Road tax is a recurring fee imposed on vehicle owners to fund the maintenance of public roads and infrastructure. Congestion tax targets drivers in high-traffic urban areas during peak hours to reduce traffic congestion and improve air quality. Both taxes serve distinct purposes: road tax supports general transportation infrastructure, while congestion tax manages urban traffic flow and environmental impact.

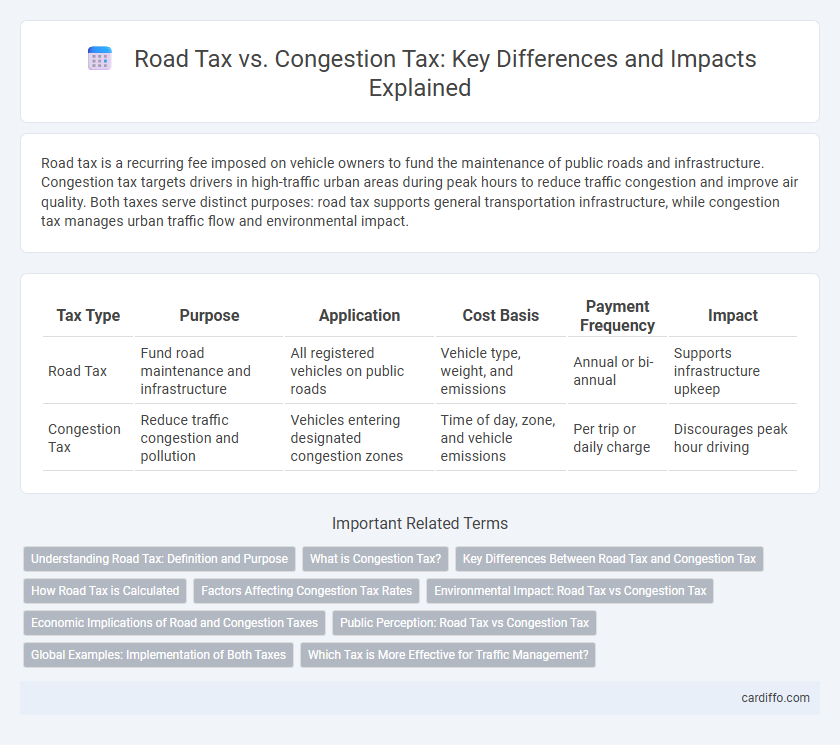

Table of Comparison

| Tax Type | Purpose | Application | Cost Basis | Payment Frequency | Impact |

|---|---|---|---|---|---|

| Road Tax | Fund road maintenance and infrastructure | All registered vehicles on public roads | Vehicle type, weight, and emissions | Annual or bi-annual | Supports infrastructure upkeep |

| Congestion Tax | Reduce traffic congestion and pollution | Vehicles entering designated congestion zones | Time of day, zone, and vehicle emissions | Per trip or daily charge | Discourages peak hour driving |

Understanding Road Tax: Definition and Purpose

Road tax, also known as vehicle excise duty, is a mandatory charge imposed on vehicle owners to fund the maintenance and development of public road infrastructure. It varies based on factors such as vehicle type, engine size, and emissions, promoting environmental responsibility and fair usage. Understanding road tax is crucial for compliance and contributes directly to the sustainability of transportation networks.

What is Congestion Tax?

Congestion tax is a fee imposed on vehicles entering designated high-traffic urban areas to reduce traffic congestion and pollution. It targets peak hours and zones with heavy vehicle density, encouraging the use of public transport and lowering emissions. Unlike road tax, which is an annual vehicle ownership charge, congestion tax is time and area-specific, applied directly to vehicular movement within congested city centers.

Key Differences Between Road Tax and Congestion Tax

Road tax is an annual fee imposed on vehicle owners to fund road maintenance and infrastructure, calculated based on factors such as vehicle type, engine size, and emissions. Congestion tax is a usage-based charge applied to drivers entering designated urban areas during peak hours to reduce traffic congestion and pollution. Unlike road tax, which is fixed and region-wide, congestion tax is variable, location-specific, and time-dependent.

How Road Tax is Calculated

Road tax is typically calculated based on vehicle type, engine size, fuel type, and CO2 emissions, with rates varying by jurisdiction and sometimes by weight or usage. Some regions implement fixed tariffs for specific categories, while others use a sliding scale tied to environmental impact metrics like carbon output. This calculation method aims to balance revenue generation with incentivizing eco-friendly vehicle choices.

Factors Affecting Congestion Tax Rates

Congestion tax rates are influenced by factors such as traffic density, time of day, and vehicle type, aiming to reduce urban traffic and pollution. Unlike road tax, which is a fixed annual fee based on vehicle specifications, congestion tax dynamically adjusts to manage demand and decrease gridlock in high-traffic zones. Geographic location and environmental policies also play critical roles in determining congestion tax levels and exemptions.

Environmental Impact: Road Tax vs Congestion Tax

Road tax primarily funds infrastructure maintenance but has limited direct influence on reducing emissions, whereas congestion tax actively discourages vehicle use in high-traffic urban zones, leading to measurable reductions in air pollution and greenhouse gas emissions. Congestion pricing encourages shifts to public transportation and non-motorized travel, directly addressing urban air quality and carbon footprint. Data from cities implementing congestion tax show significant decreases in NOx and CO2 levels compared to regions relying solely on road tax revenues.

Economic Implications of Road and Congestion Taxes

Road tax generates steady revenue for infrastructure maintenance, influencing vehicle ownership and usage patterns, while congestion tax specifically targets urban traffic, reducing peak-hour congestion and pollution. Economic implications include altered commuter behavior, shifts in public transport demand, and potential impacts on local businesses due to decreased accessibility. Both taxes aim to internalize external costs, promoting sustainable transportation and optimizing urban mobility efficiency.

Public Perception: Road Tax vs Congestion Tax

Public perception of road tax often associates it with routine vehicle maintenance funding, whereas congestion tax is viewed as a dynamic tool targeting urban traffic management and environmental benefits. Many drivers perceive road tax as a fixed, obligatory cost irrespective of road usage, while congestion tax is seen as a usage-based charge designed to reduce peak-time traffic congestion in city centers. Surveys indicate that acceptance of congestion tax increases when revenues are transparently reinvested in public transport and infrastructure improvements.

Global Examples: Implementation of Both Taxes

Road tax is a recurring vehicle ownership fee implemented in countries like the United Kingdom and Germany to fund infrastructure maintenance, while congestion tax aims to reduce urban traffic and emissions by charging drivers in specific zones, such as Singapore's Electronic Road Pricing and Stockholm's congestion charge. These taxes serve complementary roles: road tax supports general road upkeep, whereas congestion tax specifically targets traffic volume reduction during peak hours in densely populated cities worldwide. Cities like Milan and London exemplify integrated use of both taxes, combining road usage fees with congestion pricing to enhance urban mobility and environmental sustainability.

Which Tax is More Effective for Traffic Management?

Road tax primarily generates revenue for infrastructure maintenance, while congestion tax directly targets reducing traffic volume in high-density areas during peak hours. Congestion tax has proven more effective in traffic management by incentivizing drivers to modify travel behavior, thus alleviating congestion and improving urban air quality. Urban centers employing congestion charges, such as London and Stockholm, report significant declines in traffic and increased use of public transportation compared to regions relying solely on road tax.

Road Tax vs Congestion Tax Infographic

cardiffo.com

cardiffo.com