Benefit-in-Kind Tax on company pets often results in a taxable perk for employees, increasing their overall tax liability. In contrast, a Cash Allowance Scheme provides a straightforward, taxable cash payment that employees can use at their discretion, simplifying accounting and administration for employers. Choosing between these options impacts both tax treatment and employee satisfaction in pet-related benefits.

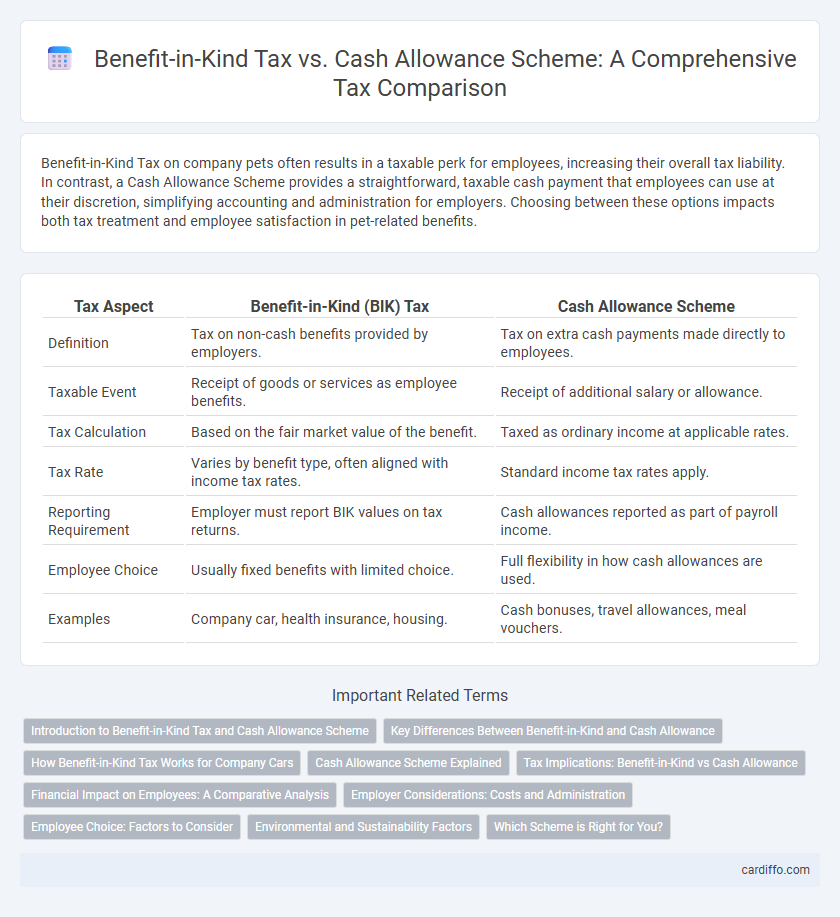

Table of Comparison

| Tax Aspect | Benefit-in-Kind (BIK) Tax | Cash Allowance Scheme |

|---|---|---|

| Definition | Tax on non-cash benefits provided by employers. | Tax on extra cash payments made directly to employees. |

| Taxable Event | Receipt of goods or services as employee benefits. | Receipt of additional salary or allowance. |

| Tax Calculation | Based on the fair market value of the benefit. | Taxed as ordinary income at applicable rates. |

| Tax Rate | Varies by benefit type, often aligned with income tax rates. | Standard income tax rates apply. |

| Reporting Requirement | Employer must report BIK values on tax returns. | Cash allowances reported as part of payroll income. |

| Employee Choice | Usually fixed benefits with limited choice. | Full flexibility in how cash allowances are used. |

| Examples | Company car, health insurance, housing. | Cash bonuses, travel allowances, meal vouchers. |

Introduction to Benefit-in-Kind Tax and Cash Allowance Scheme

Benefit-in-Kind (BIK) tax applies to non-cash benefits provided by an employer, such as company cars or private health insurance, which are valued and taxed as part of an employee's income. Cash Allowance Schemes, in contrast, offer employees direct monetary payments that are subject to standard income tax and National Insurance contributions. Understanding the distinction between BIK and cash allowances is crucial for accurate tax compliance and optimizing employee remuneration packages.

Key Differences Between Benefit-in-Kind and Cash Allowance

Benefit-in-Kind (BIK) tax applies to non-cash employee benefits such as company cars or private health insurance, while cash allowances are taxable cash payments given directly to employees. BIK valuation is often complex, requiring assessment of benefit value and tax rates, whereas cash allowances are straightforwardly added to gross income and taxed at the employee's marginal rate. Employers face different reporting requirements, with BIK necessitating detailed benefit disclosures on P11D forms, unlike cash allowances typically included in payroll records.

How Benefit-in-Kind Tax Works for Company Cars

Benefit-in-Kind (BIK) tax on company cars is calculated based on the vehicle's list price, CO2 emissions, and fuel type, reflecting its taxable value to the employee. Employers report this benefit on the employee's P11D form, and the employee pays income tax on the BIK value at their marginal rate. The scheme encourages environmentally friendly choices by applying lower BIK rates to low-emission and electric vehicles, influencing company car policies and tax liabilities.

Cash Allowance Scheme Explained

The Cash Allowance Scheme provides employees with a fixed cash payment instead of a company car or other benefits, allowing greater flexibility in how the benefit is used. Unlike Benefit-in-Kind (BIK) tax, which is calculated based on the value of the non-cash benefit provided, cash allowances are treated as taxable income subject to standard income tax and National Insurance contributions. This scheme simplifies tax administration for employers and allows employees to retain more control over their expenditures, although it may result in higher personal tax liabilities depending on the allowance amount and individual tax brackets.

Tax Implications: Benefit-in-Kind vs Cash Allowance

Benefit-in-Kind (BIK) tax is applied on non-cash benefits provided to employees, such as company cars or accommodation, and is calculated based on the market value of the benefit, often leading to higher taxable amounts compared to cash allowances. Cash allowance schemes are treated as regular income and taxed through PAYE, providing more straightforward tax implications but increasing the employee's taxable income and potential National Insurance Contributions. Employers must balance tax efficiency, administrative complexity, and employee preference when choosing between BIK and cash allowance schemes to optimize overall tax liabilities.

Financial Impact on Employees: A Comparative Analysis

Benefit-in-Kind (BIK) Tax often results in a higher tax liability for employees compared to a Cash Allowance Scheme, as BIK is calculated based on the market value of non-cash benefits and can push employees into higher tax brackets. Cash Allowance Schemes provide employees with greater financial flexibility and transparency, allowing them to manage their taxable income more efficiently while potentially reducing overall tax burdens. Employers should consider the net financial impact on employees, as BIK may increase withholding taxes and reduce take-home pay, whereas cash allowances are subject to standard income tax rates and National Insurance contributions.

Employer Considerations: Costs and Administration

Employers face distinct cost implications when choosing between Benefit-in-Kind (BIK) tax schemes and Cash Allowance Schemes, with BIK often involving higher administration expenses due to complex valuation and reporting requirements. Cash Allowance Schemes offer simpler payroll integration and reduced compliance costs, but may increase the employer's National Insurance Contributions depending on the allowance structure. Careful evaluation of administrative efficiency and overall financial impact is essential for employers optimizing tax strategies and employee compensation packages.

Employee Choice: Factors to Consider

When deciding between Benefit-in-Kind (BIK) tax and a cash allowance scheme, employees must consider tax efficiency, personal financial goals, and the impact on overall compensation. BIK options often offer non-cash benefits that might be taxed at a lower rate or receive specific exemptions, whereas cash allowances provide immediate liquidity but are subject to standard income tax and National Insurance contributions. Evaluating factors like usage flexibility, tax treatment, and potential changes in personal circumstances ensures a well-informed choice aligning with long-term financial planning.

Environmental and Sustainability Factors

Benefit-in-Kind Tax on company-provided vehicles incentivizes the use of low-emission and electric cars by offering reduced tax rates, aligning with environmental sustainability goals. Cash Allowance Schemes often lead to higher emissions as employees may select less eco-friendly vehicles or increase personal car usage without tax penalties. Prioritizing Benefit-in-Kind Tax adjustments to favor green vehicles promotes corporate responsibility and supports national carbon reduction targets.

Which Scheme is Right for You?

Choosing between Benefit-in-Kind Tax and Cash Allowance schemes depends on individual financial situations and tax efficiencies. Benefit-in-Kind Tax often applies to company cars, providing fixed monetary value taxed at employees' marginal rates, while Cash Allowance offers flexibility but is fully taxable as income. Evaluating vehicle usage, taxable income, and potential tax savings helps determine the most cost-effective scheme tailored to personal or business circumstances.

Benefit-in-Kind Tax vs Cash Allowance Scheme Infographic

cardiffo.com

cardiffo.com