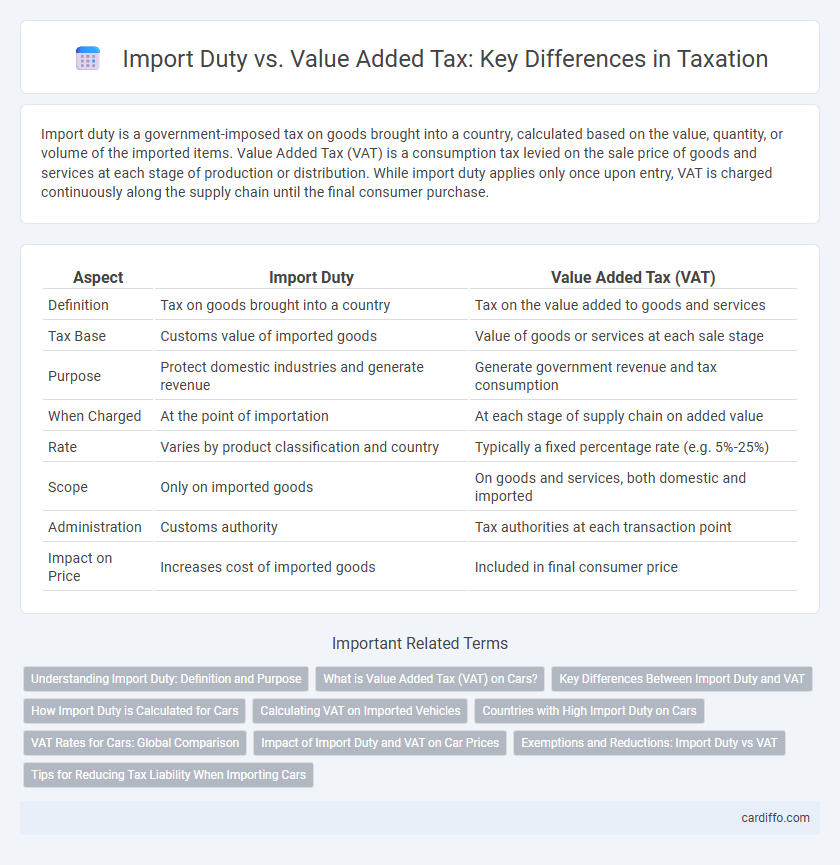

Import duty is a government-imposed tax on goods brought into a country, calculated based on the value, quantity, or volume of the imported items. Value Added Tax (VAT) is a consumption tax levied on the sale price of goods and services at each stage of production or distribution. While import duty applies only once upon entry, VAT is charged continuously along the supply chain until the final consumer purchase.

Table of Comparison

| Aspect | Import Duty | Value Added Tax (VAT) |

|---|---|---|

| Definition | Tax on goods brought into a country | Tax on the value added to goods and services |

| Tax Base | Customs value of imported goods | Value of goods or services at each sale stage |

| Purpose | Protect domestic industries and generate revenue | Generate government revenue and tax consumption |

| When Charged | At the point of importation | At each stage of supply chain on added value |

| Rate | Varies by product classification and country | Typically a fixed percentage rate (e.g. 5%-25%) |

| Scope | Only on imported goods | On goods and services, both domestic and imported |

| Administration | Customs authority | Tax authorities at each transaction point |

| Impact on Price | Increases cost of imported goods | Included in final consumer price |

Understanding Import Duty: Definition and Purpose

Import duty is a tariff imposed by customs authorities on goods brought into a country, intended to protect domestic industries and generate government revenue. It is calculated based on the declared value, classification, and origin of imported items, varying significantly between countries and product categories. Understanding import duty is essential for accurate cost estimation in international trade, as it directly impacts the landed cost of imported merchandise.

What is Value Added Tax (VAT) on Cars?

Value Added Tax (VAT) on cars is a consumption tax levied at each stage of the vehicle's supply chain, calculated on the car's sale price including import duty and other costs. It is generally charged at a standard rate, such as 20% in many countries, and applies whether the car is new or used, imported or domestically produced. VAT ensures revenue for governments by taxing the added value created in the sale or importation of vehicles, distinct from import duty which specifically targets the cost of bringing the car across borders.

Key Differences Between Import Duty and VAT

Import duty is a customs tax imposed on goods when they are brought into a country, calculated based on the product's classification and declared value. Value Added Tax (VAT) is a consumption tax levied on the sale of goods and services at each stage of production or distribution, including imports. Import duty affects the initial cost of imported goods, while VAT applies to both domestic and imported products as a percentage of their final sale price.

How Import Duty is Calculated for Cars

Import duty for cars is calculated based on the customs value, which includes the cost of the vehicle, shipping, and insurance fees. The applicable duty rate varies depending on the country's tariff schedule, vehicle type, and engine capacity. This duty is typically a percentage of the declared value and must be paid before the vehicle can be cleared through customs.

Calculating VAT on Imported Vehicles

Calculating VAT on imported vehicles involves applying the standard VAT rate to the vehicle's customs value, which includes the cost, insurance, freight (CIF), and applicable import duty. The import duty is added to the CIF value to form the tax base for VAT calculation, leading to a compounded tax effect on the total landed cost. Accurate declaration of import duty and vehicle cost ensures compliance and correct VAT assessment by customs authorities.

Countries with High Import Duty on Cars

Countries with high import duty on cars, such as India, Brazil, and Malaysia, impose tariffs exceeding 100% to protect domestic automobile industries. These high import duties significantly increase the final price of imported vehicles, making them less competitive compared to locally manufactured cars. In contrast, the value added tax (VAT) on cars in these countries typically ranges between 10% and 20%, serving as an additional but relatively lower tax burden compared to the import duty.

VAT Rates for Cars: Global Comparison

Value Added Tax (VAT) rates on cars vary significantly across countries, reflecting diverse fiscal policies and economic strategies. For example, European Union nations typically impose VAT rates ranging from 17% to 27%, with Sweden and Denmark near the higher end, while no VAT applies in countries like the United States, where sales tax is used instead. Understanding these differences is critical for importers and consumers when calculating total costs and compliance for vehicle purchases internationally.

Impact of Import Duty and VAT on Car Prices

Import Duty significantly raises the base cost of imported cars by applying a percentage charge on the vehicle's declared customs value, directly increasing the initial purchase price. Value Added Tax (VAT), calculated as a percentage of the total transaction value including import duty, further escalates the final retail price paid by consumers. The combined effect of import duty and VAT can increase car prices by 30% to 70%, making vehicle ownership substantially more expensive in countries with high tax rates on imports.

Exemptions and Reductions: Import Duty vs VAT

Import duty exemptions often apply to raw materials, essential goods, and specific industries to promote economic growth and reduce production costs, whereas VAT exemptions typically target basic food items, healthcare products, and educational materials to alleviate consumer burden. Reductions in import duty can be granted through trade agreements or preferential tariff programs, while VAT rate reductions frequently apply to goods and services deemed essential or socially beneficial. Understanding the distinct criteria and scope of exemptions and reductions for import duty and VAT is crucial for optimizing tax liabilities in international trade.

Tips for Reducing Tax Liability When Importing Cars

Import duty on vehicles varies by country but generally constitutes a significant upfront cost based on the car's declared value, while Value Added Tax (VAT) is calculated as a percentage of the sum of the car's cost, insurance, and freight charges. To reduce tax liability when importing cars, consider accurately classifying the vehicle under Harmonized System codes to ensure correct duty rates, and explore eligibility for preferential trade agreements that may lower rates. Utilizing customs brokers familiar with local regulations and ensuring thorough documentation can prevent costly delays and penalties, optimizing overall import expenses.

Import Duty vs Value Added Tax Infographic

cardiffo.com

cardiffo.com