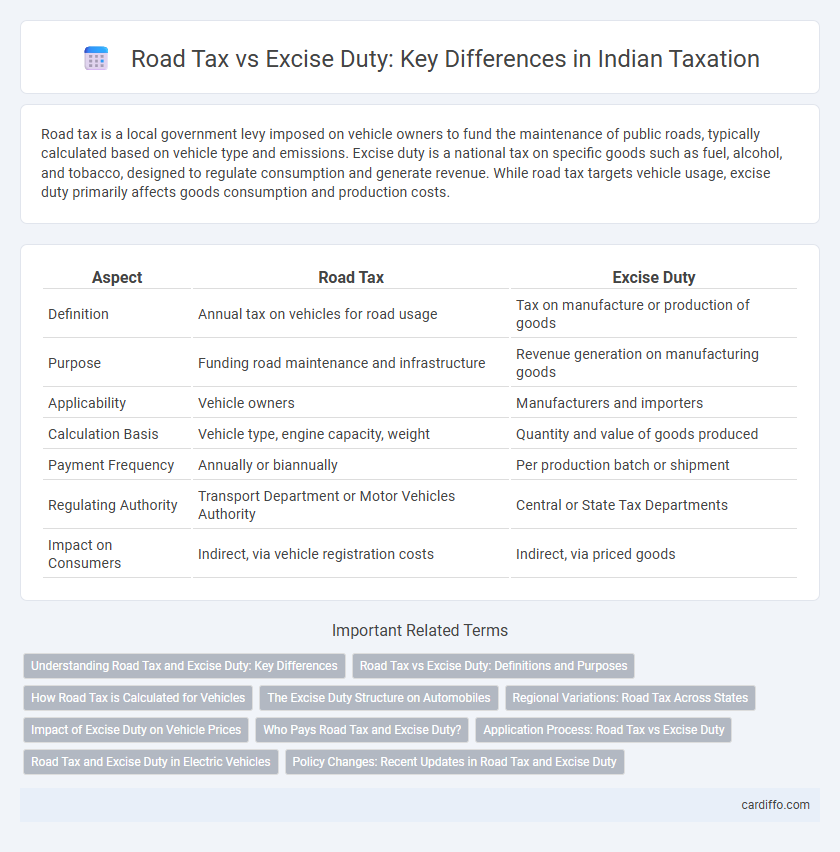

Road tax is a local government levy imposed on vehicle owners to fund the maintenance of public roads, typically calculated based on vehicle type and emissions. Excise duty is a national tax on specific goods such as fuel, alcohol, and tobacco, designed to regulate consumption and generate revenue. While road tax targets vehicle usage, excise duty primarily affects goods consumption and production costs.

Table of Comparison

| Aspect | Road Tax | Excise Duty |

|---|---|---|

| Definition | Annual tax on vehicles for road usage | Tax on manufacture or production of goods |

| Purpose | Funding road maintenance and infrastructure | Revenue generation on manufacturing goods |

| Applicability | Vehicle owners | Manufacturers and importers |

| Calculation Basis | Vehicle type, engine capacity, weight | Quantity and value of goods produced |

| Payment Frequency | Annually or biannually | Per production batch or shipment |

| Regulating Authority | Transport Department or Motor Vehicles Authority | Central or State Tax Departments |

| Impact on Consumers | Indirect, via vehicle registration costs | Indirect, via priced goods |

Understanding Road Tax and Excise Duty: Key Differences

Road tax is a government-imposed fee levied on vehicle owners for using public roads, typically calculated based on vehicle type, weight, or engine capacity. Excise duty, on the other hand, is an indirect tax charged on the manufacture or import of goods, including vehicles and fuel, aiming to regulate consumption and raise revenue. Understanding the distinction helps in compliance, as road tax funds infrastructure maintenance, while excise duty influences product pricing and market control.

Road Tax vs Excise Duty: Definitions and Purposes

Road tax is a government levy imposed on vehicle owners to fund the maintenance and development of public roads, while excise duty is an indirect tax applied to specific goods such as fuel, alcohol, and tobacco to regulate consumption and generate revenue. Road tax primarily supports infrastructure, ensuring safe and efficient transportation networks, whereas excise duty targets products to influence consumer behavior and raise funds for public services. Understanding the distinct roles of road tax and excise duty helps clarify their impact on both transportation costs and broader economic policies.

How Road Tax is Calculated for Vehicles

Road tax is calculated based on specific vehicle parameters such as engine capacity, vehicle type, and weight, often varying by jurisdiction to reflect road usage and environmental impact. Some regions apply flat rates for certain vehicle categories, while others use progressive scales tied to emissions or fuel efficiency. Excise duty differs as it is typically levied on fuel consumption or vehicle purchase price rather than road usage.

The Excise Duty Structure on Automobiles

The Excise Duty Structure on Automobiles is a key component of indirect taxation, applied to the manufacture of motor vehicles within a country. It varies based on engine capacity, fuel type, and vehicle category, influencing the final retail price significantly. This structure operates alongside road tax, which is a recurring fee for vehicle usage on public roads, whereas excise duty is a one-time tax imposed during production or import.

Regional Variations: Road Tax Across States

Road tax rates vary significantly across states, influenced by regional policies and vehicle usage patterns, with states like California imposing higher fees compared to others such as Texas. These variations reflect differing budget allocations for infrastructure and local environmental regulations. Understanding state-specific road tax laws is crucial for vehicle owners to ensure compliance and optimize tax obligations.

Impact of Excise Duty on Vehicle Prices

Excise duty significantly increases vehicle prices by adding a substantial tax component to the manufacturing cost, leading to higher retail prices for consumers. This tax, imposed by the government on the production and sale of automobiles, directly affects the affordability and demand for vehicles in the market. Unlike road tax, which is paid periodically for vehicle usage, excise duty is a one-time charge integrated into the initial purchase cost, making it a critical factor in the overall pricing structure.

Who Pays Road Tax and Excise Duty?

Vehicle owners pay road tax, which is usually an annual fee imposed by local or regional governments to fund road maintenance and infrastructure. Excise duty is paid by manufacturers or importers of vehicles and certain goods, as it is a tax levied on the production or importation of specific items before they reach consumers. Ultimately, road tax targets vehicle usage, while excise duty targets the production or sale stage.

Application Process: Road Tax vs Excise Duty

Road tax is typically applied for through local transportation or motor vehicle departments, requiring vehicle registration documents, proof of insurance, and payment based on the vehicle type and usage. Excise duty application involves filing with customs or tax authorities, usually necessitating detailed documentation about the goods, such as manufacturing details, quantity, and value for domestic production or imports. The road tax application is primarily focused on vehicle ownership and usage compliance, whereas excise duty application centers on the production, import, and distribution of taxable goods.

Road Tax and Excise Duty in Electric Vehicles

Road tax on electric vehicles is typically lower or waived in many regions to promote eco-friendly transportation, while excise duty applies to the manufacturing price but often benefits from exemptions or reduced rates for EVs. Excise duty is a form of indirect tax imposed on goods production, including electric vehicles, influencing their final market price. Understanding the differences in road tax and excise duty policies helps consumers and manufacturers navigate the financial implications of adopting electric vehicle technology.

Policy Changes: Recent Updates in Road Tax and Excise Duty

Recent policy changes have introduced higher road tax rates in several jurisdictions to fund infrastructure projects, reflecting a shift towards sustainable transportation funding. Excise duty adjustments now often target fuel products, influencing vehicle operating costs and encouraging cleaner energy use. These updates demonstrate governments' efforts to balance revenue generation with environmental objectives in the transportation sector.

road tax vs excise duty Infographic

cardiffo.com

cardiffo.com