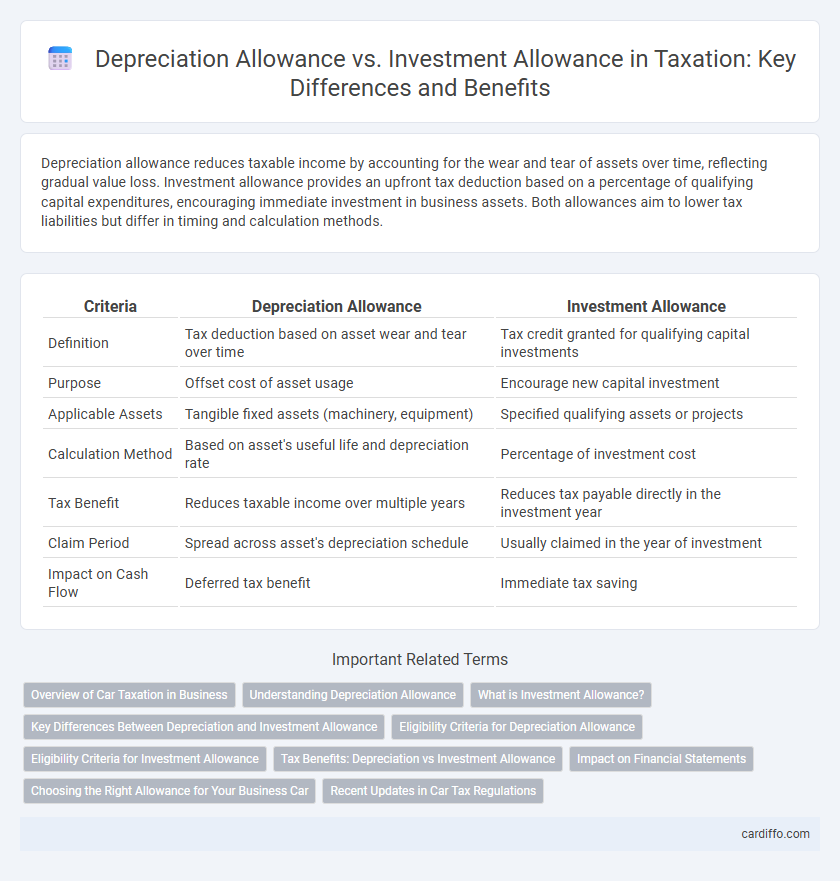

Depreciation allowance reduces taxable income by accounting for the wear and tear of assets over time, reflecting gradual value loss. Investment allowance provides an upfront tax deduction based on a percentage of qualifying capital expenditures, encouraging immediate investment in business assets. Both allowances aim to lower tax liabilities but differ in timing and calculation methods.

Table of Comparison

| Criteria | Depreciation Allowance | Investment Allowance |

|---|---|---|

| Definition | Tax deduction based on asset wear and tear over time | Tax credit granted for qualifying capital investments |

| Purpose | Offset cost of asset usage | Encourage new capital investment |

| Applicable Assets | Tangible fixed assets (machinery, equipment) | Specified qualifying assets or projects |

| Calculation Method | Based on asset's useful life and depreciation rate | Percentage of investment cost |

| Tax Benefit | Reduces taxable income over multiple years | Reduces tax payable directly in the investment year |

| Claim Period | Spread across asset's depreciation schedule | Usually claimed in the year of investment |

| Impact on Cash Flow | Deferred tax benefit | Immediate tax saving |

Overview of Car Taxation in Business

Depreciation allowance allows businesses to deduct the cost of vehicle wear and tear over time, reducing taxable income based on the asset's useful life and rate prescribed by tax authorities. Investment allowance provides an immediate tax relief on the purchase price of business vehicles, incentivizing capital expenditure by lowering tax liabilities in the acquisition year. Understanding the interaction between these allowances is crucial for optimizing car taxation and maximizing financial benefits within corporate tax planning.

Understanding Depreciation Allowance

Depreciation Allowance enables businesses to deduct the cost of tangible fixed assets over their useful life, reducing taxable income annually based on asset wear and tear. Unlike Investment Allowance, which offers a direct deduction or credit related to qualifying capital expenditures, Depreciation Allowance systematically matches expense recognition with asset utility. Proper understanding of Depreciation methods--such as straight-line or reducing balance--is essential for accurate tax planning and compliance.

What is Investment Allowance?

Investment allowance is a tax incentive that permits businesses to deduct a specified percentage of qualifying capital expenditure from their taxable income, reducing the overall tax liability. This allowance encourages companies to invest in new assets by providing immediate tax relief on purchases such as machinery, equipment, or property improvements. Unlike depreciation allowance, which spreads the cost deduction over the useful life of an asset, investment allowance offers a one-time deduction to stimulate business growth and capital investment.

Key Differences Between Depreciation and Investment Allowance

Depreciation allowance permits businesses to deduct the cost of tangible fixed assets over their useful life, reducing taxable income annually based on asset wear and tear. Investment allowance offers a predetermined percentage deduction on qualifying capital expenditures in the year of investment, incentivizing immediate capital reinvestment. The key difference lies in depreciation allowance spreading tax relief over asset life, while investment allowance provides upfront tax benefits to stimulate capital outlay.

Eligibility Criteria for Depreciation Allowance

Eligibility criteria for Depreciation Allowance require that the asset be used for business purposes and owned by the taxpayer, with tangible fixed assets such as machinery, equipment, and buildings qualifying under specific tax codes. The asset must have a determinable useful life beyond one year and be subject to wear and tear, obsolescence, or exhaustion. Only assets placed in service during the tax year and actively used for income generation are eligible for depreciation deductions.

Eligibility Criteria for Investment Allowance

Investment Allowance eligibility requires businesses to invest in qualifying assets such as machinery, equipment, or industrial buildings used in manufacturing or production activities. The allowance is typically available to companies engaged in specific sectors outlined by tax authorities, often mandating minimum investment amounts and compliance with regional development policies. Unlike Depreciation Allowance, which applies broadly to asset wear and tear, Investment Allowance targets new capital expenditures aimed at expanding productive capacity.

Tax Benefits: Depreciation vs Investment Allowance

Depreciation allowance permits businesses to deduct the cost of tangible assets over their useful life, reducing taxable income gradually and reflecting asset wear and tear. Investment allowance offers immediate tax relief by allowing a percentage of qualifying capital expenditures to be deducted in the year of investment, accelerating tax savings. Comparing tax benefits, investment allowance enhances cash flow with upfront deductions, while depreciation allowance spreads tax relief over time for long-term asset management.

Impact on Financial Statements

Depreciation allowance reduces taxable income by spreading the cost of an asset over its useful life, thus decreasing reported net income gradually and reflecting asset value decline on the balance sheet. Investment allowance provides an immediate deduction on qualifying capital expenditures, significantly lowering taxable income and boosting net income in the short term, while capitalized asset values remain unchanged. The choice between these allowances directly influences cash flow, tax liability, and the timing of expense recognition in financial reporting.

Choosing the Right Allowance for Your Business Car

Choosing the right allowance for your business car depends on the nature of your expenses and tax goals. Depreciation allowance enables you to deduct the wear and tear of the vehicle over time, aligning with long-term asset value reduction. Investment allowance offers immediate tax relief on capital expenditure, which can improve cash flow but is typically limited to qualifying assets and specific time frames.

Recent Updates in Car Tax Regulations

Recent updates in car tax regulations have introduced specific changes affecting depreciation allowance and investment allowance claims for vehicle purchases. Depreciation allowance now restricts deductions on luxury cars exceeding set value thresholds, limiting tax benefits over the asset's useful life. Investment allowance remains applicable for qualifying green and energy-efficient vehicles, encouraging businesses to invest in sustainable assets through enhanced upfront tax relief.

Depreciation Allowance vs Investment Allowance Infographic

cardiffo.com

cardiffo.com