AMAP rates are the Applicable Federal Mid-Term Rates used to determine the interest on loans with terms between three and nine years, often applied in intra-family or estate planning transactions. AFR rates, or Applicable Federal Rates, include short, mid, and long-term rates published monthly by the IRS to calculate the interest on various types of loans for tax purposes. Understanding the differences between AMAP and AFR rates is crucial for accurate tax compliance and minimizing IRS audit risks related to below-market interest loans.

Table of Comparison

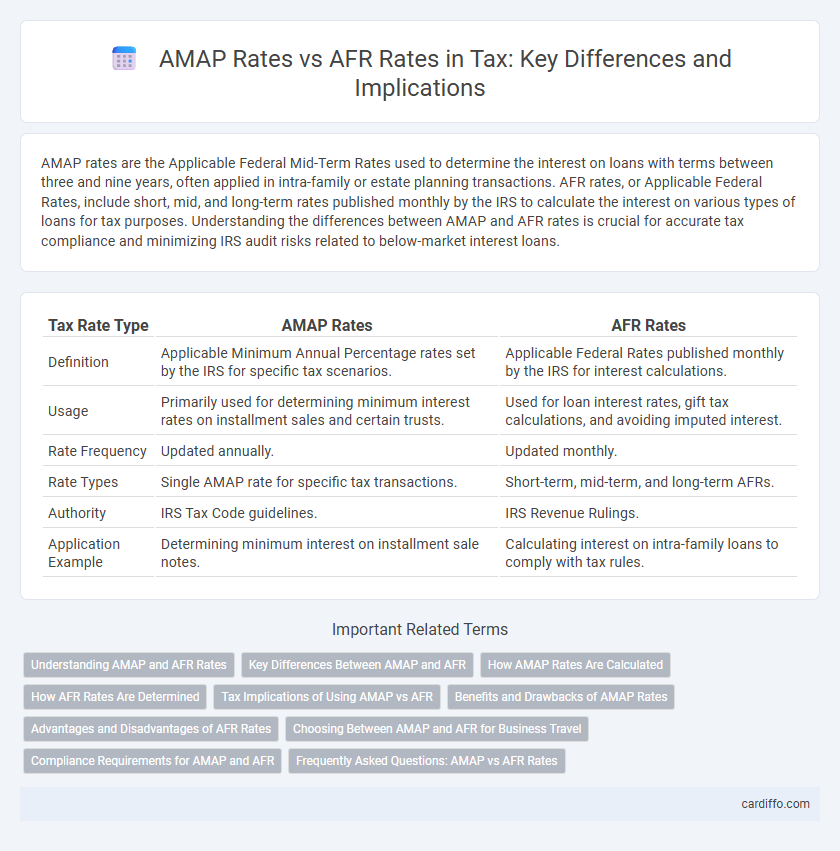

| Tax Rate Type | AMAP Rates | AFR Rates |

|---|---|---|

| Definition | Applicable Minimum Annual Percentage rates set by the IRS for specific tax scenarios. | Applicable Federal Rates published monthly by the IRS for interest calculations. |

| Usage | Primarily used for determining minimum interest rates on installment sales and certain trusts. | Used for loan interest rates, gift tax calculations, and avoiding imputed interest. |

| Rate Frequency | Updated annually. | Updated monthly. |

| Rate Types | Single AMAP rate for specific tax transactions. | Short-term, mid-term, and long-term AFRs. |

| Authority | IRS Tax Code guidelines. | IRS Revenue Rulings. |

| Application Example | Determining minimum interest on installment sale notes. | Calculating interest on intra-family loans to comply with tax rules. |

Understanding AMAP and AFR Rates

AMAP rates (Applicable Midterm Applicable Federal rates) are used to value property transfers for tax purposes, particularly when determining the present value of income from such property. AFR rates (Applicable Federal Rates) set monthly interest rates the IRS uses for various tax computations, including loans and installment sales, reflecting the current economic climate more dynamically. Understanding the distinctions between AMAP and AFR rates is critical for accurate tax planning, ensuring compliance when valuing assets and calculating imputed interest on loans.

Key Differences Between AMAP and AFR

AMAP (Applicable Midterm Applicable Percentage) rates are used for long-term loans and typically reflect the midterm market interest rate adjusted for the borrower's credit risk, while AFR (Applicable Federal Rate) rates are published monthly by the IRS and serve as minimum interest rates for various federal tax purposes. AMAP rates often exceed AFR rates due to their adjustment factors and are applied over longer periods, making them more relevant for midterm financial agreements. These distinctions influence tax calculations by determining imputed interest on loans, affecting gift tax valuations and income recognition.

How AMAP Rates Are Calculated

AMAP rates, used for determining the tax-exempt portion of employer-provided housing or transit benefits, are calculated by dividing the total eligible deductions by the total number of commuters, adjusted for the employer's geographic location and the type of benefit provided. These rates are set annually by the IRS based on extensive data collection, including commuting patterns and regional cost variations. The calculation ensures compliance with tax regulations by limiting the amount of pre-tax income allocated to transportation and parking benefits.

How AFR Rates Are Determined

Applicable Federal Rates (AFR) are established monthly by the IRS based on average market yields of U.S. Treasury securities with varying maturities, reflecting current economic conditions and interest rate environments. These rates serve as benchmarks for valuing loans, annuities, and other financial transactions to ensure compliance with tax regulations. AFR rates vary by short-term, mid-term, and long-term categories, depending on the term of the financial arrangement.

Tax Implications of Using AMAP vs AFR

AMAP rates, which reflect the rates paid by the federal government for intragovernmental loans, often result in lower interest obligations compared to AFR rates, thereby reducing taxable imputed interest income for borrowers. AFR rates, established monthly by the IRS, are typically higher and used for commercial loan valuations, leading to increased taxable interest income but ensuring compliance with federal gift and estate tax rules. Selecting AMAP over AFR can minimize tax liabilities on below-market loans but requires adherence to strict regulatory definitions to avoid IRS penalties.

Benefits and Drawbacks of AMAP Rates

AMAP rates offer predictable and stable valuation for tax purposes, reducing administrative burden by avoiding annual recalculations tied to fluctuating market rates. Their primary drawback includes potential discrepancies between AMAP rates and actual market interest, which can lead to either understated or overstated taxable income. Despite these limitations, AMAP rates provide a simplified method for calculating imputed interest, beneficial for taxpayers seeking consistency in tax planning.

Advantages and Disadvantages of AFR Rates

AFR rates offer advantages such as standardized, IRS-approved interest rates for calculating imputed interest on below-market loans, reducing audit risk and simplifying compliance. However, disadvantage includes their fluctuation, which can increase borrowing costs unpredictably and may not reflect current market rates accurately. AFR rates are less flexible compared to AMAP rates, potentially limiting strategic tax planning opportunities for trusts and estate planners.

Choosing Between AMAP and AFR for Business Travel

Choosing between AMAP (Agency Mileage Allowance Payment) and AFR (Accountable Flat Rate) for business travel depends on the nature of the travel expenses and record-keeping preferences. AMAP rates allow reimbursement based on actual miles driven, aligning closely with IRS standard mileage rates, making them suitable for precise mileage tracking and tax compliance. AFR rates provide a simplified, flat per diem approach, streamlining accounting for businesses with frequent, consistent travel patterns or when detailed mileage records are impractical.

Compliance Requirements for AMAP and AFR

AMAP rates (Applicable Federal Midterm Rates) and AFR rates (Applicable Federal Rates) both impose strict compliance requirements to ensure adherence to IRS tax regulations. AMAP requires precise application in midterm loan transactions to avoid imputed interest penalties, while AFR mandates accurate interest calculations on below-market loans and gifts for federal tax reporting. Failure to comply with either can trigger interest recalculations, penalties, and increased IRS scrutiny on tax returns involving interfamily loans, transfers, or payments.

Frequently Asked Questions: AMAP vs AFR Rates

AMAP (Applicable Midterm AFR) and AFR (Applicable Federal Rates) are IRS-published interest rates used for various tax calculations, including loans and installment sales. AMAP rates typically apply to midterm loans with terms from three to nine years, often used in intra-family or related-party transactions to avoid below-market interest rates. AFR rates are divided into short, mid, and long-term periods and serve as baseline interest rates for tax purposes such as gift loans, installment sales, and compensatory loans.

AMAP Rates vs AFR Rates Infographic

cardiffo.com

cardiffo.com