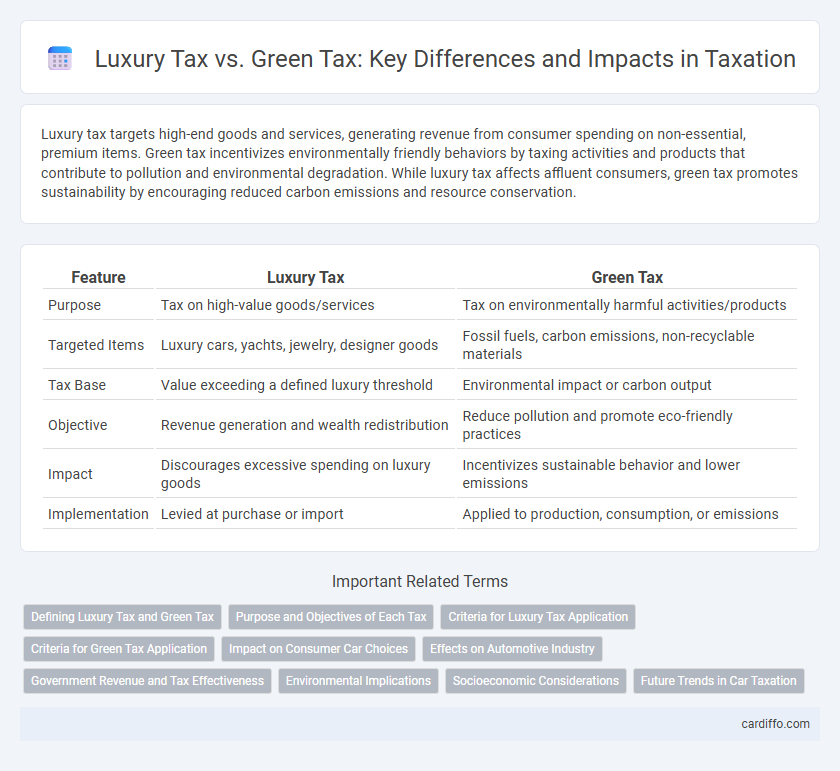

Luxury tax targets high-end goods and services, generating revenue from consumer spending on non-essential, premium items. Green tax incentivizes environmentally friendly behaviors by taxing activities and products that contribute to pollution and environmental degradation. While luxury tax affects affluent consumers, green tax promotes sustainability by encouraging reduced carbon emissions and resource conservation.

Table of Comparison

| Feature | Luxury Tax | Green Tax |

|---|---|---|

| Purpose | Tax on high-value goods/services | Tax on environmentally harmful activities/products |

| Targeted Items | Luxury cars, yachts, jewelry, designer goods | Fossil fuels, carbon emissions, non-recyclable materials |

| Tax Base | Value exceeding a defined luxury threshold | Environmental impact or carbon output |

| Objective | Revenue generation and wealth redistribution | Reduce pollution and promote eco-friendly practices |

| Impact | Discourages excessive spending on luxury goods | Incentivizes sustainable behavior and lower emissions |

| Implementation | Levied at purchase or import | Applied to production, consumption, or emissions |

Defining Luxury Tax and Green Tax

Luxury tax is a government-imposed levy on high-priced goods and services, targeting non-essential items such as luxury cars, jewelry, and designer clothing to generate revenue and curb excessive consumption. Green tax, also known as an environmental tax, is designed to incentivize sustainable practices by taxing activities or products that harm the environment, including carbon emissions, plastic usage, and fossil fuel consumption. Both taxes serve distinct policy goals: luxury tax addresses economic inequality and consumer behavior, while green tax focuses on environmental protection and reducing ecological footprints.

Purpose and Objectives of Each Tax

Luxury tax targets high-value goods and services to curb excessive consumption and generate revenue from affluent consumers, aiming to promote economic fairness and reduce inequality. Green tax is designed to internalize environmental costs by taxing activities or products that contribute to pollution, encouraging businesses and individuals to adopt sustainable practices. Both taxes serve regulatory purposes but differ in focus: luxury tax addresses wealth redistribution, while green tax prioritizes environmental protection and sustainability.

Criteria for Luxury Tax Application

Luxury tax applies predominantly to high-value goods and services exceeding specific price thresholds, often targeting items like luxury vehicles, designer jewelry, and expensive real estate. Green tax, conversely, is levied based on environmental impact factors such as carbon emissions or resource consumption, encouraging sustainable consumption. Criteria for luxury tax application center on the exclusivity, non-essential nature, and premium pricing of products rather than their environmental footprint.

Criteria for Green Tax Application

Green tax application primarily targets industries and products with significant environmental impact, such as fossil fuel consumption, carbon emissions, and waste generation. The criteria include measurable pollution levels, carbon footprint thresholds, and adherence to environmental regulations promoting sustainability. Unlike luxury tax, which focuses on high-value goods, green tax incentivizes eco-friendly practices by imposing higher costs on environmentally harmful activities.

Impact on Consumer Car Choices

Luxury tax increases the cost of high-end vehicles, often deterring consumers from purchasing premium models and encouraging a shift towards more affordable cars. Green tax targets vehicles with higher emissions, incentivizing buyers to opt for environmentally friendly options such as electric or hybrid cars. Both taxes influence consumer behavior by altering the total cost of ownership and promoting choices aligned with fiscal and environmental policies.

Effects on Automotive Industry

Luxury tax increases the cost of high-end vehicles, reducing demand and prompting manufacturers to focus on premium market segments. Green tax targets emissions, incentivizing automakers to develop fuel-efficient and electric vehicles to meet environmental regulations. Both taxes reshape automotive industry strategies by driving innovation and altering consumer purchasing patterns.

Government Revenue and Tax Effectiveness

Luxury tax generates significant government revenue by targeting non-essential high-value goods, effectively redistributing wealth while helping to curb excessive consumption. Green tax incentivizes environmentally friendly behavior and generates revenue earmarked for sustainability initiatives, proving effective in promoting long-term ecological goals and reducing pollution-related costs. Both taxes enhance fiscal policy but differ in their impact, with luxury tax primarily addressing income inequality and green tax fostering environmental sustainability.

Environmental Implications

Luxury Tax targets high-value goods often associated with increased carbon footprints, potentially discouraging excessive consumption and promoting sustainable purchasing behavior. Green Tax directly imposes fees on activities or products that harm the environment, incentivizing reductions in pollution and encouraging eco-friendly alternatives. The environmental implications of Green Tax are more immediate and targeted, while Luxury Tax indirectly supports sustainability by curbing demand for resource-intensive luxury items.

Socioeconomic Considerations

Luxury tax targets high-end goods, primarily affecting wealthier individuals and potentially reducing socioeconomic inequality by discouraging excessive consumption. Green tax imposes levies on environmentally harmful activities, promoting sustainability while influencing lower-income groups disproportionately due to increased costs on essential goods. Balancing luxury tax and green tax policies requires careful consideration of equity and economic impact to achieve both social justice and environmental goals.

Future Trends in Car Taxation

Future trends in car taxation indicate a shift from traditional luxury tax models towards environmentally-driven green taxes aimed at reducing carbon emissions. Governments are increasingly implementing higher levies on high-emission vehicles while offering incentives for electric and hybrid cars to promote sustainable transportation. This transition reflects a global commitment to climate goals, influencing the automotive market and consumer behavior.

Luxury Tax vs Green Tax Infographic

cardiffo.com

cardiffo.com