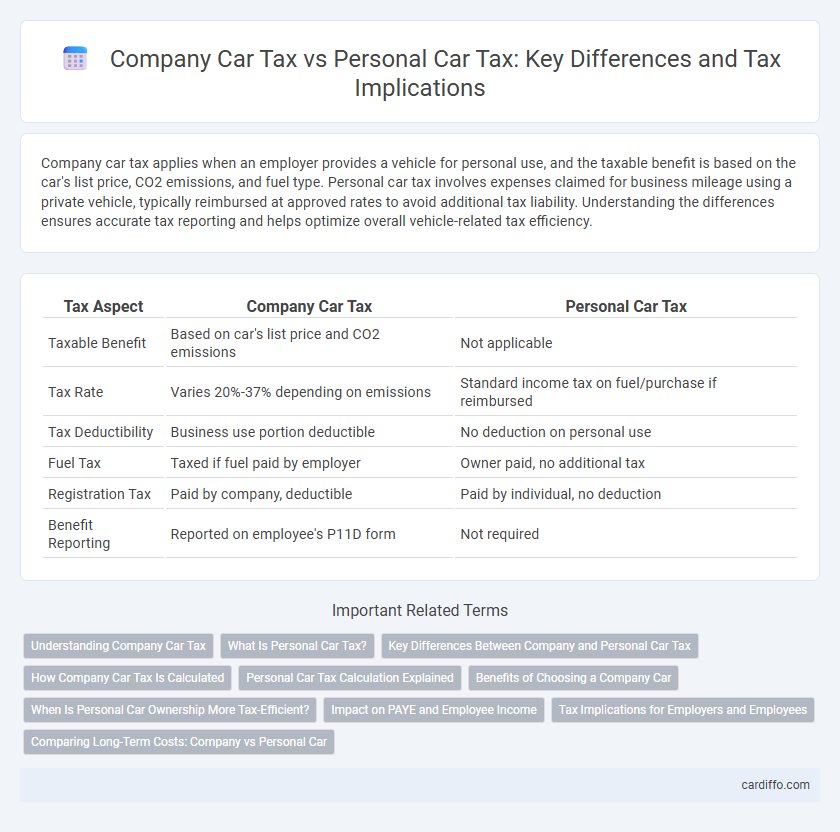

Company car tax applies when an employer provides a vehicle for personal use, and the taxable benefit is based on the car's list price, CO2 emissions, and fuel type. Personal car tax involves expenses claimed for business mileage using a private vehicle, typically reimbursed at approved rates to avoid additional tax liability. Understanding the differences ensures accurate tax reporting and helps optimize overall vehicle-related tax efficiency.

Table of Comparison

| Tax Aspect | Company Car Tax | Personal Car Tax |

|---|---|---|

| Taxable Benefit | Based on car's list price and CO2 emissions | Not applicable |

| Tax Rate | Varies 20%-37% depending on emissions | Standard income tax on fuel/purchase if reimbursed |

| Tax Deductibility | Business use portion deductible | No deduction on personal use |

| Fuel Tax | Taxed if fuel paid by employer | Owner paid, no additional tax |

| Registration Tax | Paid by company, deductible | Paid by individual, no deduction |

| Benefit Reporting | Reported on employee's P11D form | Not required |

Understanding Company Car Tax

Company car tax is calculated based on the vehicle's list price, CO2 emissions, and the employee's income tax band, making it distinct from personal car tax obligations. This tax applies when an employer provides a car for personal use, impacting the employee's taxable benefits and overall tax liability. Understanding the specific rates and allowances associated with company cars helps optimize tax planning and compliance.

What Is Personal Car Tax?

Personal car tax refers to the vehicle tax liabilities incurred when an individual owns or uses a car for private purposes, distinct from company car tax which applies to cars provided by employers. It includes road tax (Vehicle Excise Duty) based on car emissions, engine size, and fuel type, typically paid directly by the car owner. Understanding personal car tax is essential for accurate financial planning and compliance with government regulations.

Key Differences Between Company and Personal Car Tax

Company car tax is calculated based on the vehicle's list price, CO2 emissions, and the employee's income tax bracket, often resulting in higher taxable benefits compared to personal car tax. Personal car tax primarily involves deductions for business-related mileage and expenses, with no taxable benefit applied on the vehicle itself. The key difference lies in company car tax treating the vehicle as a taxable benefit, whereas personal car tax focuses on allowable expense claims.

How Company Car Tax Is Calculated

Company car tax is calculated based on the car's list price, its CO2 emissions, and the employee's income tax rate. The taxable benefit is determined by applying a percentage rate, which increases with higher emissions, to the vehicle's list price including VAT and delivery charges. Personal car tax, in contrast, typically involves deductions for business mileage but does not rely on vehicle value or emissions for taxation.

Personal Car Tax Calculation Explained

Personal car tax calculation depends on factors such as the vehicle's CO2 emissions, fuel type, and the employee's income tax bracket. Unlike company car tax, which is based on the car's list price and Benefit-in-Kind (BIK) rates, personal car tax involves deducting allowable mileage expenses or claiming capital allowances if the car is used for business purposes. Accurate record-keeping of business mileage and understanding HMRC-approved rates ensures correct personal car tax deductions and compliance.

Benefits of Choosing a Company Car

Opting for a company car offers significant tax advantages, including reduced Benefit-in-Kind (BIK) rates compared to personal car ownership, especially when selecting low-emission or electric vehicles. Company car tax allows businesses to claim capital allowances and potentially lower their taxable profits through deductible car expenses, which is not available for personal car tax. Employees benefit from predictable monthly costs and potential savings on fuel and maintenance when a company car is provided, enhancing overall financial efficiency.

When Is Personal Car Ownership More Tax-Efficient?

Personal car ownership is more tax-efficient when employees have limited business mileage, as the tax liability on company cars increases with higher Advisory Fuel Rates and Benefit-in-Kind (BIK) percentages. Personal vehicles allow for mileage reimbursement based on HMRC-approved rates, which often results in lower taxable income compared to the fixed BIK tax on company cars. Small businesses and self-employed individuals benefit from claiming actual business expenses and capital allowances on personal cars, reducing overall tax burden more effectively than company car schemes.

Impact on PAYE and Employee Income

Company car tax increases the taxable benefit on an employee's PAYE income, resulting in higher income tax and National Insurance contributions deducted at source. Personal car tax, such as mileage allowance payments, is generally reimbursed without impacting PAYE unless it exceeds HMRC's approved rates, potentially triggering additional taxable income. Employers must accurately report company car benefits to HMRC to avoid underpayment of employee income tax.

Tax Implications for Employers and Employees

Company car tax impacts employers through Class 1A National Insurance contributions on the car's taxable benefit value, while employees face income tax based on the car's list price and CO2 emissions. Personal car tax for employees involves claiming mileage allowances, which employers can reimburse tax-free up to approved rates, minimizing tax liabilities on both sides. Understanding these distinctions is essential for optimizing tax efficiency in company car schemes versus personal vehicle use.

Comparing Long-Term Costs: Company vs Personal Car

Company car tax often includes benefits-in-kind (BIK) rates based on CO2 emissions and list price, making long-term costs potentially higher for high-emission vehicles compared to personal car ownership. Personal car tax expenses include fuel, maintenance, insurance, and annual vehicle tax, which can be more predictable and sometimes lower depending on usage and vehicle type. In the long term, company cars may offer tax advantages such as VAT reclaim and reduced upfront costs, but personal car ownership can be more cost-effective for low-mileage drivers due to lower tax burdens and fewer BIK liabilities.

Company Car Tax vs Personal Car Tax Infographic

cardiffo.com

cardiffo.com