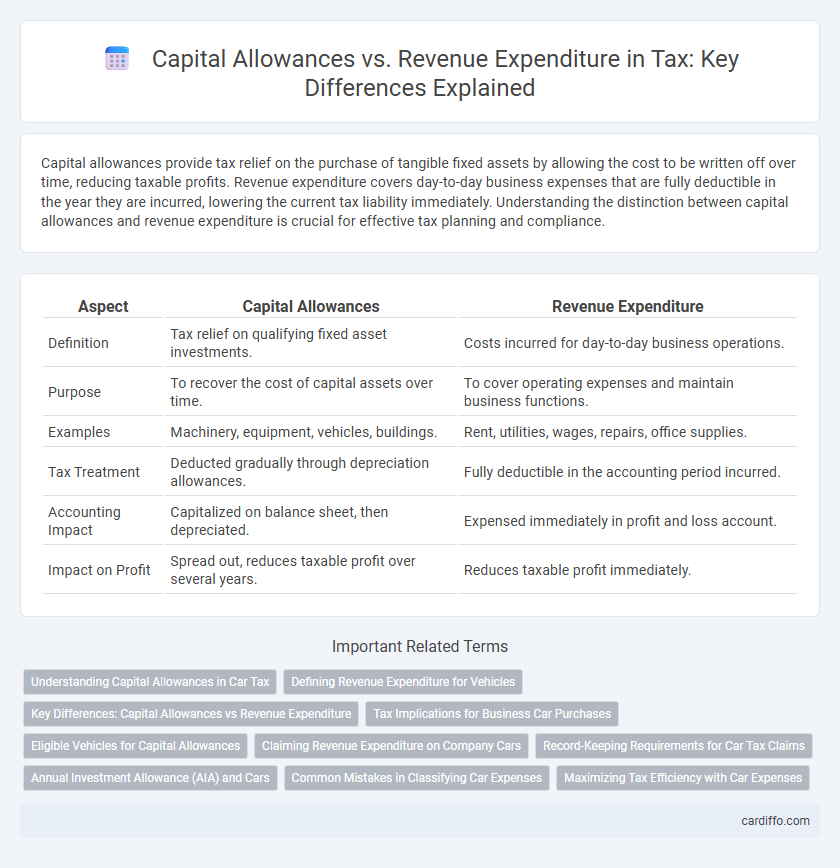

Capital allowances provide tax relief on the purchase of tangible fixed assets by allowing the cost to be written off over time, reducing taxable profits. Revenue expenditure covers day-to-day business expenses that are fully deductible in the year they are incurred, lowering the current tax liability immediately. Understanding the distinction between capital allowances and revenue expenditure is crucial for effective tax planning and compliance.

Table of Comparison

| Aspect | Capital Allowances | Revenue Expenditure |

|---|---|---|

| Definition | Tax relief on qualifying fixed asset investments. | Costs incurred for day-to-day business operations. |

| Purpose | To recover the cost of capital assets over time. | To cover operating expenses and maintain business functions. |

| Examples | Machinery, equipment, vehicles, buildings. | Rent, utilities, wages, repairs, office supplies. |

| Tax Treatment | Deducted gradually through depreciation allowances. | Fully deductible in the accounting period incurred. |

| Accounting Impact | Capitalized on balance sheet, then depreciated. | Expensed immediately in profit and loss account. |

| Impact on Profit | Spread out, reduces taxable profit over several years. | Reduces taxable profit immediately. |

Understanding Capital Allowances in Car Tax

Capital allowances in car tax enable businesses to deduct the cost of purchasing vehicles from their taxable profits, reducing the overall tax liability. These allowances are categorized under capital expenditure, allowing depreciation write-offs over the vehicle's useful life, contrasting with revenue expenditure which covers day-to-day operational costs. Understanding the distinction ensures accurate tax reporting and maximizes allowable deductions on company cars, fleet vehicles, and commercial transport assets.

Defining Revenue Expenditure for Vehicles

Revenue expenditure for vehicles refers to the costs incurred for the day-to-day running and maintenance, such as fuel, repairs, insurance, and servicing, which are fully deductible in the accounting period they occur. Unlike capital allowances, these expenses do not result in a long-term asset but are essential for operational efficiency and are recorded as operational expenses. Accurate classification of vehicle-related expenditures ensures compliance with tax regulations and optimizes deductible business expenses.

Key Differences: Capital Allowances vs Revenue Expenditure

Capital allowances are tax deductions for the depreciation of fixed assets, spread over several years, while revenue expenditure is the cost of day-to-day business operations fully deductible in the year incurred. Capital allowances reduce taxable profits by recognizing asset wear and tear, whereas revenue expenditure directly lowers profits through expenses like rent, salaries, and utilities. Key tax treatment differences include timing of deductions and impact on asset value on the balance sheet.

Tax Implications for Business Car Purchases

Capital allowances allow businesses to deduct the cost of purchasing a business car from taxable profits over several years, reducing overall tax liability. Revenue expenditure, such as routine maintenance and fuel, is fully deductible in the year incurred, directly lowering taxable income. Choosing between capital allowances and revenue expenditure impacts cash flow and tax planning, with capital allowances often providing long-term tax benefits for higher-value car acquisitions.

Eligible Vehicles for Capital Allowances

Eligible vehicles for capital allowances typically include cars, vans, trucks, and motorcycles used in business operations, with tax relief varying based on CO2 emissions and vehicle type. Capital allowances allow businesses to deduct the cost of these vehicles from taxable profits, distinguishing them from revenue expenditures, which cover day-to-day operational costs like fuel and maintenance. Understanding classification ensures optimal tax benefits by correctly categorizing purchases as capital assets or revenue expenses.

Claiming Revenue Expenditure on Company Cars

Claiming revenue expenditure on company cars involves deducting costs related to maintenance, repairs, fuel, and insurance from taxable income, reducing the company's overall tax liability. Unlike capital allowances, which apply to the purchase of the vehicle itself and are claimed over several years, revenue expenses are allowable in the accounting period they are incurred, providing immediate tax relief. Properly categorizing these expenses ensures compliance with HMRC rules and maximizes tax efficiency for businesses using vehicles primarily for company activities.

Record-Keeping Requirements for Car Tax Claims

Accurate record-keeping is essential for distinguishing capital allowances from revenue expenditure when claiming car tax deductions, as capital allowances require detailed fixed asset registers and depreciation schedules. Revenue expenditure demands precise maintenance of operational expense records, including fuel, maintenance, and repairs, to support tax claims. Ensuring comprehensive documentation aligns with HMRC guidelines minimizes audit risks and maximizes allowable deductions.

Annual Investment Allowance (AIA) and Cars

Capital allowances such as the Annual Investment Allowance (AIA) enable businesses to deduct the full cost of qualifying plant and machinery, including cars with low CO2 emissions, from taxable profits, unlike revenue expenditure which is expensed immediately against income. The AIA limit, currently set at PS1 million, provides significant upfront tax relief but excludes most cars with high emissions, which instead attract writing down allowances at reduced rates. Understanding the distinctions between capital allowances and revenue expenditure is critical for efficient tax planning, particularly when acquiring vehicles or other capital assets.

Common Mistakes in Classifying Car Expenses

Misclassifying car expenses between capital allowances and revenue expenditure often results in incorrect tax deductions, as capital allowances apply to the purchase or improvement of vehicles, while revenue expenditure covers routine maintenance and running costs. A frequent error is claiming repairs that improve the vehicle's value as revenue expenditure instead of capital allowances, leading to potential underclaimed tax relief. Properly distinguishing these expenses ensures accurate reporting and maximizes allowable tax benefits under current HMRC guidelines.

Maximizing Tax Efficiency with Car Expenses

Maximizing tax efficiency with car expenses requires distinguishing between capital allowances and revenue expenditure, as capital allowances apply to the purchase cost and depreciation of vehicles, offering long-term tax relief, while revenue expenditure covers routine running costs like fuel and maintenance, deductible in the same tax year. Claiming capital allowances on eligible vehicles reduces taxable profits by spreading the cost over several years, whereas immediate deduction of revenue expenses lowers taxable income annually. Accurate categorization and record-keeping optimize tax benefits, ensuring full utilization of allowable deductions within current tax regulations.

Capital Allowances vs Revenue Expenditure Infographic

cardiffo.com

cardiffo.com