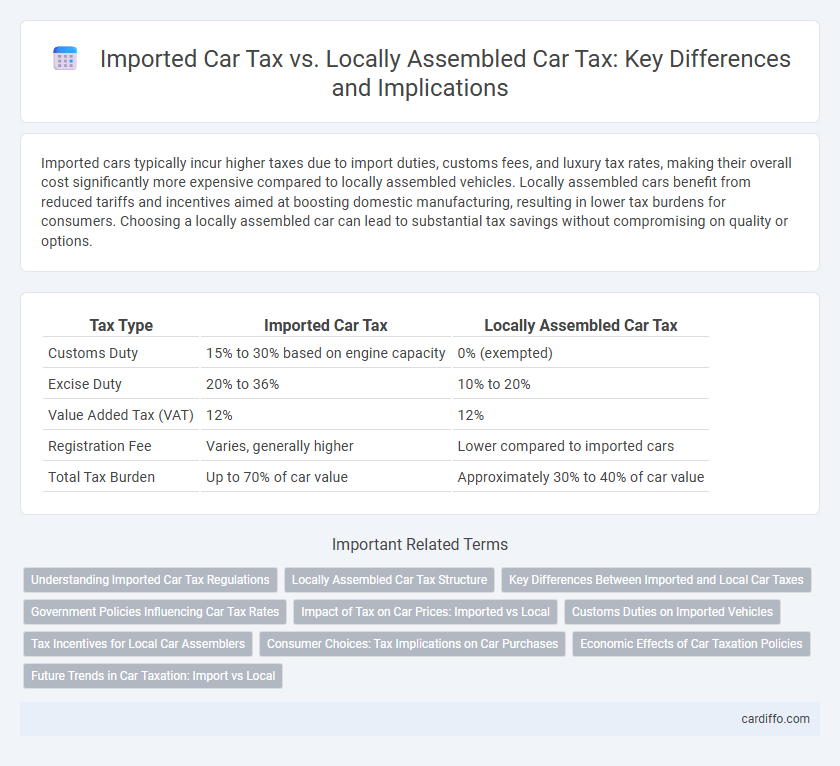

Imported cars typically incur higher taxes due to import duties, customs fees, and luxury tax rates, making their overall cost significantly more expensive compared to locally assembled vehicles. Locally assembled cars benefit from reduced tariffs and incentives aimed at boosting domestic manufacturing, resulting in lower tax burdens for consumers. Choosing a locally assembled car can lead to substantial tax savings without compromising on quality or options.

Table of Comparison

| Tax Type | Imported Car Tax | Locally Assembled Car Tax |

|---|---|---|

| Customs Duty | 15% to 30% based on engine capacity | 0% (exempted) |

| Excise Duty | 20% to 36% | 10% to 20% |

| Value Added Tax (VAT) | 12% | 12% |

| Registration Fee | Varies, generally higher | Lower compared to imported cars |

| Total Tax Burden | Up to 70% of car value | Approximately 30% to 40% of car value |

Understanding Imported Car Tax Regulations

Imported car tax regulations impose higher duty rates compared to locally assembled vehicles, reflecting tariffs designed to protect domestic auto industries and encourage local manufacturing. These taxes include import duty, VAT, and excise tax, which vary depending on the vehicle's engine capacity, age, and country of origin. Understanding these specific tax brackets and exemptions is crucial for accurate cost calculation and compliance when importing vehicles.

Locally Assembled Car Tax Structure

Locally assembled cars benefit from a preferential tax structure designed to promote domestic manufacturing, typically featuring lower import duties on components instead of whole vehicles. This tax framework includes reduced excise duties and value-added taxes compared to fully imported cars, resulting in significant cost savings. Governments often implement these measures to stimulate local industry growth and increase employment within the automotive sector.

Key Differences Between Imported and Local Car Taxes

Imported car tax rates are generally higher due to additional customs duties, import levies, and value-added tax applied to vehicles brought from abroad. Locally assembled cars benefit from lower excise taxes and government incentives aimed at promoting domestic manufacturing, reducing the overall tax burden. The tax difference significantly affects the final retail price, with imported cars often incurring a 20-40% higher tax compared to locally assembled models.

Government Policies Influencing Car Tax Rates

Government policies significantly impact car tax rates, with imported cars often subjected to higher tariffs and excise duties compared to locally assembled vehicles to promote domestic manufacturing. Import duties on foreign cars can range from 20% to 100%, depending on engine capacity and emission standards, while locally assembled cars typically benefit from reduced tax rates and incentives. These policies aim to boost the local automotive industry, increase employment, and reduce foreign exchange outflow.

Impact of Tax on Car Prices: Imported vs Local

Imported car tax rates significantly increase the final consumer price due to high import duties, tariffs, and luxury taxes imposed in many countries, often exceeding 30% of the vehicle's value. Locally assembled cars benefit from lower tax rates and government incentives aimed at boosting domestic manufacturing, resulting in more competitive pricing and increased affordability for buyers. This tax disparity directly influences consumer preference, with imported cars positioned as premium products while local assemblies dominate budget-conscious market segments.

Customs Duties on Imported Vehicles

Customs duties on imported vehicles are typically higher than taxes on locally assembled cars, impacting overall ownership costs. Import tariffs, often exceeding 30%, increase the final price of imported cars, whereas locally assembled vehicles benefit from reduced or waived customs fees under trade agreements or government incentives. This tax disparity encourages domestic auto manufacturing and affects consumer decisions between imported and locally assembled cars.

Tax Incentives for Local Car Assemblers

Tax incentives for local car assemblers significantly reduce the overall tax burden compared to imported vehicles, encouraging domestic automotive production. Locally assembled cars often benefit from reduced import duties, exemptions on excise taxes, and special depreciation allowances, making them more competitively priced. These fiscal policies aim to stimulate local manufacturing, enhance employment, and promote technology transfer within the automotive sector.

Consumer Choices: Tax Implications on Car Purchases

Imported cars typically face higher import duties, ranging from 30% to 50%, increasing the overall purchase price compared to locally assembled vehicles, which benefit from reduced tax rates and government incentives. Consumers often choose locally assembled cars to minimize tax burdens, resulting in lower upfront costs and more affordable financing options. Tax policies directly influence purchasing patterns, encouraging buyers to prefer domestically assembled vehicles to optimize cost savings.

Economic Effects of Car Taxation Policies

High import taxes on foreign vehicles increase the cost of imported cars, promoting demand for locally assembled vehicles and encouraging domestic automotive industry growth. Conversely, lower taxes on locally assembled cars stimulate local employment and supply chain development but may reduce government revenue from tariffs. Balancing these tax policies affects consumer prices, trade deficits, and economic competitiveness within the automotive sector.

Future Trends in Car Taxation: Import vs Local

Future trends in car taxation indicate a growing shift towards incentivizing locally assembled vehicles through reduced tax rates and subsidies, aiming to boost domestic manufacturing and job creation. Imported cars may face increased tariffs and stricter emission-based taxes to discourage reliance on foreign supply chains and promote environmental sustainability. Governments are leveraging tax policies to balance trade deficits while fostering innovation in electric and hybrid vehicle production within local industries.

Imported Car Tax vs Locally Assembled Car Tax Infographic

cardiffo.com

cardiffo.com