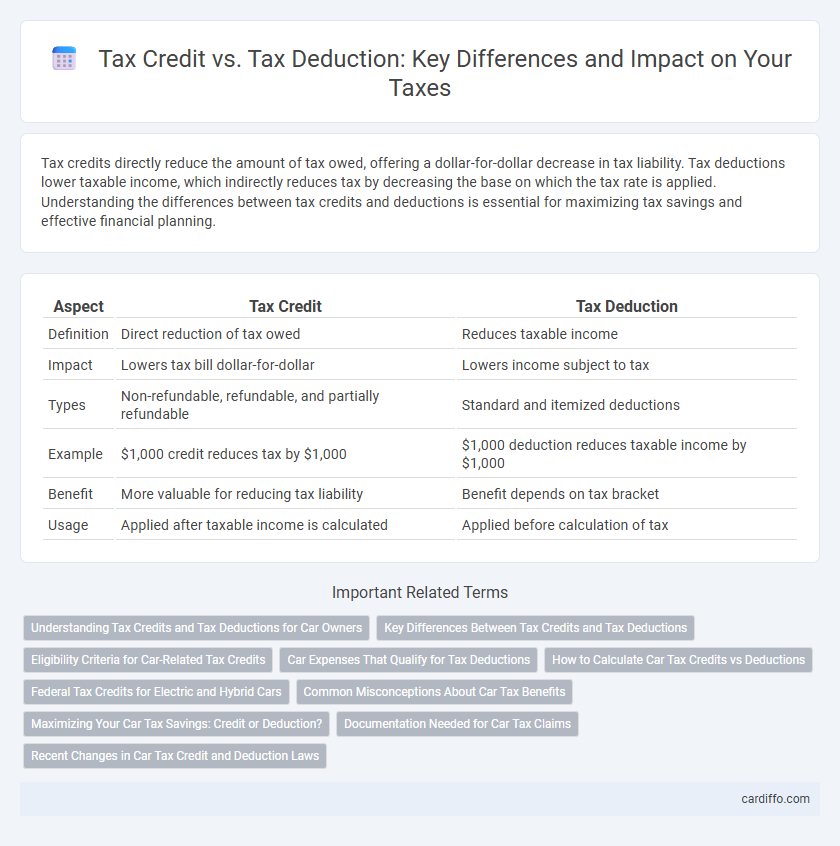

Tax credits directly reduce the amount of tax owed, offering a dollar-for-dollar decrease in tax liability. Tax deductions lower taxable income, which indirectly reduces tax by decreasing the base on which the tax rate is applied. Understanding the differences between tax credits and deductions is essential for maximizing tax savings and effective financial planning.

Table of Comparison

| Aspect | Tax Credit | Tax Deduction |

|---|---|---|

| Definition | Direct reduction of tax owed | Reduces taxable income |

| Impact | Lowers tax bill dollar-for-dollar | Lowers income subject to tax |

| Types | Non-refundable, refundable, and partially refundable | Standard and itemized deductions |

| Example | $1,000 credit reduces tax by $1,000 | $1,000 deduction reduces taxable income by $1,000 |

| Benefit | More valuable for reducing tax liability | Benefit depends on tax bracket |

| Usage | Applied after taxable income is calculated | Applied before calculation of tax |

Understanding Tax Credits and Tax Deductions for Car Owners

Tax credits for car owners directly reduce the amount of tax owed by offering specific dollar-for-dollar savings, often tied to eco-friendly vehicle purchases or energy-efficient upgrades. Tax deductions lower taxable income by allowing car owners to subtract eligible expenses such as business use of a vehicle or interest on a car loan, ultimately decreasing the overall tax liability. Understanding the distinction between these tax incentives helps car owners maximize financial benefits when filing taxes.

Key Differences Between Tax Credits and Tax Deductions

Tax credits directly reduce the amount of tax owed dollar-for-dollar, while tax deductions lower taxable income, thereby decreasing the overall tax liability indirectly. Tax credits often provide greater tax savings compared to deductions of the same amount because credits are subtracted after determining the tax owed. Examples include the Earned Income Tax Credit for credits and mortgage interest deduction for deductions, highlighting fundamental differences in their impact on tax calculations.

Eligibility Criteria for Car-Related Tax Credits

Eligibility criteria for car-related tax credits typically require the vehicle to meet specific energy efficiency or emissions standards, such as being a qualified electric or hybrid car. Tax credits often depend on factors like the vehicle's battery capacity, purchase date, and purchaser's tax liability to fully benefit from the incentive. Certain credits may also be limited to new vehicles or those used primarily for personal, not commercial, purposes.

Car Expenses That Qualify for Tax Deductions

Car expenses that qualify for tax deductions include costs such as fuel, maintenance, insurance, depreciation, and lease payments directly related to business use. The IRS allows taxpayers to deduct either actual expenses or use the standard mileage rate, which was 65.5 cents per mile for 2023. Keeping detailed records and receipts is essential to maximize deductions and differentiate between personal and business use.

How to Calculate Car Tax Credits vs Deductions

Calculating car tax credits involves directly reducing your tax liability based on the qualifying amount specified by the IRS, such as the electric vehicle credit which can range up to $7,500 per eligible vehicle. In contrast, car tax deductions lower your taxable income by the amount spent on eligible expenses like business use of a vehicle, often calculated using either the standard mileage rate or actual expenses method. Understanding the specific eligibility criteria and IRS guidelines is essential to accurately determine the financial benefit between car tax credits and deductions.

Federal Tax Credits for Electric and Hybrid Cars

Federal tax credits for electric and hybrid cars directly reduce the amount of tax owed, offering up to $7,500 depending on the vehicle's battery capacity and manufacturer eligibility. Tax credits are more beneficial than tax deductions, which only lower taxable income rather than the tax liability itself. These incentives encourage clean energy adoption by making eco-friendly vehicles more affordable for consumers and supporting environmental policy goals.

Common Misconceptions About Car Tax Benefits

Many taxpayers mistakenly believe that car tax deductions and tax credits offer the same savings, but tax credits directly reduce tax liability dollar-for-dollar, while deductions lower taxable income, resulting in variable savings. Common misconceptions include overestimating the benefit of claiming depreciation as a deduction and confusing personal vehicle expenses with business use eligibility. Understanding IRS guidelines on actual business mileage and allowable deductions is crucial to maximizing car-related tax benefits accurately.

Maximizing Your Car Tax Savings: Credit or Deduction?

Maximizing your car tax savings depends on understanding the difference between tax credits and tax deductions; tax credits reduce your tax bill dollar-for-dollar while deductions lower your taxable income, often resulting in less savings. For electric or hybrid vehicles, federal tax credits can provide up to $7,500, making credits especially valuable when eligible. Evaluating your total tax liability and eligibility for specific credits or deductions like depreciation or business use can optimize your overall tax savings on car expenses.

Documentation Needed for Car Tax Claims

Documenting car tax claims requires maintaining detailed records such as purchase invoices, registration papers, and mileage logs to support eligibility for tax credits or deductions. Receipts for expenses related to the car, including maintenance, fuel, and insurance, are essential to substantiate the claimed amounts in tax returns. Proper organization of these documents ensures compliance with IRS regulations and maximizes the potential tax benefit during filing.

Recent Changes in Car Tax Credit and Deduction Laws

Recent changes in car tax credit and deduction laws have increased the maximum allowable credit for electric and hybrid vehicle purchases, reflecting government incentives to promote eco-friendly transportation. Taxpayers can now claim up to $7,500 in federal tax credits for qualifying vehicles, with specific eligibility based on battery capacity and assembly location. Meanwhile, deductions related to business use of vehicles have updated mileage rates, requiring careful record-keeping for accurate claims under the IRS guidelines.

Tax Credit vs Tax Deduction Infographic

cardiffo.com

cardiffo.com