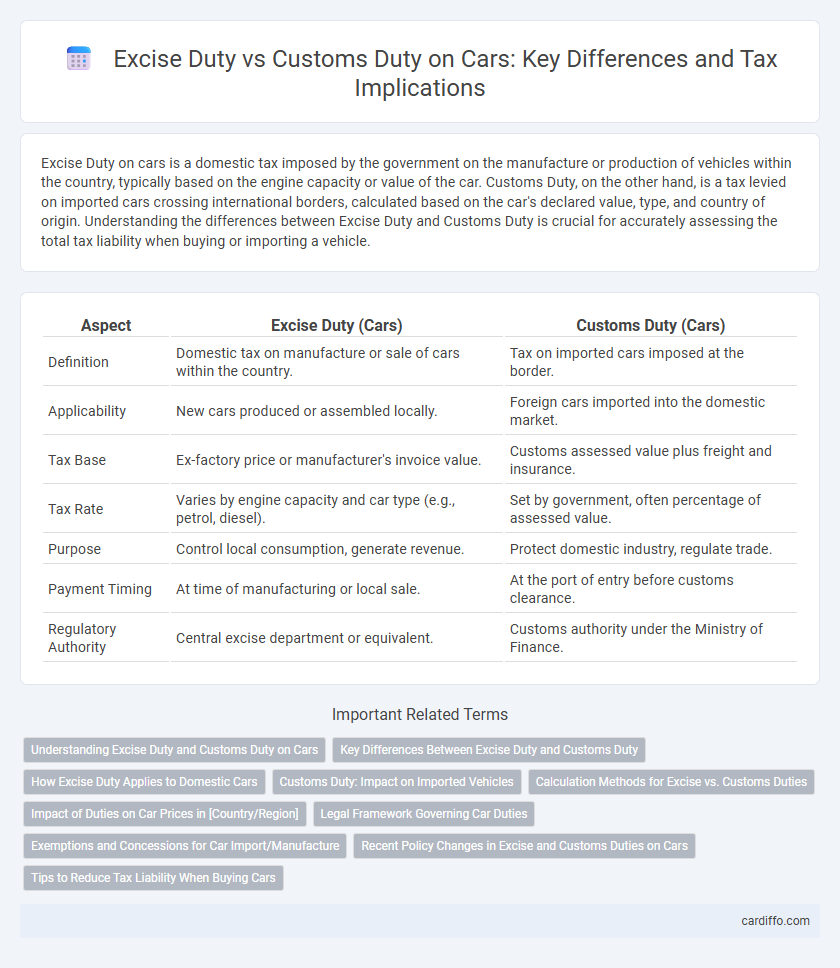

Excise Duty on cars is a domestic tax imposed by the government on the manufacture or production of vehicles within the country, typically based on the engine capacity or value of the car. Customs Duty, on the other hand, is a tax levied on imported cars crossing international borders, calculated based on the car's declared value, type, and country of origin. Understanding the differences between Excise Duty and Customs Duty is crucial for accurately assessing the total tax liability when buying or importing a vehicle.

Table of Comparison

| Aspect | Excise Duty (Cars) | Customs Duty (Cars) |

|---|---|---|

| Definition | Domestic tax on manufacture or sale of cars within the country. | Tax on imported cars imposed at the border. |

| Applicability | New cars produced or assembled locally. | Foreign cars imported into the domestic market. |

| Tax Base | Ex-factory price or manufacturer's invoice value. | Customs assessed value plus freight and insurance. |

| Tax Rate | Varies by engine capacity and car type (e.g., petrol, diesel). | Set by government, often percentage of assessed value. |

| Purpose | Control local consumption, generate revenue. | Protect domestic industry, regulate trade. |

| Payment Timing | At time of manufacturing or local sale. | At the port of entry before customs clearance. |

| Regulatory Authority | Central excise department or equivalent. | Customs authority under the Ministry of Finance. |

Understanding Excise Duty and Customs Duty on Cars

Excise duty on cars is an inland tax imposed on the manufacture or sale of vehicles within a country, often varying based on engine capacity, fuel type, and vehicle classification. Customs duty is a border tax levied on imported cars, calculated as a percentage of the vehicle's declared value, including shipping and insurance costs. Understanding the differences between excise duty and customs duty is essential for accurate cost estimation when buying or importing cars, as both taxes impact the final purchase price and compliance requirements.

Key Differences Between Excise Duty and Customs Duty

Excise duty on cars is an internal tax levied on the manufacture or production of vehicles within a country, targeting specific goods often considered luxury or non-essential. Customs duty is an external tax imposed on imported vehicles when they cross national borders, aimed at regulating trade and protecting domestic industries. Key differences include their points of application--excise duty applies domestically on production, while customs duty applies internationally on imports--and their roles in revenue generation and trade policy enforcement.

How Excise Duty Applies to Domestic Cars

Excise duty on domestic cars is levied based on the vehicle's engine capacity and ex-factory price, targeting manufacturers and assemblers within the country to regulate pricing and production standards. This duty impacts the final cost of domestically produced vehicles by adding a direct tax component before they reach dealers or consumers. Unlike customs duty, which applies to imported cars, excise duty fosters local industry growth through incentivizing domestic manufacturing and controlling market competitiveness.

Customs Duty: Impact on Imported Vehicles

Customs duty on imported vehicles significantly increases the overall cost, often making foreign cars less competitive compared to locally manufactured models. This tax is calculated based on the vehicle's CIF value (Cost, Insurance, and Freight), impacting luxury and high-engine capacity vehicles the most. Governments use customs duty to protect domestic industries while generating revenue and regulating vehicle imports.

Calculation Methods for Excise vs. Customs Duties

Excise duty on cars is typically calculated based on the vehicle's engine capacity, value, or a predefined percentage of the manufacturer's invoice price, depending on the jurisdiction's tax laws. Customs duty, however, is generally assessed as a percentage of the car's declared customs value, which includes the purchase price, freight, insurance, and other related costs. Understanding these distinct calculation methods is crucial for accurate tax compliance and cost estimation in automotive imports.

Impact of Duties on Car Prices in [Country/Region]

Excise duty on cars in [Country/Region] significantly raises the retail price by targeting the vehicle's engine capacity and luxury status, often constituting up to 40% of the total cost. Customs duty, applied on imported vehicles, varies based on origin and import type, but typically adds an extra 20-30% to the car's base price. The combined effect of excise and customs duties results in substantially higher car prices, limiting affordability and influencing consumer preferences toward locally manufactured models.

Legal Framework Governing Car Duties

Excise duty on cars is governed by domestic tax laws that impose levies on the manufacture, sale, and usage of vehicles within a country, often regulated under acts like the Central Excise Act or specific motor vehicle taxation statutes. Customs duty applies to imported cars and is regulated by international trade laws and national customs tariffs, typically outlined in customs legislation such as the Customs Act or Harmonized System codes. The legal framework distinguishes excise duty as an indirect tax on production and sale, while customs duty targets importation, ensuring compliance with trade policies and revenue collection mechanisms.

Exemptions and Concessions for Car Import/Manufacture

Excise duty exemptions on cars often apply to electric vehicles and hybrid models to promote eco-friendly transportation, whereas customs duty concessions typically target vehicles imported under specific government schemes such as export promotion or diplomatic usage. Manufacturers benefit from excise duty reductions when producing cars that meet energy efficiency and emission standards, while customs duty exemptions may be granted for cars imported temporarily or those brought in under preferential trade agreements. Understanding these specific exemptions and concessions is crucial for importers and manufacturers to optimize tax liabilities and comply with regulatory frameworks efficiently.

Recent Policy Changes in Excise and Customs Duties on Cars

Recent policy changes in excise duty on cars have introduced differentiated rates based on engine capacity, emission standards, and vehicle type, aiming to promote electric and hybrid vehicle adoption. Customs duty adjustments now focus on reducing tariffs for electric vehicles while maintaining higher rates for traditional internal combustion engines to encourage environmentally friendly imports. These changes reflect government initiatives to support cleaner mobility and align with global emission reduction targets in the automotive sector.

Tips to Reduce Tax Liability When Buying Cars

When purchasing cars, understanding the difference between excise duty and customs duty can significantly reduce tax liability; excise duty is imposed on domestically manufactured vehicles, while customs duty applies to imported cars. Utilize exemptions, such as electric vehicle incentives or compliance with emissions standards, to lower excise taxes. Opt for vehicles with smaller engine capacities or purchase during government tax relief periods to minimize customs duties and overall expenses.

Excise Duty vs Customs Duty (on cars) Infographic

cardiffo.com

cardiffo.com