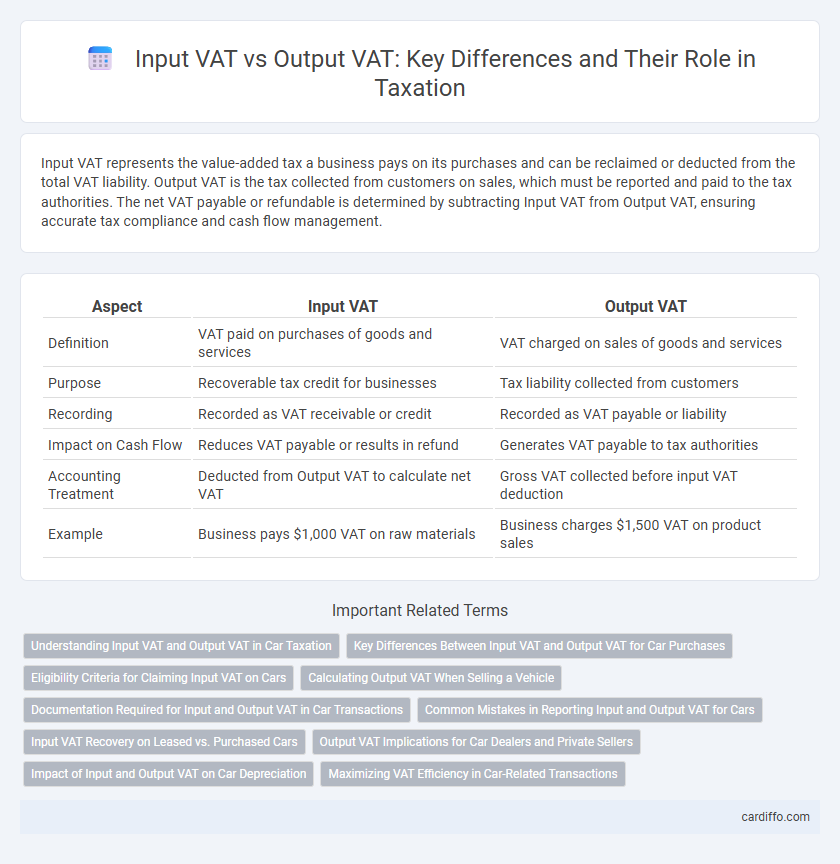

Input VAT represents the value-added tax a business pays on its purchases and can be reclaimed or deducted from the total VAT liability. Output VAT is the tax collected from customers on sales, which must be reported and paid to the tax authorities. The net VAT payable or refundable is determined by subtracting Input VAT from Output VAT, ensuring accurate tax compliance and cash flow management.

Table of Comparison

| Aspect | Input VAT | Output VAT |

|---|---|---|

| Definition | VAT paid on purchases of goods and services | VAT charged on sales of goods and services |

| Purpose | Recoverable tax credit for businesses | Tax liability collected from customers |

| Recording | Recorded as VAT receivable or credit | Recorded as VAT payable or liability |

| Impact on Cash Flow | Reduces VAT payable or results in refund | Generates VAT payable to tax authorities |

| Accounting Treatment | Deducted from Output VAT to calculate net VAT | Gross VAT collected before input VAT deduction |

| Example | Business pays $1,000 VAT on raw materials | Business charges $1,500 VAT on product sales |

Understanding Input VAT and Output VAT in Car Taxation

Input VAT in car taxation refers to the value-added tax paid on the purchase of vehicles or related services, which businesses can reclaim if the vehicle is used for taxable activities. Output VAT is charged on the sale or lease of vehicles to customers, representing the tax collected by the business on behalf of the government. Understanding Input VAT and Output VAT is crucial for accurate tax compliance, as it affects the net VAT payable or refundable in automotive transactions.

Key Differences Between Input VAT and Output VAT for Car Purchases

Input VAT on car purchases refers to the value-added tax a business pays when acquiring vehicles, which can often be reclaimed if the cars are used for taxable business activities. Output VAT is the tax a business must charge and remit to the tax authorities when selling goods or services, including vehicles sold to customers. The key difference lies in Input VAT being recoverable for business-related car acquisitions, whereas Output VAT represents tax collected on vehicle sales, affecting cash flow and tax reporting differently.

Eligibility Criteria for Claiming Input VAT on Cars

Eligibility criteria for claiming input VAT on cars require the vehicle to be used exclusively for business purposes, supported by proper documentation such as a logbook and invoices. VAT on cars that are partially used for personal purposes is generally non-deductible or requires apportionment based on actual business use. Businesses must also ensure compliance with local tax regulations and maintain records to substantiate the VAT claims during audits.

Calculating Output VAT When Selling a Vehicle

Calculating Output VAT when selling a vehicle requires identifying the taxable sale price and applying the standard VAT rate to determine the VAT liability. Input VAT on the purchase or expenses related to the vehicle can be deducted, provided the vehicle is used for taxable business activities. Accurate record-keeping of purchase invoices and sales receipts is crucial for correct VAT reporting and compliance with tax regulations.

Documentation Required for Input and Output VAT in Car Transactions

In car transactions, detailed invoices and purchase agreements are essential for documenting Input VAT, proving the VAT paid on vehicle acquisition. Output VAT requires accurately issued sales invoices reflecting the VAT charged during vehicle resale to ensure compliance and proper tax reporting. Supporting documents such as registration certificates and payment receipts further validate VAT claims and audits.

Common Mistakes in Reporting Input and Output VAT for Cars

Common mistakes in reporting input VAT for cars include incorrect classification of vehicle types, leading to disallowed VAT claims, and failure to maintain proper documentation for business use. Output VAT errors often arise from incorrect VAT rates applied on the sale or lease of cars, as well as neglecting to adjust VAT when vehicles are used partially for non-business purposes. Accurate record-keeping and understanding tax regulations are essential to avoid penalties and ensure correct VAT reporting on automobiles.

Input VAT Recovery on Leased vs. Purchased Cars

Input VAT recovery varies significantly between leased and purchased vehicles, with leased cars often allowing for more straightforward VAT reclaim due to consistent invoicing and usage documentation. Purchased cars require detailed allocation of business versus private use to accurately claim Input VAT, complicating full recovery. Tax regulations typically limit Input VAT recovery on purchased vehicles, while leased vehicles may offer more favorable conditions for claiming VAT based on lease payments and operational expenses.

Output VAT Implications for Car Dealers and Private Sellers

Output VAT for car dealers is a critical tax liability calculated on the sale price of vehicles, requiring accurate invoices to ensure compliance with tax authorities. Private sellers, typically exempt from charging Output VAT, must be aware that selling vehicles without VAT registration means they cannot reclaim Input VAT on purchases. Proper management of Output VAT affects cash flow and profitability, making it essential for car dealers to maintain detailed records and understand VAT rates applicable to different vehicle types.

Impact of Input and Output VAT on Car Depreciation

Input VAT on car purchases can be deducted to reduce the overall taxable income, directly lowering the cost of the vehicle for business use. Output VAT collected on car sales or disposals increases the tax liability, affecting the depreciation recovery process. Proper management of both Input and Output VAT ensures accurate calculation of net car depreciation expenses for tax reporting.

Maximizing VAT Efficiency in Car-Related Transactions

Maximizing VAT efficiency in car-related transactions requires a strategic approach to differentiating Input VAT and Output VAT. Businesses should meticulously track Input VAT on vehicle purchases, maintenance, and fuel expenses to ensure full reclaim where applicable, while accurately calculating Output VAT on sales, leases, or rentals of cars to avoid compliance issues. Optimizing VAT recovery hinges on understanding the specific tax treatment of commercial versus private use and leveraging exemptions or partial exemptions pursuant to jurisdictional VAT laws.

Input VAT vs Output VAT Infographic

cardiffo.com

cardiffo.com