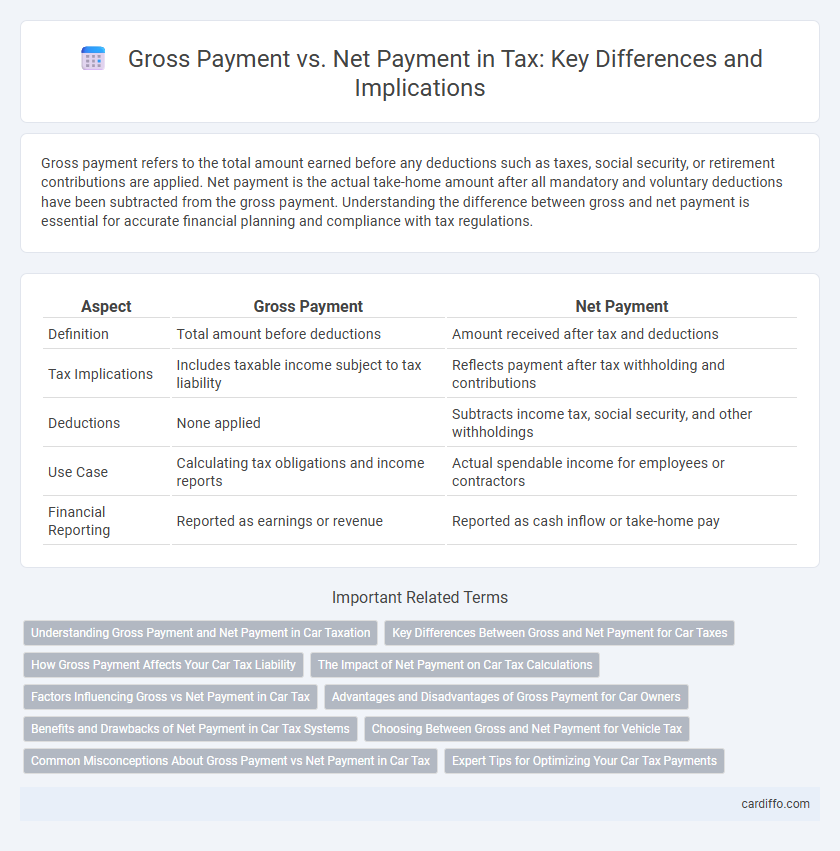

Gross payment refers to the total amount earned before any deductions such as taxes, social security, or retirement contributions are applied. Net payment is the actual take-home amount after all mandatory and voluntary deductions have been subtracted from the gross payment. Understanding the difference between gross and net payment is essential for accurate financial planning and compliance with tax regulations.

Table of Comparison

| Aspect | Gross Payment | Net Payment |

|---|---|---|

| Definition | Total amount before deductions | Amount received after tax and deductions |

| Tax Implications | Includes taxable income subject to tax liability | Reflects payment after tax withholding and contributions |

| Deductions | None applied | Subtracts income tax, social security, and other withholdings |

| Use Case | Calculating tax obligations and income reports | Actual spendable income for employees or contractors |

| Financial Reporting | Reported as earnings or revenue | Reported as cash inflow or take-home pay |

Understanding Gross Payment and Net Payment in Car Taxation

Gross payment in car taxation refers to the total amount paid before any deductions, including taxes, fees, and allowances, while net payment represents the actual amount received after these deductions. Understanding the distinction is essential for accurately calculating car-related tax liabilities, as gross payment impacts tax brackets and eligibility for deductions. Accurate assessment of gross and net payments ensures compliance with tax regulations and prevents underpayment or overpayment in vehicle taxation.

Key Differences Between Gross and Net Payment for Car Taxes

Gross payment for car taxes represents the total amount due before any deductions, including the full taxable value and applicable tax rates. Net payment reflects the final amount payable after subtracting tax credits, exemptions, or prepayments, impacting the actual cost to the vehicle owner. Understanding the distinction between gross and net payments is essential for accurate tax reporting and financial planning in automotive tax obligations.

How Gross Payment Affects Your Car Tax Liability

Gross payment directly influences your car tax liability by determining the taxable income on which the vehicle tax is calculated. When your gross payment increases, your taxable income rises, potentially pushing you into a higher tax bracket and increasing your car tax liability. Understanding the relationship between gross payment and taxable income is crucial for accurate tax planning and minimizing unexpected tax burdens.

The Impact of Net Payment on Car Tax Calculations

Net payment plays a crucial role in car tax calculations by determining the taxable amount after deductions such as insurance, maintenance, and loan interest are subtracted from the gross payment. This adjusted payment figure directly influences the calculation of vehicle tax liabilities, often reducing the overall tax burden for taxpayers. Consequently, understanding the difference between gross payment and net payment is essential for accurate and efficient car tax planning.

Factors Influencing Gross vs Net Payment in Car Tax

Factors influencing gross vs net payment in car tax include applicable tax rates, allowable deductions, and claimable credits specific to vehicle ownership. Gross payment reflects the total tax liability before adjustments, while net payment accounts for deductions such as depreciation, exemptions for electric vehicles, and rebate programs. Regional variations in emission standards and vehicle age also significantly impact the calculation of net tax owed.

Advantages and Disadvantages of Gross Payment for Car Owners

Gross payment provides car owners with clear visibility of total expenses before deductions, simplifying budget planning and ensuring tax obligations are transparent. However, it may lead to higher immediate tax liabilities since deductions and allowances are not accounted for upfront, potentially resulting in cash flow challenges. Despite this, gross payment can facilitate easier reconciliation during tax filings but requires careful management to avoid financial strain due to untaxed amounts.

Benefits and Drawbacks of Net Payment in Car Tax Systems

Net payment in car tax systems offers clear advantages, including simplified cash flow management and immediate clarity on tax liabilities for taxpayers. However, it can limit transparency by obscuring the breakdown of gross tax components, potentially complicating audits and compliance verification. The reduced administrative burden is beneficial, but reliance on net figures may result in less precise fiscal reporting and challenge policy adjustments based on detailed tax data.

Choosing Between Gross and Net Payment for Vehicle Tax

Choosing between gross and net payment for vehicle tax depends on whether the tax amount is calculated before or after deductions such as allowances and exemptions. Gross payment refers to the total vehicle tax liability prior to any adjustments, while net payment reflects the final tax due after accounting for applicable credits or reductions. Understanding local tax regulations and the specific calculation method ensures accurate compliance and financial planning.

Common Misconceptions About Gross Payment vs Net Payment in Car Tax

Many taxpayers confuse gross payment with net payment in car tax, mistakenly believing the gross amount is what they ultimately pay, when in fact net payment reflects the actual cost after deductions and credits. Misunderstanding this distinction can lead to overestimating tax liabilities and complicating vehicle budgeting. Accurate knowledge of gross versus net payment clarifies car tax responsibilities and prevents financial planning errors.

Expert Tips for Optimizing Your Car Tax Payments

Maximize your car tax savings by understanding the difference between gross payment and net payment, where gross payment represents your total income before deductions and net payment reflects the amount after taxes. Expert tips include leveraging allowable expenses and tax credits to reduce your gross income, thereby lowering your net tax liability. Consistently track deductible items such as insurance, maintenance, and fuel costs to optimize your car tax payments effectively.

Gross Payment vs Net Payment Infographic

cardiffo.com

cardiffo.com