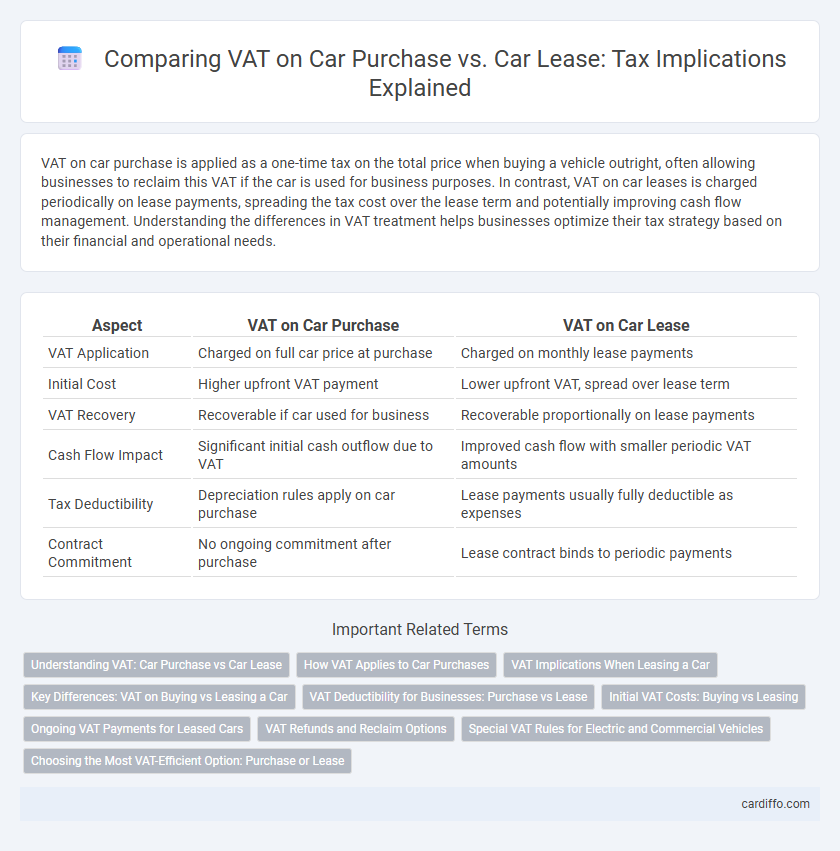

VAT on car purchase is applied as a one-time tax on the total price when buying a vehicle outright, often allowing businesses to reclaim this VAT if the car is used for business purposes. In contrast, VAT on car leases is charged periodically on lease payments, spreading the tax cost over the lease term and potentially improving cash flow management. Understanding the differences in VAT treatment helps businesses optimize their tax strategy based on their financial and operational needs.

Table of Comparison

| Aspect | VAT on Car Purchase | VAT on Car Lease |

|---|---|---|

| VAT Application | Charged on full car price at purchase | Charged on monthly lease payments |

| Initial Cost | Higher upfront VAT payment | Lower upfront VAT, spread over lease term |

| VAT Recovery | Recoverable if car used for business | Recoverable proportionally on lease payments |

| Cash Flow Impact | Significant initial cash outflow due to VAT | Improved cash flow with smaller periodic VAT amounts |

| Tax Deductibility | Depreciation rules apply on car purchase | Lease payments usually fully deductible as expenses |

| Contract Commitment | No ongoing commitment after purchase | Lease contract binds to periodic payments |

Understanding VAT: Car Purchase vs Car Lease

VAT on car purchases is typically charged on the total sale price of the vehicle, requiring immediate payment of the full VAT amount. In contrast, VAT on car leases is usually spread over the lease term, allowing businesses to claim VAT on monthly payments, which can improve cash flow management. Understanding these differences is crucial for businesses to optimize tax efficiency between purchasing and leasing options.

How VAT Applies to Car Purchases

VAT on car purchases is applied to the total sale price at the point of purchase, including the cost of the vehicle and any additional fees such as registration or dealer services. Businesses registered for VAT can often reclaim the VAT paid on a car purchase, provided the vehicle is used for business purposes, subject to specific regulations and restrictions. Private individuals, however, cannot reclaim VAT on car purchases, making the VAT a non-recoverable part of the total cost.

VAT Implications When Leasing a Car

Leasing a car allows businesses to recover VAT on the lease payments rather than the full purchase price, providing more flexible cash flow management. VAT on car leases is typically charged on each monthly payment, enabling companies to claim input tax proportionate to business use. Unlike purchasing, where VAT is reclaimed upfront, leasing spreads the VAT recovery over the contract duration, affecting overall tax planning strategies.

Key Differences: VAT on Buying vs Leasing a Car

VAT on car purchase is typically paid upfront on the full vehicle price, allowing ownership transfer and potential for VAT reclaim if the buyer is VAT-registered and the car is used for business purposes. In contrast, VAT on car lease is charged on each monthly lease payment, spreading the VAT cost over the lease term without transferring ownership but enabling easier cash flow management. Key differences include initial VAT payment timing, ownership rights, and the potential for partial VAT recovery depending on business use and local tax regulations.

VAT Deductibility for Businesses: Purchase vs Lease

Businesses can fully deduct VAT on car purchases if the vehicle is used exclusively for business purposes, ensuring effective cost recovery. In contrast, VAT on car leases is deductible proportionally based on the lease payments and the business use percentage, offering greater flexibility with cash flow management. Understanding these distinctions helps companies optimize tax benefits and maintain accurate VAT compliance.

Initial VAT Costs: Buying vs Leasing

When purchasing a car, the initial VAT cost is paid upfront in full on the vehicle's purchase price, impacting immediate cash flow significantly. Leasing a car typically involves paying VAT on monthly lease payments rather than a lump sum, spreading out the VAT expense over the lease term. This difference affects budgeting strategies and VAT reclaim opportunities for businesses depending on their financial structure and tax planning preferences.

Ongoing VAT Payments for Leased Cars

Ongoing VAT payments for leased cars are typically calculated on each lease installment, allowing businesses to recover VAT continuously throughout the lease term, unlike a one-time VAT payment on car purchases. This structure improves cash flow management for companies by spreading the VAT expense over time rather than incurring a large upfront VAT cost. Leasing arrangements often specify that VAT on maintenance and other associated costs can also be reclaimed periodically, enhancing tax efficiency for leaseholders.

VAT Refunds and Reclaim Options

VAT on car purchases typically allows businesses to reclaim the full input VAT if the vehicle is used exclusively for business purposes, subject to local tax authority rules, while VAT on car leases generally involves reclaiming VAT on lease payments rather than the full vehicle cost. VAT refunds on car purchases are limited when vehicles are used partly for personal use, reducing the reclaimable amount, whereas lease agreements often offer more flexible VAT recovery aligned with business usage. Careful documentation and compliance with country-specific VAT regulations are essential to maximize VAT refund and reclaim options for both purchased and leased vehicles.

Special VAT Rules for Electric and Commercial Vehicles

VAT on car purchase allows partial or full reclaim of input VAT for commercial and electric vehicles under special schemes, reducing overall cost. Leasing electric cars often benefits from specific VAT exemptions or reduced rates, encouraging sustainable transportation investments for businesses. Special VAT rules prioritize environmental goals, providing incentives that differ markedly between ownership and leasing options for commercial fleets.

Choosing the Most VAT-Efficient Option: Purchase or Lease

Choosing between purchasing or leasing a car significantly impacts VAT efficiency based on business use and VAT recovery rules. Businesses can reclaim full VAT on leased vehicles if the car is used exclusively for business purposes, while VAT on purchased cars is recoverable proportionally to business use, factoring in input tax restrictions. Evaluating the VAT deduction eligibility, cash flow implications, and long-term financial goals helps determine the most VAT-efficient option between buying and leasing.

VAT on Car Purchase vs VAT on Car Lease Infographic

cardiffo.com

cardiffo.com