Road Tax (Vehicle Excise Duty) is an annual fee based on a vehicle's emissions and weight, aimed at funding road maintenance and environmental initiatives. Congestion Charge is a daily charge imposed on vehicles entering designated central urban areas during peak hours to reduce traffic congestion and pollution. Choosing between the two depends on your driving patterns, vehicle type, and the areas you frequent most often.

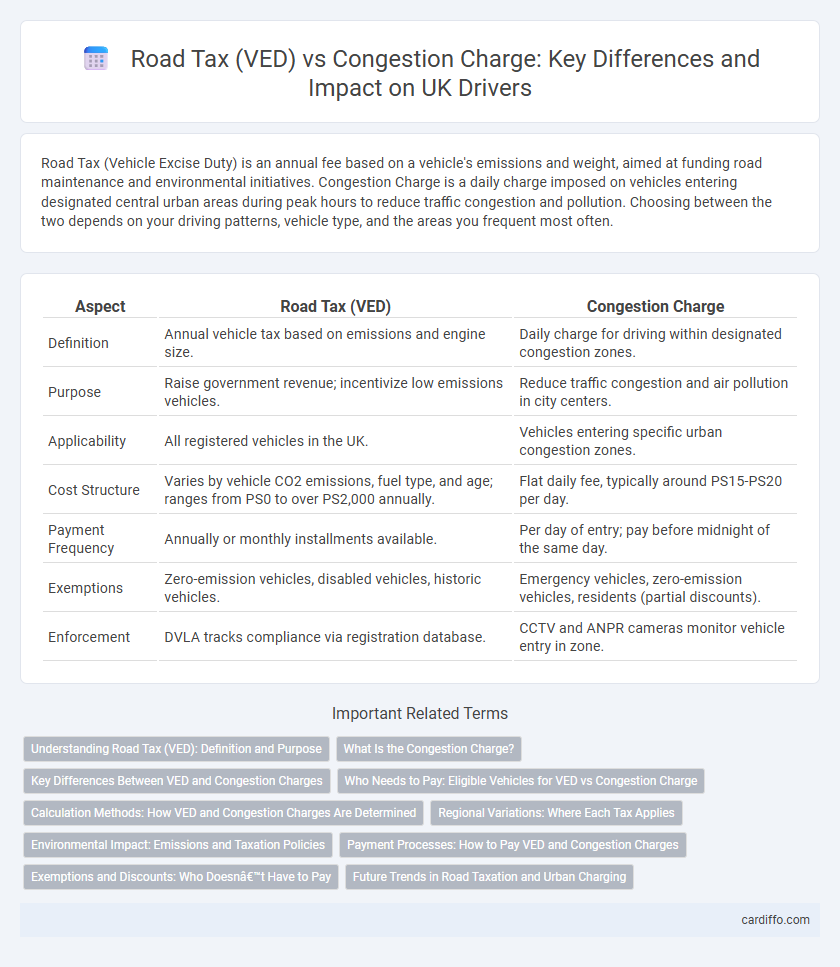

Table of Comparison

| Aspect | Road Tax (VED) | Congestion Charge |

|---|---|---|

| Definition | Annual vehicle tax based on emissions and engine size. | Daily charge for driving within designated congestion zones. |

| Purpose | Raise government revenue; incentivize low emissions vehicles. | Reduce traffic congestion and air pollution in city centers. |

| Applicability | All registered vehicles in the UK. | Vehicles entering specific urban congestion zones. |

| Cost Structure | Varies by vehicle CO2 emissions, fuel type, and age; ranges from PS0 to over PS2,000 annually. | Flat daily fee, typically around PS15-PS20 per day. |

| Payment Frequency | Annually or monthly installments available. | Per day of entry; pay before midnight of the same day. |

| Exemptions | Zero-emission vehicles, disabled vehicles, historic vehicles. | Emergency vehicles, zero-emission vehicles, residents (partial discounts). |

| Enforcement | DVLA tracks compliance via registration database. | CCTV and ANPR cameras monitor vehicle entry in zone. |

Understanding Road Tax (VED): Definition and Purpose

Road Tax, also known as Vehicle Excise Duty (VED), is a mandatory annual tax levied on vehicles registered for use on public roads in the UK, aimed at contributing to road maintenance and environmental management. VED rates vary based on factors such as vehicle type, engine size, and CO2 emissions, promoting the use of cleaner, low-emission vehicles. Unlike the Congestion Charge, which is a fee for driving in designated urban areas during peak times, Road Tax applies nationwide and serves as an ongoing fiscal measure linked to vehicle ownership.

What Is the Congestion Charge?

The Congestion Charge is a daily fee imposed on vehicles entering specified areas in London to reduce traffic congestion and improve air quality. Unlike Road Tax (Vehicle Excise Duty or VED), which is an annual tax based on vehicle emissions and type, the Congestion Charge targets urban traffic flow during peak hours. This charge helps manage demand, encouraging the use of public transport and low-emission vehicles within designated zones.

Key Differences Between VED and Congestion Charges

Road Tax (Vehicle Excise Duty, VED) is an annual tax based on vehicle emissions and type, required for legal vehicle use on public roads across the UK. Congestion Charge is a daily fee imposed on drivers entering designated urban zones during peak hours to reduce traffic and pollution, most notably in central London. VED revenues support national road maintenance and environmental policies, while Congestion Charges specifically target urban traffic management and air quality improvements.

Who Needs to Pay: Eligible Vehicles for VED vs Congestion Charge

Owners of vehicles registered in the UK must pay Vehicle Excise Duty (VED) based on emissions and vehicle type, including cars, motorcycles, and heavy goods vehicles. The Congestion Charge applies specifically to vehicles entering central London during specified hours, targeting private cars, taxis, and vans but exempting certain low-emission and electric vehicles. Understanding eligibility for VED involves vehicle registration and emissions data, while Congestion Charge liability depends on entry into the congestion zone and time of day.

Calculation Methods: How VED and Congestion Charges Are Determined

Road Tax (VED) calculations are primarily based on vehicle emissions, engine size, and fuel type, with higher polluting vehicles incurring greater charges to promote environmental sustainability. Congestion Charges are determined by factors such as entry time, vehicle type, and specific zones within a city, incentivizing off-peak travel and reducing urban traffic congestion. Both systems use variable rates to influence driver behavior but target different objectives: VED focuses on long-term environmental impact, while Congestion Charges aim at immediate traffic management.

Regional Variations: Where Each Tax Applies

Road Tax (Vehicle Excise Duty) applies uniformly across the United Kingdom with variations in rates based on vehicle type, emissions, and weight, while the Congestion Charge is specific to central London and a few other cities implementing traffic management schemes. Regional variations in Road Tax rates reflect environmental policies and infrastructure needs, whereas the Congestion Charge targets urban areas with high traffic congestion to reduce air pollution and improve traffic flow. Understanding these geographical differences is crucial for vehicle owners to comply with applicable taxes and optimize costs.

Environmental Impact: Emissions and Taxation Policies

Road Tax (VED) incentivizes lower vehicle emissions by imposing higher fees on cars with greater carbon output, effectively promoting eco-friendly transportation choices. The Congestion Charge specifically targets urban pollution by discouraging vehicle entry in high-traffic zones, reducing emissions and traffic congestion simultaneously. Both taxation policies align to lower environmental impact, but Road Tax drives nationwide emissions reductions, while Congestion Charges focus on improving air quality in dense metropolitan areas.

Payment Processes: How to Pay VED and Congestion Charges

Vehicle Excise Duty (VED) payments can be made online through the UK government's official website, by phone, or at designated post offices, requiring the vehicle's registration number and new tax class details. Congestion Charge fees must be paid daily via an online account, mobile app, or automated phone service before midnight on the charging day to avoid penalties. Both systems offer automatic payment options through direct debit or auto-pay for seamless transaction management.

Exemptions and Discounts: Who Doesn’t Have to Pay

Electric vehicles (EVs) and certain low-emission vehicles are exempt from the Road Tax (Vehicle Excise Duty - VED), reducing the financial burden for environmentally friendly drivers. Congestion Charge exemptions apply primarily to residents within the charge zone, disabled badge holders, and specific vehicle categories such as taxis and motorcycles, offering relief for frequent urban travelers. Both schemes provide discounts or exemptions aimed at promoting sustainable transportation and supporting vulnerable groups, making compliance more affordable for eligible users.

Future Trends in Road Taxation and Urban Charging

Road Tax (Vehicle Excise Duty, VED) is increasingly being restructured to encourage low-emission vehicles through differentiated rates based on CO2 emissions and electric vehicle exemptions, reflecting a shift toward environmental sustainability. Urban congestion charges are evolving with dynamic pricing models powered by real-time traffic data and integrated smart city technologies to manage traffic flow and reduce pollution more effectively. Future trends indicate a convergence of VED policies and congestion charges into comprehensive mobility pricing frameworks that leverage digital infrastructure for adaptive, location-based taxation.

Road Tax (VED) vs Congestion Charge Infographic

cardiffo.com

cardiffo.com