Import duty is a tax imposed on goods brought into a country from abroad, primarily aimed at protecting domestic industries and generating revenue. Excise duty is a domestic tax levied on the manufacture or sale of specific goods, such as alcohol, tobacco, and fuel, to regulate consumption and raise funds for government programs. Understanding the distinction between import duty and excise duty is crucial for businesses to ensure compliance and optimize cost management in international trade and local production.

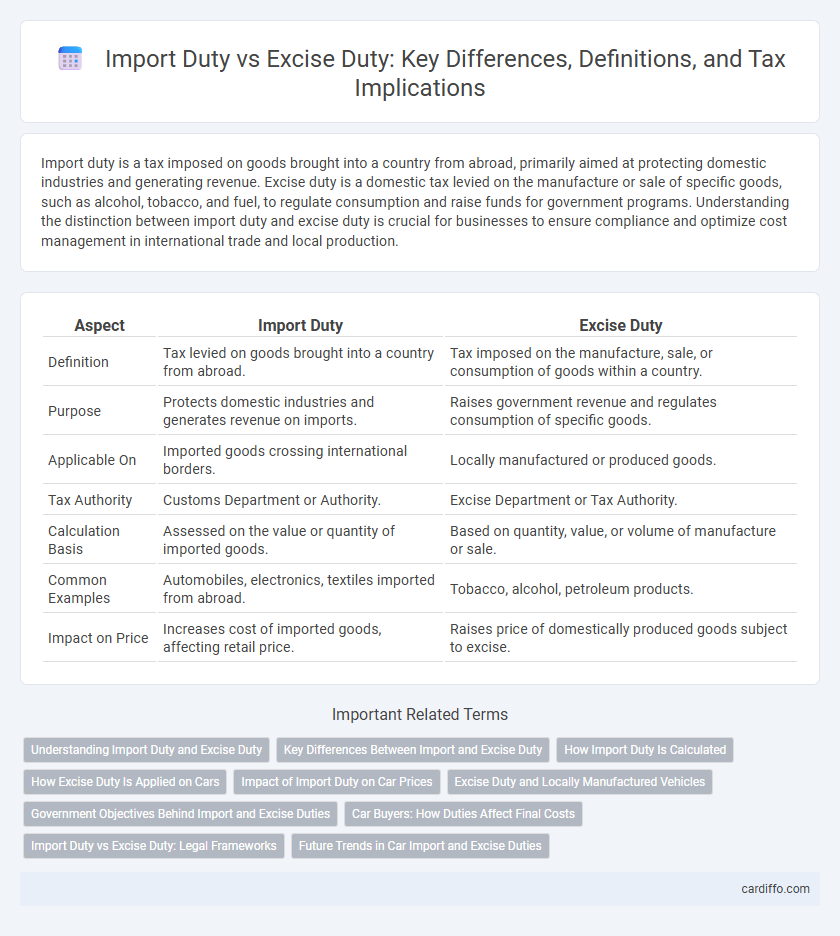

Table of Comparison

| Aspect | Import Duty | Excise Duty |

|---|---|---|

| Definition | Tax levied on goods brought into a country from abroad. | Tax imposed on the manufacture, sale, or consumption of goods within a country. |

| Purpose | Protects domestic industries and generates revenue on imports. | Raises government revenue and regulates consumption of specific goods. |

| Applicable On | Imported goods crossing international borders. | Locally manufactured or produced goods. |

| Tax Authority | Customs Department or Authority. | Excise Department or Tax Authority. |

| Calculation Basis | Assessed on the value or quantity of imported goods. | Based on quantity, value, or volume of manufacture or sale. |

| Common Examples | Automobiles, electronics, textiles imported from abroad. | Tobacco, alcohol, petroleum products. |

| Impact on Price | Increases cost of imported goods, affecting retail price. | Raises price of domestically produced goods subject to excise. |

Understanding Import Duty and Excise Duty

Import duty is a government-imposed tariff on goods brought into a country, calculated based on the product's customs value, classification, and country of origin. Excise duty is a domestic tax levied on specific goods such as alcohol, tobacco, and petroleum products, aimed at regulating consumption and generating revenue. Both duties serve distinct regulatory and fiscal purposes, with import duty affecting cross-border trade while excise duty targets goods produced or consumed within the country.

Key Differences Between Import and Excise Duty

Import duty is a tax imposed on goods brought into a country from abroad, targeting the valuation and classification of imported products. Excise duty is levied on specific domestic goods such as alcohol, tobacco, and fuel, focusing on their production, manufacture, or consumption within the country. The key difference lies in import duty regulating international trade, while excise duty controls manufacturing and sale of certain goods domestically.

How Import Duty Is Calculated

Import duty is calculated based on the customs value of the goods, which typically includes the cost of the product, shipping, and insurance. The applicable duty rate, expressed as a percentage, varies depending on the type of product and the country of origin. Import duty is assessed on the total landed cost, incorporating any additional charges such as packaging and handling fees, ensuring an accurate taxable base for customs authorities.

How Excise Duty Is Applied on Cars

Excise duty on cars is applied based on the vehicle's engine capacity, fuel type, and price, often leading to higher taxes on luxury and high-performance models. This tax is imposed domestically to regulate consumption and generate revenue, differing from import duty which targets vehicles brought into a country. Excise duty rates vary significantly across regions, with hybrid and electric vehicles sometimes benefiting from reduced or exempted charges to encourage environmentally friendly choices.

Impact of Import Duty on Car Prices

Import duty significantly increases the final retail price of imported cars by adding a percentage-based tax on the vehicle's customs value, often ranging from 10% to 100% depending on the country and car type. This levy directly affects affordability, limiting consumer choice and demand for foreign-made cars in the domestic market. Unlike excise duty, which targets production or consumption of specific goods internally, import duty primarily serves as a trade barrier, influencing market dynamics and government revenue through altered car pricing structures.

Excise Duty and Locally Manufactured Vehicles

Excise duty is a tax imposed on the manufacture of goods within a country, including locally manufactured vehicles, and is calculated based on the vehicle's value, engine capacity, and fuel type. Unlike import duty, which applies to vehicles brought into the country, excise duty directly influences pricing and production decisions of domestic automobile manufacturers. Understanding excise duty rates and exemptions is crucial for automakers and consumers to navigate costs associated with locally produced vehicles.

Government Objectives Behind Import and Excise Duties

Import duties aim to protect domestic industries by restricting foreign competition and generating government revenue from international trade, ensuring a balanced trade environment. Excise duties serve to regulate consumption of specific goods like alcohol, tobacco, and fuel, reducing public health costs and promoting social welfare. Both duties support fiscal policies by funding public services and encouraging economic stability through targeted taxation strategies.

Car Buyers: How Duties Affect Final Costs

Import duty significantly increases the upfront cost of purchasing a car by applying a percentage tax on the vehicle's declared import value, often ranging from 10% to 40% depending on the country and car type. Excise duty, on the other hand, is levied based on engine capacity or vehicle type, adding a variable cost that can substantially raise the final price for buyers seeking luxury or high-performance cars. Understanding the combined impact of import and excise duties is crucial for car buyers to accurately estimate the total expenditure and avoid unexpected financial burdens.

Import Duty vs Excise Duty: Legal Frameworks

Import duty is governed by customs laws and international trade agreements, primarily aimed at regulating goods entering a country and generating revenue. Excise duty falls under domestic tax laws and targets the manufacture, sale, or consumption of specific goods, often to discourage harmful products or raise public funds. Both duties operate within distinct legal frameworks that define their scope, rates, and enforcement mechanisms to support national economic and social policies.

Future Trends in Car Import and Excise Duties

Future trends in car import and excise duties indicate increasing reliance on environmental impact assessments, with governments imposing higher excise duties on vehicles with larger carbon footprints. Trade policies are expected to adapt import duty structures to favor electric and hybrid vehicles, supporting green technology adoption and reducing emissions. Digitalization of customs procedures and real-time data analytics will enhance duty compliance and enable dynamic adjustment of tariffs based on evolving market and environmental conditions.

Import Duty vs Excise Duty Infographic

cardiffo.com

cardiffo.com