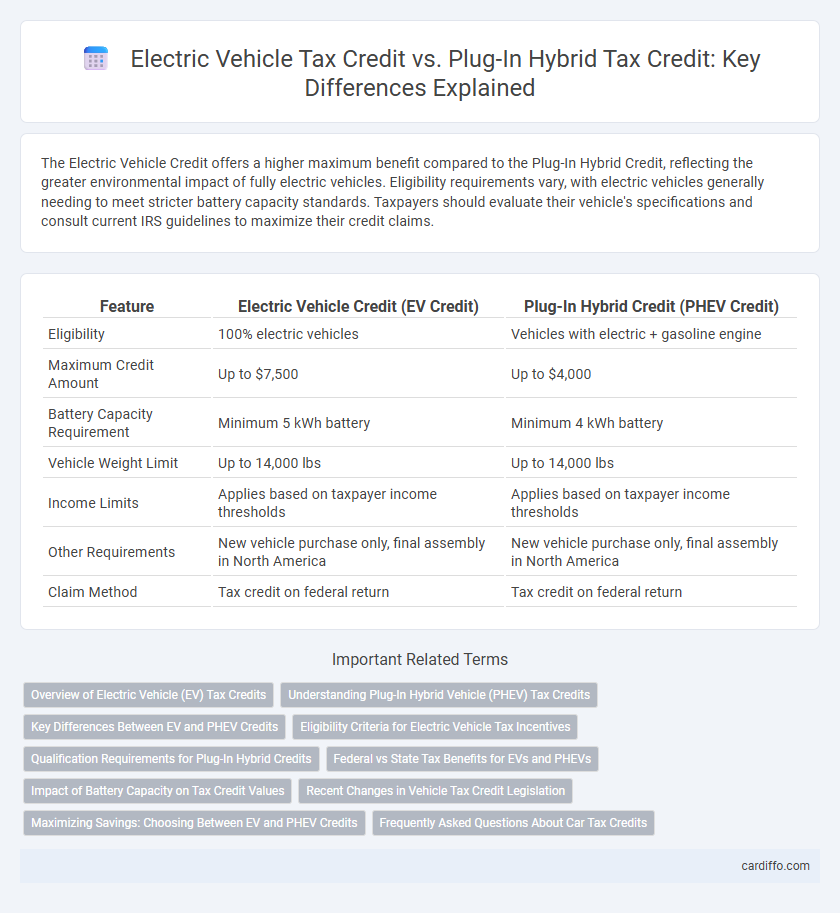

The Electric Vehicle Credit offers a higher maximum benefit compared to the Plug-In Hybrid Credit, reflecting the greater environmental impact of fully electric vehicles. Eligibility requirements vary, with electric vehicles generally needing to meet stricter battery capacity standards. Taxpayers should evaluate their vehicle's specifications and consult current IRS guidelines to maximize their credit claims.

Table of Comparison

| Feature | Electric Vehicle Credit (EV Credit) | Plug-In Hybrid Credit (PHEV Credit) |

|---|---|---|

| Eligibility | 100% electric vehicles | Vehicles with electric + gasoline engine |

| Maximum Credit Amount | Up to $7,500 | Up to $4,000 |

| Battery Capacity Requirement | Minimum 5 kWh battery | Minimum 4 kWh battery |

| Vehicle Weight Limit | Up to 14,000 lbs | Up to 14,000 lbs |

| Income Limits | Applies based on taxpayer income thresholds | Applies based on taxpayer income thresholds |

| Other Requirements | New vehicle purchase only, final assembly in North America | New vehicle purchase only, final assembly in North America |

| Claim Method | Tax credit on federal return | Tax credit on federal return |

Overview of Electric Vehicle (EV) Tax Credits

Electric Vehicle (EV) tax credits provide significant financial incentives to encourage the adoption of zero-emission vehicles, typically offering up to $7,500 for qualifying models. Plug-In Hybrid Electric Vehicles (PHEVs) are also eligible, but credits vary based on battery capacity, often resulting in smaller amounts compared to fully electric EVs. These federal tax credits are designed to reduce the upfront cost of EVs and PHEVs, making green transportation more accessible while promoting environmental benefits.

Understanding Plug-In Hybrid Vehicle (PHEV) Tax Credits

Plug-In Hybrid Electric Vehicles (PHEVs) qualify for federal tax credits based on battery capacity, with a maximum credit of up to $7,500 under the Internal Revenue Code Section 30D. The credit amount decreases as battery size reduces, distinguishing PHEVs from fully electric vehicles that typically have larger batteries and potentially higher credits. Understanding eligibility criteria, including vehicle weight, battery capacity, and manufacturer limits, is essential for maximizing tax benefits on PHEV purchases.

Key Differences Between EV and PHEV Credits

Electric Vehicle (EV) credits typically offer higher incentive amounts compared to Plug-In Hybrid Electric Vehicle (PHEV) credits due to the fully electric nature of EVs, which produce zero tailpipe emissions. EV credits often require a minimum battery capacity, generally around 5 kWh or more, while PHEV credits may be available for vehicles with smaller battery sizes and partial electric range. The eligibility criteria for EV credits emphasize zero emissions and longer electric-only driving range, whereas PHEV credits account for combined electric and gasoline usage, reflecting their dual power sources.

Eligibility Criteria for Electric Vehicle Tax Incentives

Electric vehicle tax incentives primarily require eligibility based on battery capacity, with EVs needing a minimum battery size of 5 kWh to qualify for the full credit, whereas plug-in hybrids must meet a lower threshold, typically around 4 kWh. Both vehicle types must be new, purchased for personal use, and meet specific manufacturer sales limits to qualify under the federal tax credit program. Income thresholds and vehicle price caps further determine eligibility for these tax incentives, ensuring targeted benefits based on economic and environmental criteria.

Qualification Requirements for Plug-In Hybrid Credits

Qualification requirements for plug-in hybrid credits include a minimum electric-only driving range of typically 20 miles or more and a battery capacity of at least 4 kWh. Vehicles must be primarily designed to run on both electric power and gasoline, meeting specific emissions and efficiency standards set by the IRS. Eligibility also depends on the vehicle's make, model year, and compliance with prevailing federal guidelines for clean energy tax incentives.

Federal vs State Tax Benefits for EVs and PHEVs

Federal tax credits for Electric Vehicles (EVs) can reach up to $7,500, while Plug-In Hybrid Electric Vehicles (PHEVs) often qualify for similar federal incentives based on battery capacity. States vary significantly in their additional tax benefits; for example, California offers rebates up to $2,000 for EVs but lower or no incentives for PHEVs, whereas Colorado provides up to $4,000 for both vehicle types. Understanding the combined impact of federal and state credits is essential for maximizing savings on EV and PHEV purchases.

Impact of Battery Capacity on Tax Credit Values

Electric Vehicle (EV) tax credits are directly influenced by the vehicle's battery capacity, with larger battery sizes typically qualifying for higher federal tax credit amounts. Plug-In Hybrid Electric Vehicles (PHEVs) often receive lower tax credits since their smaller battery capacities reduce eligibility compared to full EVs. Understanding the specific kilowatt-hour thresholds is crucial, as the credit amount phases out incrementally for vehicles with battery capacities under certain limits, affecting overall tax savings for consumers.

Recent Changes in Vehicle Tax Credit Legislation

Recent changes in vehicle tax credit legislation expanded eligibility for electric vehicle (EV) credits, increasing the maximum credit amount for qualifying EVs to $7,500. Plug-in hybrid electric vehicles (PHEVs) now face stricter battery capacity requirements to qualify, reducing available credits compared to fully electric models. Updated regulations also introduce income limits and adjusted pricing caps, impacting both EV and PHEV buyers seeking tax incentives.

Maximizing Savings: Choosing Between EV and PHEV Credits

Maximizing tax savings depends on understanding the specific credits available for Electric Vehicles (EVs) and Plug-In Hybrid Electric Vehicles (PHEVs). EVs typically qualify for higher federal tax credits, up to $7,500, due to their fully electric powertrains, while PHEVs may receive lower credits that vary based on battery capacity and electric-only range. Evaluating state incentives alongside federal credits can further enhance savings when choosing between EV and PHEV tax benefits.

Frequently Asked Questions About Car Tax Credits

Electric Vehicle (EV) Credits typically offer higher tax benefits compared to Plug-In Hybrid Electric Vehicle (PHEV) Credits due to the zero-emission nature of full electric vehicles. Eligibility for tax credits often depends on factors like battery capacity, manufacturer sales limits, and vehicle price caps, which vary between EVs and PHEVs. Common questions address credit amounts, phase-out schedules, and how leasing versus purchasing impacts tax incentives for both types of vehicles.

Electric Vehicle Credit vs Plug-In Hybrid Credit Infographic

cardiffo.com

cardiffo.com