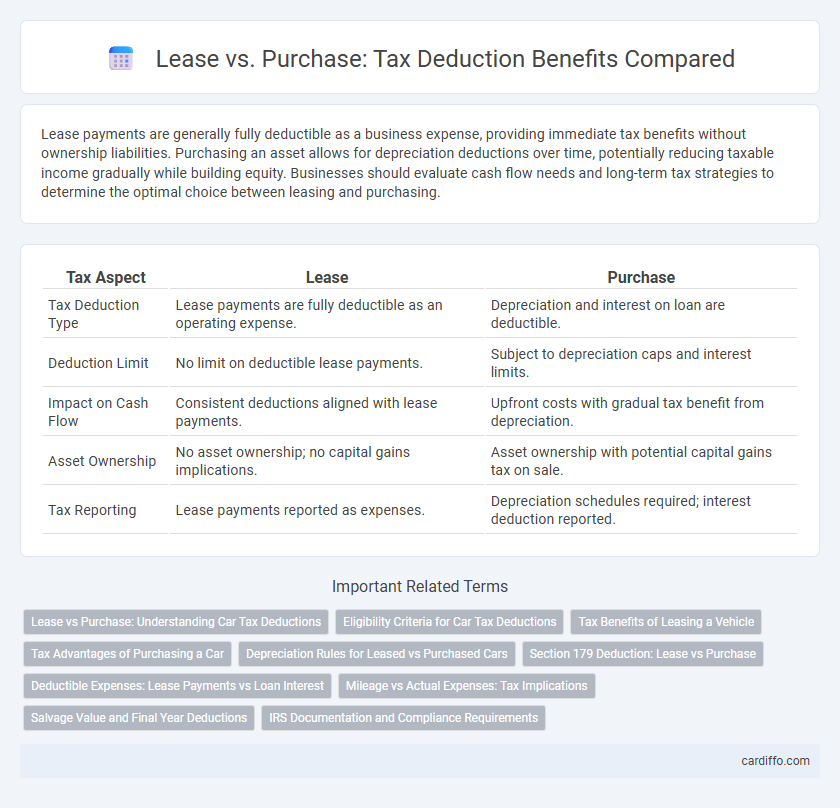

Lease payments are generally fully deductible as a business expense, providing immediate tax benefits without ownership liabilities. Purchasing an asset allows for depreciation deductions over time, potentially reducing taxable income gradually while building equity. Businesses should evaluate cash flow needs and long-term tax strategies to determine the optimal choice between leasing and purchasing.

Table of Comparison

| Tax Aspect | Lease | Purchase |

|---|---|---|

| Tax Deduction Type | Lease payments are fully deductible as an operating expense. | Depreciation and interest on loan are deductible. |

| Deduction Limit | No limit on deductible lease payments. | Subject to depreciation caps and interest limits. |

| Impact on Cash Flow | Consistent deductions aligned with lease payments. | Upfront costs with gradual tax benefit from depreciation. |

| Asset Ownership | No asset ownership; no capital gains implications. | Asset ownership with potential capital gains tax on sale. |

| Tax Reporting | Lease payments reported as expenses. | Depreciation schedules required; interest deduction reported. |

Lease vs Purchase: Understanding Car Tax Deductions

When deciding between leasing or purchasing a car, understanding tax deductions hinges on the nature of expenses deductible for each option. Lease payments are generally fully deductible as a business expense if the vehicle is used for business purposes, whereas purchasing a car allows for depreciation deductions over several years, including Section 179 expensing limits. Evaluating mileage, business use percentage, and IRS guidelines on vehicle classification ensures maximizing tax benefits within the Lease vs Purchase framework.

Eligibility Criteria for Car Tax Deductions

Eligibility criteria for car tax deductions vary significantly between lease and purchase options, impacting how business owners maximize their tax benefits. For leased vehicles, taxpayers can generally deduct the monthly lease payments, provided the car is used for business purposes and the lease term complies with IRS limits, including the vehicle's fair market value cap. In contrast, purchasing a vehicle allows for depreciation deductions under Section 179 or bonus depreciation, subject to specific limits on vehicle weight and business-use percentage, requiring meticulous documentation to qualify.

Tax Benefits of Leasing a Vehicle

Leasing a vehicle offers significant tax benefits by allowing businesses to deduct monthly lease payments as a business expense, reducing taxable income more consistently than depreciation on purchased vehicles. Lease payments are fully deductible in most cases, including maintenance and insurance costs rolled into the lease, providing predictable cash flow advantages. This tax treatment can be particularly advantageous for businesses seeking to manage expenses while upgrading vehicles regularly without the capital outlay required for purchase.

Tax Advantages of Purchasing a Car

Purchasing a car offers tax advantages such as eligibility for depreciation deductions under Section 179, allowing businesses to deduct the full purchase price of the vehicle in the year it is placed in service, subject to limits. Buyers can also claim bonus depreciation for qualified vehicles, reducing taxable income significantly. Unlike leases, ownership provides potential long-term tax benefits tied to asset depreciation and interest expense deductions.

Depreciation Rules for Leased vs Purchased Cars

Depreciation rules for leased cars differ significantly from purchased vehicles, as lessees typically claim a lease expense deduction rather than depreciation, while owners depreciate the vehicle's cost over its useful life using the Modified Accelerated Cost Recovery System (MACRS). For purchased cars, the IRS imposes luxury auto limits on depreciation deductions, capping the annual write-offs, which do not apply to lease payments directly. Understanding these distinctions is crucial for maximizing tax benefits, as leased car deductions are based on lease payments minus any included interest, whereas purchased car owners benefit from capitalizing and depreciating the asset.

Section 179 Deduction: Lease vs Purchase

Section 179 deduction allows businesses to immediately expense the cost of purchased equipment or property, reducing taxable income in the year of acquisition. Leasing equipment typically disqualifies the lessee from claiming a Section 179 deduction, as ownership remains with the lessor, barring immediate expensing benefits. For businesses prioritizing upfront tax savings, purchasing assets under Section 179 offers significant advantages compared to leasing options.

Deductible Expenses: Lease Payments vs Loan Interest

Lease payments are fully deductible as business expenses, reducing taxable income directly in the year they are paid. In contrast, purchasing an asset allows for the deduction of loan interest but not the principal, with depreciation applicable to the asset's cost over time. Evaluating which option offers greater tax benefits depends on cash flow, asset type, and the applicable tax codes.

Mileage vs Actual Expenses: Tax Implications

When choosing between lease and purchase tax deductions, the method of expense calculation--mileage versus actual expenses--significantly impacts tax outcomes. The IRS allows a standard mileage rate deduction for leased vehicles, simplifying record-keeping but potentially limiting deductible amounts, whereas actual expense deductions for purchased vehicles enable taxpayers to deduct depreciation, maintenance, and other specific costs, often resulting in higher overall deductions. Understanding the differences in allowable deductions and depreciation schedules between leased and owned vehicles is essential for optimizing tax benefits under IRS guidelines.

Salvage Value and Final Year Deductions

Lease payments are fully deductible as business expenses, providing consistent tax benefits without concern for salvage value, whereas purchased assets require depreciation deductions over their useful life, with salvage value reducing the depreciable base. In the final year of ownership, the asset's salvage value limits the amount depreciated, potentially lowering the tax deduction compared to earlier years. Leasing avoids complexities associated with salvage value and final-year deductions, offering straightforward expense recognition.

IRS Documentation and Compliance Requirements

IRS documentation and compliance requirements for lease versus purchase tax deductions differ significantly, impacting how businesses report expenses and claim deductions. Lease payments are typically fully deductible as operating expenses under IRS regulations, requiring clear lease agreements and proof of payment to substantiate claims. In contrast, purchasing assets requires adherence to depreciation schedules outlined in IRS Publication 946, necessitating detailed records of acquisition costs, asset classification, and depreciation methods to ensure compliance and maximize tax benefits.

Lease vs Purchase Tax Deduction Infographic

cardiffo.com

cardiffo.com