Section 179 allows businesses to immediately expense the cost of qualifying property up to a certain limit, providing significant upfront tax savings, while bonus depreciation enables a 100% write-off of the remaining asset cost after Section 179 is applied, with no limit. Section 179 is subject to income limitations and caps on equipment costs, making it ideal for small to mid-sized businesses, whereas bonus depreciation can create a net operating loss since it is not limited by income. Combining both can maximize tax deductions in the year of purchase but requires careful planning to optimize benefits under current tax laws.

Table of Comparison

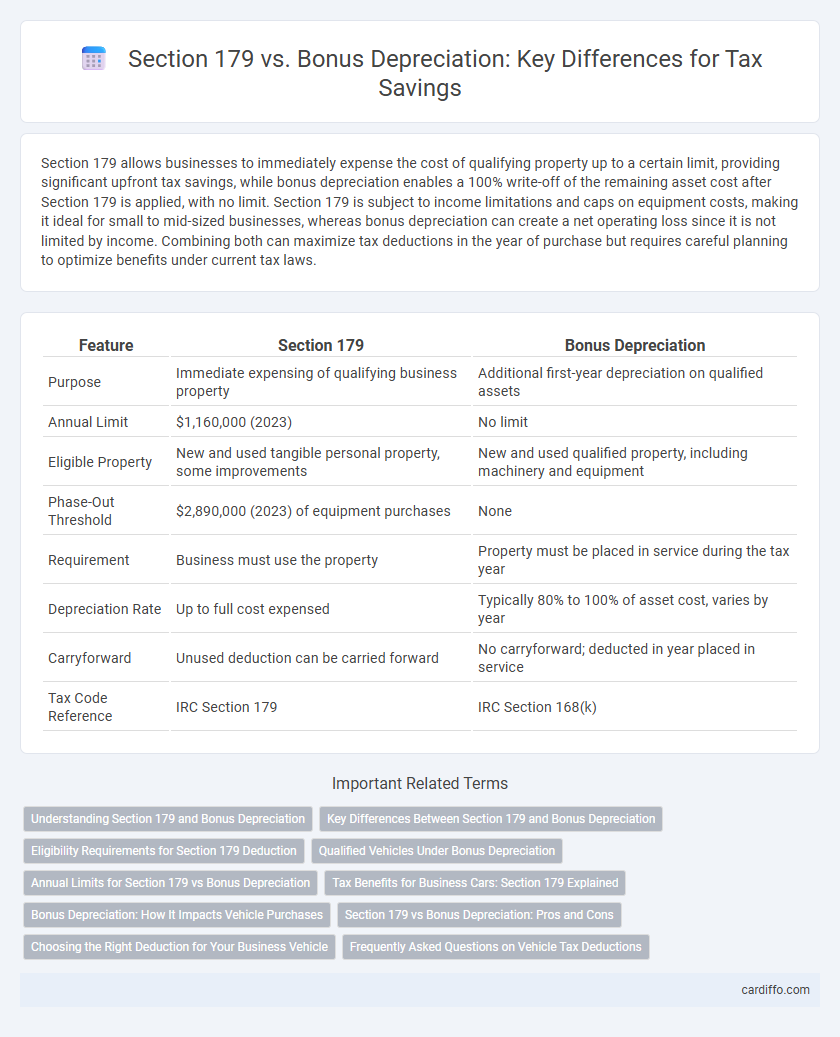

| Feature | Section 179 | Bonus Depreciation |

|---|---|---|

| Purpose | Immediate expensing of qualifying business property | Additional first-year depreciation on qualified assets |

| Annual Limit | $1,160,000 (2023) | No limit |

| Eligible Property | New and used tangible personal property, some improvements | New and used qualified property, including machinery and equipment |

| Phase-Out Threshold | $2,890,000 (2023) of equipment purchases | None |

| Requirement | Business must use the property | Property must be placed in service during the tax year |

| Depreciation Rate | Up to full cost expensed | Typically 80% to 100% of asset cost, varies by year |

| Carryforward | Unused deduction can be carried forward | No carryforward; deducted in year placed in service |

| Tax Code Reference | IRC Section 179 | IRC Section 168(k) |

Understanding Section 179 and Bonus Depreciation

Section 179 allows businesses to immediately expense the cost of qualifying property up to a specified limit, reducing taxable income in the year of purchase. Bonus depreciation permits the accelerated deduction of a percentage of the cost of eligible assets in the first year, often applied after the Section 179 deduction. Both provisions incentivize investment by enabling faster cost recovery, but Section 179 has spending caps and phase-outs, while bonus depreciation applies more broadly without such limits.

Key Differences Between Section 179 and Bonus Depreciation

Section 179 allows businesses to immediately expense up to $1.16 million of qualifying property in the tax year it is placed in service, subject to a phase-out threshold of $2.89 million, while bonus depreciation enables 100% first-year depreciation on new and used assets with no spending limit. Unlike Section 179, which requires active business use and can be limited by taxable income, bonus depreciation applies automatically and can create or increase a net operating loss. Section 179 offers the flexibility to expense specific assets selectively, whereas bonus depreciation applies to the entire cost basis of eligible property, providing faster write-offs but less control over timing.

Eligibility Requirements for Section 179 Deduction

Section 179 deduction eligibility requires that property must be purchased and placed into service during the tax year and used more than 50% for business purposes. The deduction is limited by the total amount of taxable income from active trade or business activities, and the maximum deduction limit for 2024 is $1,160,000, phased out dollar-for-dollar when equipment purchases exceed $2,890,000. Unlike bonus depreciation, which applies to new and used property without income limits, Section 179 also excludes certain real property and limits eligibility based on the taxpayer's business income.

Qualified Vehicles Under Bonus Depreciation

Qualified vehicles under bonus depreciation include passenger cars, trucks, and vans meeting specific weight and use criteria, typically those over 6,000 pounds gross vehicle weight rating (GVWR). Bonus depreciation allows for immediate expensing of 100% of the cost of qualifying new and used vehicles acquired and placed in service after September 27, 2017. This contrasts with Section 179, which imposes lower limits on passenger vehicles and requires the vehicle to be used more than 50% for business purposes to qualify.

Annual Limits for Section 179 vs Bonus Depreciation

Section 179 offers an annual limit of $1,160,000 for qualified property placed in service, phasing out dollar-for-dollar after $2,890,000 of total equipment purchases, while Bonus Depreciation allows for 100% immediate expensing of qualified assets with no annual dollar limit. Section 179 deductions must be elected and are subject to taxable income limitations, whereas Bonus Depreciation is automatically applied and can create or increase a net operating loss. Understanding the annual cap on Section 179 versus the unlimited nature of Bonus Depreciation is critical for optimizing asset write-offs in tax planning strategies.

Tax Benefits for Business Cars: Section 179 Explained

Section 179 allows businesses to immediately expense the cost of qualifying vehicles up to a set limit, reducing taxable income in the year of purchase and providing substantial upfront tax benefits. Unlike bonus depreciation, which applies to new and used vehicles with fewer restrictions, Section 179 has specific dollar caps and vehicle weight requirements, influencing the maximum deduction available. For businesses purchasing cars, leveraging Section 179 can maximize tax savings by accelerating cost recovery within the first year, optimizing cash flow and investment return.

Bonus Depreciation: How It Impacts Vehicle Purchases

Bonus depreciation allows businesses to immediately expense a significant percentage of the cost of eligible vehicles, reducing taxable income in the year of purchase. Unlike Section 179, which has a limit on the deduction amount, bonus depreciation applies to new and used vehicles without dollar limits and can be used even if the business has no taxable income. This accelerated deduction method encourages investment in fleet upgrades and newer, more efficient vehicles, significantly impacting cash flow and tax planning strategies.

Section 179 vs Bonus Depreciation: Pros and Cons

Section 179 allows businesses to expense up to $1,160,000 of qualifying equipment purchases in the year of acquisition, providing immediate tax relief but with a phase-out threshold starting at $2.89 million. Bonus depreciation permits 100% write-off of new and used assets, including qualified improvement property, without dollar limits, but requires the full expense in the first year, potentially reducing deductions in future periods. Choosing Section 179 offers flexibility with spending limits and property types, whereas bonus depreciation benefits larger investments with no cap but less control over timing.

Choosing the Right Deduction for Your Business Vehicle

Section 179 allows businesses to immediately deduct the full purchase price of qualifying vehicles up to a specified limit, maximizing tax savings in the year of acquisition. Bonus Depreciation offers a 100% write-off on new and used vehicles but is especially beneficial for higher-cost assets exceeding Section 179 caps. Evaluating vehicle cost, usage, and long-term tax strategy ensures optimal selection between Section 179 and Bonus Depreciation for business vehicle deductions.

Frequently Asked Questions on Vehicle Tax Deductions

Section 179 allows businesses to immediately deduct the full purchase price of qualifying vehicles within a specified limit, offering significant upfront tax savings. Bonus depreciation applies to new and used vehicles, enabling the deduction of a percentage of the vehicle's cost after the Section 179 limit is reached, often utilized for vehicles exceeding the Section 179 cap. Understanding vehicle eligibility, deduction limits, and the interaction between Section 179 and bonus depreciation is essential for maximizing vehicle tax deductions.

Section 179 vs Bonus Depreciation Infographic

cardiffo.com

cardiffo.com