Road tax is a recurring fee imposed on vehicle owners to fund the maintenance and development of public roads, while toll tax is a specific charge collected at certain road points, bridges, or tunnels to pay for their usage or construction costs. Road tax rates usually depend on vehicle type, engine size, or emissions, whereas toll tax varies based on distance traveled or the infrastructure accessed. Understanding the distinction helps drivers budget for regular expenses versus pay-per-use fees during travel.

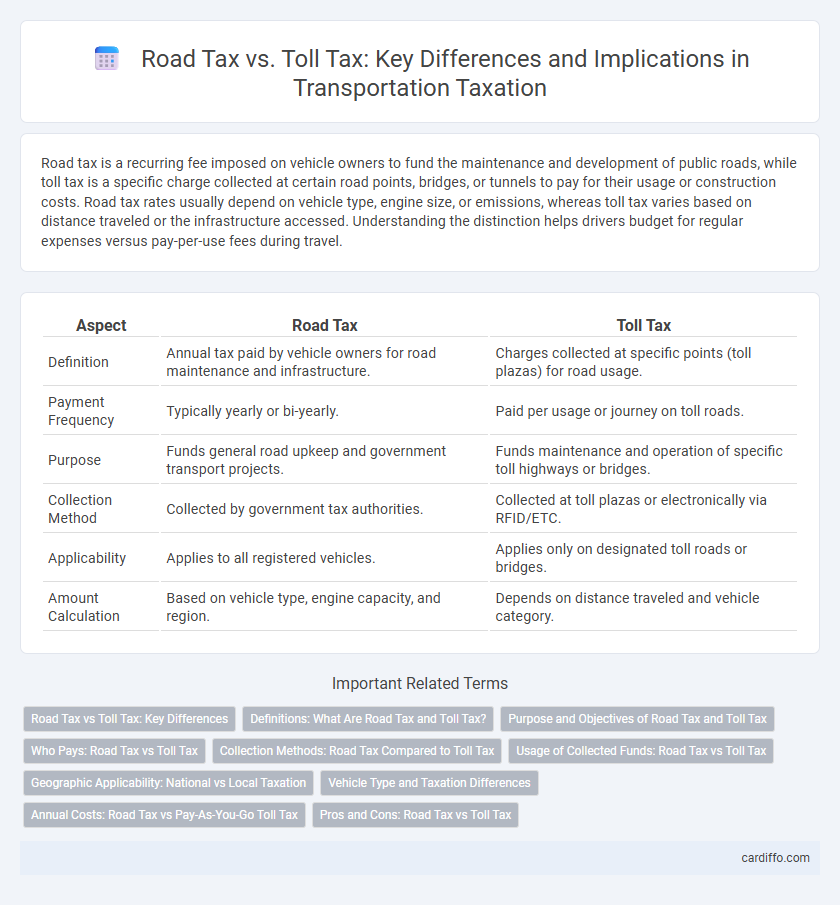

Table of Comparison

| Aspect | Road Tax | Toll Tax |

|---|---|---|

| Definition | Annual tax paid by vehicle owners for road maintenance and infrastructure. | Charges collected at specific points (toll plazas) for road usage. |

| Payment Frequency | Typically yearly or bi-yearly. | Paid per usage or journey on toll roads. |

| Purpose | Funds general road upkeep and government transport projects. | Funds maintenance and operation of specific toll highways or bridges. |

| Collection Method | Collected by government tax authorities. | Collected at toll plazas or electronically via RFID/ETC. |

| Applicability | Applies to all registered vehicles. | Applies only on designated toll roads or bridges. |

| Amount Calculation | Based on vehicle type, engine capacity, and region. | Depends on distance traveled and vehicle category. |

Road Tax vs Toll Tax: Key Differences

Road tax is an annual or periodic fee imposed by the government for the use and maintenance of public roads, while toll tax is a charge collected at specific points such as bridges, tunnels, or highways to fund the construction and upkeep of those infrastructures. Road tax is typically based on vehicle type, engine size, or emissions, whereas toll tax varies depending on the distance traveled or the specific toll point accessed. Understanding the distinction between road tax and toll tax is essential for budgeting vehicle expenses and complying with transportation regulations.

Definitions: What Are Road Tax and Toll Tax?

Road tax is a mandatory government levy imposed on vehicle owners to fund the maintenance and infrastructure of public roads. Toll tax refers to fees collected at specific points like bridges, highways, or tunnels, charged directly to users for access and usage of these facilities. Both taxes serve to finance transportation infrastructure but apply differently based on usage and vehicle registration.

Purpose and Objectives of Road Tax and Toll Tax

Road tax is primarily imposed to generate revenue for the construction, maintenance, and improvement of public roads and highways, ensuring safe and efficient transportation infrastructure. Toll tax specifically targets the funding of particular roads, bridges, or tunnels, charging users directly based on usage to manage traffic flow and cover operational costs. Both taxes aim to support transportation infrastructure but differ in their application scope and user-based funding mechanisms.

Who Pays: Road Tax vs Toll Tax

Road tax is paid by vehicle owners or registrants as an annual or periodic fee based on vehicle type, weight, and emissions, supporting general road maintenance and infrastructure. Toll tax is paid specifically by drivers using tolled roads, bridges, or tunnels, and is calculated according to vehicle class and distance traveled. While road tax is a fixed or recurring obligation, toll tax varies depending on road usage frequency and location.

Collection Methods: Road Tax Compared to Toll Tax

Road tax is primarily collected through annual registration fees or vehicle license plates issued by government authorities, which are paid irrespective of road usage. Toll tax, in contrast, is collected at specific points such as toll booths or electronic toll collection systems, charging drivers directly based on kilometers traveled on certain roads or bridges. This differential collection method impacts funding allocation and scales with road usage intensity, making toll tax a user-pay system while road tax is a general vehicle ownership tax.

Usage of Collected Funds: Road Tax vs Toll Tax

Road tax funds are primarily allocated to the maintenance, repair, and upgrading of public roads and highways, supporting overall infrastructure development and safety improvements. Toll tax revenues are specifically used for the construction, operation, and maintenance of the tolled road or bridge where the fees are collected, often financing the initial investment and ongoing expenses. This direct allocation of toll fees ensures a user-pays principle, while road tax distribution supports broader transportation projects across a region or country.

Geographic Applicability: National vs Local Taxation

Road tax is typically a national tax levied by central governments to fund the maintenance and construction of highways and major road infrastructure across the entire country. Toll tax, on the other hand, is locally imposed at specific points such as bridges, tunnels, or highway stretches, and revenues are often used for the upkeep of the toll facility or regional transport projects. Geographic applicability distinguishes road tax as a broad-based national fee, while toll tax operates as a targeted, location-specific charge.

Vehicle Type and Taxation Differences

Road tax varies based on vehicle type, generally applied as an annual fee determined by factors such as vehicle weight, engine size, and usage, primarily funding road maintenance. Toll tax is a usage-based charge imposed at specific points like highways or bridges, collected per vehicle passage regardless of type but often with different rates for cars, trucks, and motorcycles. The key taxation difference lies in road tax being a fixed periodic payment tied to vehicle registration, while toll tax is a variable fee directly linked to road usage frequency and vehicle classification.

Annual Costs: Road Tax vs Pay-As-You-Go Toll Tax

Road tax requires a fixed annual payment based on vehicle type, engine capacity, and emissions, resulting in predictable yearly costs regardless of road usage. Pay-as-you-go toll tax charges vary with distance traveled, road type, and toll rates, offering cost savings for infrequent drivers but potentially higher expenses for daily commuters. Comparing annual costs depends on individual driving habits, with road tax providing stability and toll tax enabling flexible expenditure aligned with actual road use.

Pros and Cons: Road Tax vs Toll Tax

Road tax generates consistent revenue for infrastructure maintenance but may impose a financial burden regardless of actual road usage, limiting fairness for infrequent drivers. Toll tax promotes user-pays principles, encouraging efficient road use and funding specific projects directly, yet it can lead to congestion at toll points and higher costs for frequent commuters. Balancing these taxes involves evaluating revenue stability against user equity and administrative efficiency in road network funding.

Road Tax vs Toll Tax Infographic

cardiffo.com

cardiffo.com