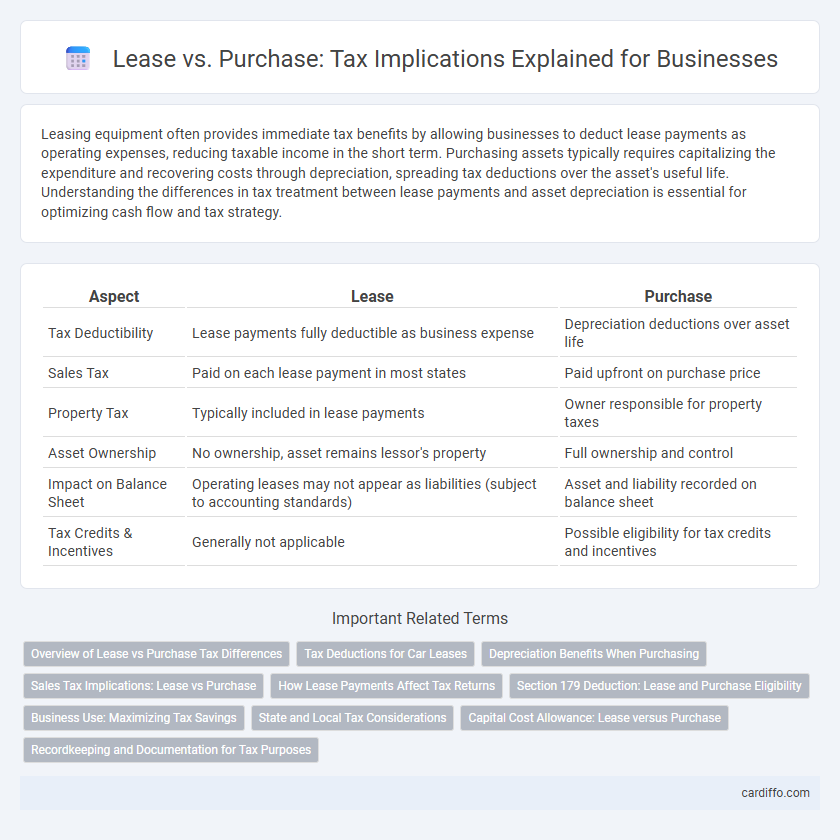

Leasing equipment often provides immediate tax benefits by allowing businesses to deduct lease payments as operating expenses, reducing taxable income in the short term. Purchasing assets typically requires capitalizing the expenditure and recovering costs through depreciation, spreading tax deductions over the asset's useful life. Understanding the differences in tax treatment between lease payments and asset depreciation is essential for optimizing cash flow and tax strategy.

Table of Comparison

| Aspect | Lease | Purchase |

|---|---|---|

| Tax Deductibility | Lease payments fully deductible as business expense | Depreciation deductions over asset life |

| Sales Tax | Paid on each lease payment in most states | Paid upfront on purchase price |

| Property Tax | Typically included in lease payments | Owner responsible for property taxes |

| Asset Ownership | No ownership, asset remains lessor's property | Full ownership and control |

| Impact on Balance Sheet | Operating leases may not appear as liabilities (subject to accounting standards) | Asset and liability recorded on balance sheet |

| Tax Credits & Incentives | Generally not applicable | Possible eligibility for tax credits and incentives |

Overview of Lease vs Purchase Tax Differences

Leasing a vehicle allows businesses to deduct lease payments as operating expenses, providing immediate tax benefits without affecting asset depreciation schedules. Purchasing an asset enables depreciation tax deductions over multiple years, potentially offering larger long-term tax savings through capital cost allowance claims. Understanding the distinction between lease expense deductions and depreciation deductions is crucial for optimizing tax strategy in asset acquisition decisions.

Tax Deductions for Car Leases

Car lease payments are typically fully deductible as a business expense, allowing for consistent tax benefits over the lease term. Lease agreements often include maintenance and insurance costs, which may also be deductible, enhancing overall tax efficiency. Unlike purchasing, leased vehicles avoid depreciation complexities, simplifying tax reporting and maximizing immediate expense recognition.

Depreciation Benefits When Purchasing

Purchasing an asset allows businesses to capitalize on depreciation benefits, which can significantly reduce taxable income over the asset's useful life through methods like MACRS or Section 179 expensing. Lease payments are typically treated as deductible expenses, but purchasing enables the gradual recovery of the asset's cost via annual depreciation deductions. These tax advantages can enhance cash flow and lower overall tax liabilities compared to leasing, especially when long-term asset retention is planned.

Sales Tax Implications: Lease vs Purchase

Sales tax on leased assets is typically calculated on each lease payment, spreading the tax burden over time, while purchasing an asset usually requires paying the full sales tax upfront based on the total purchase price. Some states exempt certain leases from sales tax, influencing the overall cost-effectiveness between leasing and buying. Businesses must evaluate state-specific sales tax rules to optimize financial outcomes and ensure compliance in lease versus purchase decisions.

How Lease Payments Affect Tax Returns

Lease payments are typically considered operating expenses and can be fully deducted on tax returns, reducing taxable income in the year they are paid. Unlike asset purchases, lease payments do not provide depreciation deductions since the lessee does not own the property. This distinction impacts cash flow and tax strategy, as leasing offers immediate tax benefits without the long-term asset depreciation schedules associated with purchases.

Section 179 Deduction: Lease and Purchase Eligibility

Section 179 deduction allows businesses to immediately expense the cost of qualifying purchased equipment, but leased equipment payments generally do not qualify for this deduction. When purchasing, the full cost of eligible assets up to the Section 179 limit can be deducted in the year of acquisition. Lease payments, categorized as operating expenses, are typically deductible as ordinary business expenses but do not provide Section 179 benefits.

Business Use: Maximizing Tax Savings

Leasing business equipment allows for 100% deductible lease payments under Section 179, providing immediate tax benefits by reducing taxable income. Purchasing assets enables depreciation deductions over time through the Modified Accelerated Cost Recovery System (MACRS), offering long-term tax savings. Understanding the balance between lease payment deductibility and depreciation schedules maximizes tax savings based on your business's cash flow and asset usage.

State and Local Tax Considerations

State and local tax implications of lease versus purchase decisions significantly affect overall costs and tax liabilities. Leasing often allows businesses to deduct lease payments as operating expenses, whereas purchasing may provide opportunities for depreciation deductions and property tax obligations. Understanding specific state and local tax codes, including sales tax applicability and property tax rates, is crucial for optimizing tax benefits in lease versus purchase evaluations.

Capital Cost Allowance: Lease versus Purchase

When considering Capital Cost Allowance (CCA) for tax purposes, purchasing an asset allows the owner to claim CCA on the depreciable property, reducing taxable income over time. Leasing an asset typically means lease payments are fully deductible as business expenses, but the lessee cannot claim CCA since ownership remains with the lessor. Understanding these differences in tax treatment between lease and purchase is crucial for optimizing tax planning and cash flow management.

Recordkeeping and Documentation for Tax Purposes

Accurate recordkeeping and thorough documentation are vital for differentiating lease versus purchase tax treatments, as leases often require tracking monthly payments and lease terms for deductibility, while purchases necessitate detailed asset documentation and depreciation schedules. Maintaining detailed contracts, payment receipts, and asset acquisition documents ensures compliance with IRS regulations and facilitates accurate tax reporting. Proper documentation supports eligibility for tax deductions such as lease expense deductions or capital expense depreciation, preventing audit issues and optimizing tax benefits.

Lease vs purchase tax implications Infographic

cardiffo.com

cardiffo.com