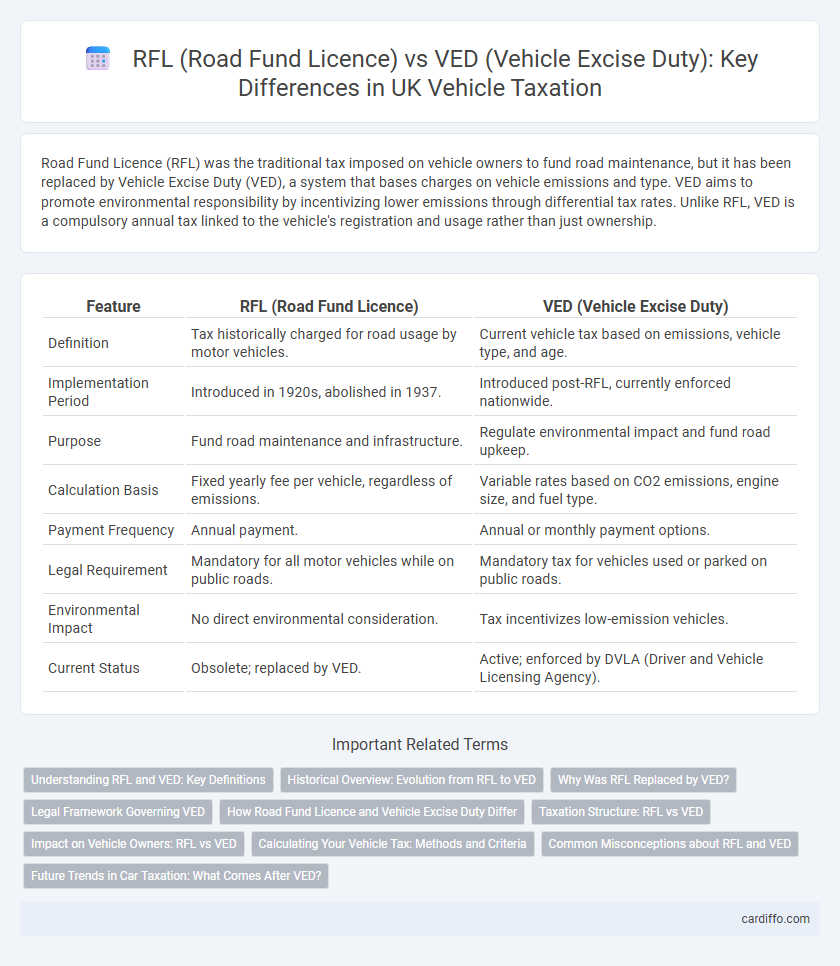

Road Fund Licence (RFL) was the traditional tax imposed on vehicle owners to fund road maintenance, but it has been replaced by Vehicle Excise Duty (VED), a system that bases charges on vehicle emissions and type. VED aims to promote environmental responsibility by incentivizing lower emissions through differential tax rates. Unlike RFL, VED is a compulsory annual tax linked to the vehicle's registration and usage rather than just ownership.

Table of Comparison

| Feature | RFL (Road Fund Licence) | VED (Vehicle Excise Duty) |

|---|---|---|

| Definition | Tax historically charged for road usage by motor vehicles. | Current vehicle tax based on emissions, vehicle type, and age. |

| Implementation Period | Introduced in 1920s, abolished in 1937. | Introduced post-RFL, currently enforced nationwide. |

| Purpose | Fund road maintenance and infrastructure. | Regulate environmental impact and fund road upkeep. |

| Calculation Basis | Fixed yearly fee per vehicle, regardless of emissions. | Variable rates based on CO2 emissions, engine size, and fuel type. |

| Payment Frequency | Annual payment. | Annual or monthly payment options. |

| Legal Requirement | Mandatory for all motor vehicles while on public roads. | Mandatory tax for vehicles used or parked on public roads. |

| Environmental Impact | No direct environmental consideration. | Tax incentivizes low-emission vehicles. |

| Current Status | Obsolete; replaced by VED. | Active; enforced by DVLA (Driver and Vehicle Licensing Agency). |

Understanding RFL and VED: Key Definitions

Road Fund Licence (RFL) was the former term for Vehicle Excise Duty (VED), a tax levied on most types of vehicles used on public roads in the UK. Vehicle Excise Duty is calculated based on factors such as vehicle type, engine size, and CO2 emissions, with revenues funding road maintenance and infrastructure. Understanding the key differences highlights that while RFL referred primarily to a licensing fee, VED encompasses a broader taxation system aligned with environmental and policy goals.

Historical Overview: Evolution from RFL to VED

The Road Fund Licence (RFL) originated in the UK in 1923 as a tax earmarked exclusively for road maintenance, funded by vehicle owners based on engine capacity. Over time, administrative and political changes led to the transition from RFL to Vehicle Excise Duty (VED) in 1937, expanding the tax's use beyond just road funding to general government revenue. The evolution reflects a shift from a designated fund to a broader fiscal policy instrument, while retaining the objective of vehicle taxation.

Why Was RFL Replaced by VED?

The Road Fund Licence (RFL) was replaced by Vehicle Excise Duty (VED) to streamline vehicle taxation and improve government revenue collection efficiency. Unlike RFL, which was intended to fund road maintenance specifically, VED enables broader allocation of funds from vehicle owners to support various public expenses. This change also addressed evasion issues linked to RFL and aligned tax policies with modern transportation funding needs.

Legal Framework Governing VED

The Legal Framework Governing Vehicle Excise Duty (VED) is established under the Vehicle Excise and Registration Act 1994, which mandates the payment of VED for motor vehicle use on public roads in the UK. Unlike the Road Fund Licence (RFL), which was abolished in 1937, VED revenues are collected by the DVLA and contribute to the general government budget rather than being ring-fenced specifically for road maintenance. Compliance with VED regulations is enforced through legal penalties including fines and vehicle clamping, ensuring that all vehicle owners meet payment obligations as stipulated in statutory requirements.

How Road Fund Licence and Vehicle Excise Duty Differ

Road Fund Licence (RFL) and Vehicle Excise Duty (VED) both represent taxes levied on vehicle owners in the UK but differ significantly in purpose and allocation. RFL was historically a levy dedicated exclusively to funding road maintenance and infrastructure, whereas VED is a general tax collected by the government used for broader public expenditure beyond just roads. Unlike RFL which explicitly linked fees to road upkeep, VED rates vary based on vehicle emissions, engine size, and fuel type, reflecting modern environmental policies rather than direct road funding.

Taxation Structure: RFL vs VED

The Taxation Structure for Road Fund Licence (RFL) and Vehicle Excise Duty (VED) differ significantly, with RFL historically serving as a flat-rate tax on vehicle ownership. VED, on the other hand, is calculated based on vehicle emissions, engine size, and fuel type, aligning tax rates with environmental impact. This shift from RFL to VED reflects a policy move towards incentivizing low-emission vehicles and promoting sustainable transportation.

Impact on Vehicle Owners: RFL vs VED

Road Fund Licence (RFL) and Vehicle Excise Duty (VED) both represent compulsory charges for vehicle owners, but VED replaced RFL in 1937, broadening its scope and adjusting tax rates based on emissions and vehicle type. VED impacts vehicle owners by incentivizing environmentally friendly choices through differential rates, whereas RFL primarily funded road maintenance without emission-based differentiation. Modern VED schemes often reduce costs for low-emission or electric vehicles, offering a financial advantage not present with the traditional RFL system.

Calculating Your Vehicle Tax: Methods and Criteria

Calculating your vehicle tax involves understanding the distinctions between Road Fund Licence (RFL) and Vehicle Excise Duty (VED), with VED being the current system based on emissions, CO2 output, and vehicle type. The calculation methods for VED consider factors such as engine size, fuel type, and registration date to determine accurate tax rates. RFL, the older system, was a flat-rate charge without emissions consideration, whereas VED's criteria reflect environmental impact to promote greener vehicle usage.

Common Misconceptions about RFL and VED

Many drivers mistakenly believe that Road Fund Licence (RFL) and Vehicle Excise Duty (VED) are separate charges, whereas RFL is now outdated terminology for VED. VED is a mandatory tax on vehicles used on public roads, and the term "Road Fund Licence" was abolished in 2003 but remains in common usage. Understanding that VED revenue supports broader government funds, not exclusively road maintenance, clears up common misconceptions.

Future Trends in Car Taxation: What Comes After VED?

Future trends in car taxation indicate a significant shift from traditional Vehicle Excise Duty (VED) toward usage-based and emissions-focused models, reflecting the rise of electric vehicles and smart mobility technologies. The Road Fund Licence (RFL) concept, originally tied to fuel consumption, is being reconsidered as governments explore distance-based charging and congestion pricing to replace flat-rate VED fees. Innovations in telematics and real-time data collection enable more equitable and environmentally aligned car taxation systems beyond the static VED framework.

RFL (Road Fund Licence) vs VED (Vehicle Excise Duty) Infographic

cardiffo.com

cardiffo.com