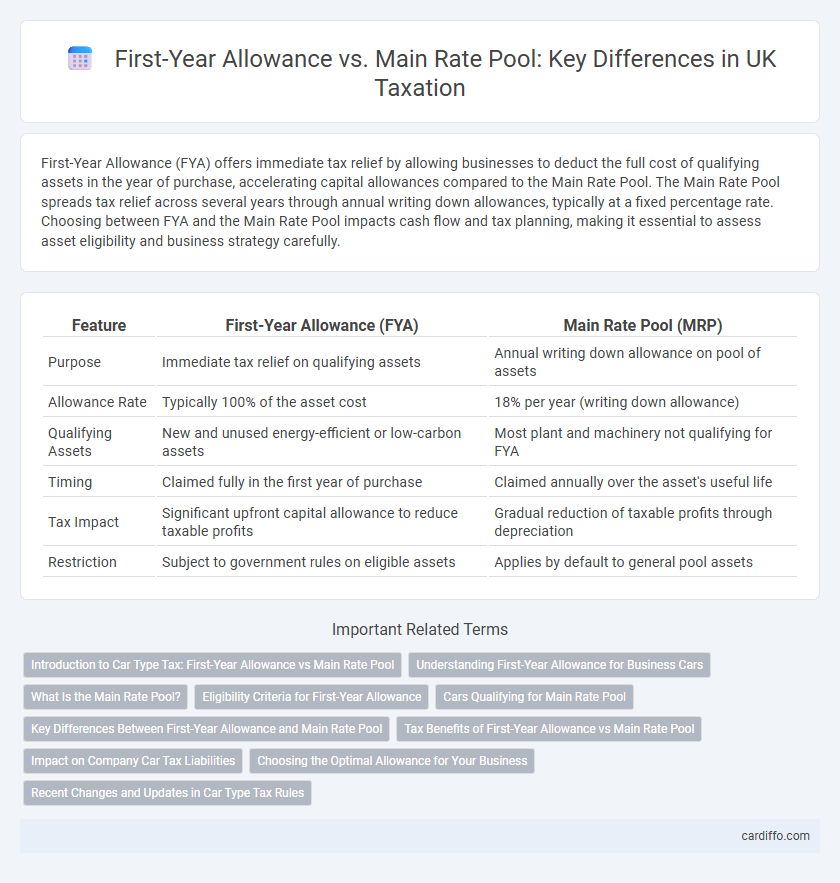

First-Year Allowance (FYA) offers immediate tax relief by allowing businesses to deduct the full cost of qualifying assets in the year of purchase, accelerating capital allowances compared to the Main Rate Pool. The Main Rate Pool spreads tax relief across several years through annual writing down allowances, typically at a fixed percentage rate. Choosing between FYA and the Main Rate Pool impacts cash flow and tax planning, making it essential to assess asset eligibility and business strategy carefully.

Table of Comparison

| Feature | First-Year Allowance (FYA) | Main Rate Pool (MRP) |

|---|---|---|

| Purpose | Immediate tax relief on qualifying assets | Annual writing down allowance on pool of assets |

| Allowance Rate | Typically 100% of the asset cost | 18% per year (writing down allowance) |

| Qualifying Assets | New and unused energy-efficient or low-carbon assets | Most plant and machinery not qualifying for FYA |

| Timing | Claimed fully in the first year of purchase | Claimed annually over the asset's useful life |

| Tax Impact | Significant upfront capital allowance to reduce taxable profits | Gradual reduction of taxable profits through depreciation |

| Restriction | Subject to government rules on eligible assets | Applies by default to general pool assets |

Introduction to Car Type Tax: First-Year Allowance vs Main Rate Pool

First-Year Allowance (FYA) offers immediate tax relief for qualifying low-emission vehicles, allowing businesses to deduct the full cost in the year of purchase, accelerating capital allowances. The Main Rate Pool applies to cars with higher CO2 emissions, where expenditure is written down at a standard rate of 18% per annum on a reducing balance basis. Understanding the distinction between FYA and the Main Rate Pool is crucial for optimizing tax efficiency in business vehicle investments.

Understanding First-Year Allowance for Business Cars

First-Year Allowance (FYA) enables businesses to deduct 100% of the cost of qualifying business cars in the year of purchase, accelerating tax relief and improving cash flow. This contrasts with the Main Rate Pool, where cars not eligible for FYA are depreciated over several years at the standard writing down allowance rate, typically 18%. Understanding FYA eligibility depends on the car's CO2 emissions; vehicles emitting 0-50g/km generally qualify for FYA, encouraging investment in low-emission cars.

What Is the Main Rate Pool?

The Main Rate Pool refers to the category of capital assets for which depreciation is calculated using the standard writing-down allowance rate, typically set at 18% per annum in the UK tax system. Assets classified in the Main Rate Pool exclude those eligible for First-Year Allowances, which offer accelerated tax relief by allowing higher initial deductions. Understanding the distinction between the Main Rate Pool and First-Year Allowance is crucial for accurate capital allowance claims and optimizing tax efficiency on business expenditures.

Eligibility Criteria for First-Year Allowance

First-Year Allowance (FYA) eligibility requires qualifying expenditures on specific types of plant and machinery, such as energy-saving equipment, low-emission vehicles, and certain eco-friendly technologies. Assets must be new and unused, and the business must claim the allowance in the year of purchase to benefit from the accelerated tax relief. The FYA is available to companies and sole traders investing in qualifying assets that meet specified environmental or technological criteria.

Cars Qualifying for Main Rate Pool

Cars qualifying for the Main Rate Pool typically have CO2 emissions above the low emission threshold set by HMRC, meaning they do not meet the stricter criteria for First-Year Allowance eligibility. Capital allowances on these vehicles are claimed through the Main Rate Pool at a writing-down allowance rate of 18% per annum on a reducing balance basis. This classification directly affects tax planning strategies for businesses aiming to maximize capital allowance claims on fleet investments.

Key Differences Between First-Year Allowance and Main Rate Pool

First-Year Allowance (FYA) enables businesses to deduct 100% of the cost of qualifying assets from taxable profits in the year of purchase, accelerating tax relief. The Main Rate Pool, part of the Annual Investment Allowance, applies a standard writing-down allowance rate (usually 18%) on the reducing balance of most qualifying plant and machinery. Key differences include the immediacy of tax relief under FYA versus the gradual depreciation method of the Main Rate Pool, and eligibility criteria where FYA targets specific energy-efficient or environmentally beneficial assets.

Tax Benefits of First-Year Allowance vs Main Rate Pool

First-Year Allowance (FYA) offers immediate tax relief by allowing businesses to deduct 100% of the cost of qualifying capital assets in the year of purchase, accelerating tax savings. In contrast, Main Rate Pool depreciation allocates tax relief gradually over several years through annual writing down allowances, spreading the tax benefits. Utilizing FYA improves cash flow and reduces taxable profits more quickly compared to the slower deduction pace of the Main Rate Pool.

Impact on Company Car Tax Liabilities

First-Year Allowance (FYA) allows businesses to claim a significant upfront tax relief on low-emission company cars, reducing taxable profits in the acquisition year and lowering company car tax liabilities. In contrast, vehicles classified under the Main Rate Pool depreciate over several years through writing down allowances, spreading the tax relief and potentially resulting in higher annual taxable benefits. Choosing FYA-eligible vehicles can strategically minimize immediate company car tax charges, while reliance on the Main Rate Pool impacts cash flow due to prolonged depreciation schedules.

Choosing the Optimal Allowance for Your Business

Selecting the optimal allowance between First-Year Allowance (FYA) and the Main Rate Pool significantly impacts your business's tax efficiency. FYA enables immediate 100% tax relief on qualifying capital expenditures, accelerating cost recovery and improving cash flow. The Main Rate Pool provides annual writing-down allowances at a standard rate of 18%, offering gradual tax relief over time suitable for assets not eligible for FYA.

Recent Changes and Updates in Car Type Tax Rules

Recent changes in car tax rules have altered the application of First-Year Allowances (FYA) and Main Rate Pools, primarily focusing on emissions-based classifications. Ultra-low emission vehicles now qualify for 100% FYA, enabling full capital allowance claims in the acquisition year, while cars with higher CO2 emissions are allocated to the Main Rate Pool, depreciated at 18% per annum. These updates emphasize the government's commitment to incentivizing environmentally friendly vehicles through accelerated tax relief.

First-Year Allowance vs Main Rate Pool Infographic

cardiffo.com

cardiffo.com