Depreciation tax shield reduces taxable income by allowing businesses to deduct the depreciation expense of assets, effectively lowering tax liability over the asset's useful life. Capital allowances serve a similar purpose but are specifically defined by tax laws, permitting firms to claim deductions on qualifying capital expenditures. Understanding the distinction between depreciation tax shields and capital allowances is crucial for optimizing tax strategies and maximizing cash flow benefits.

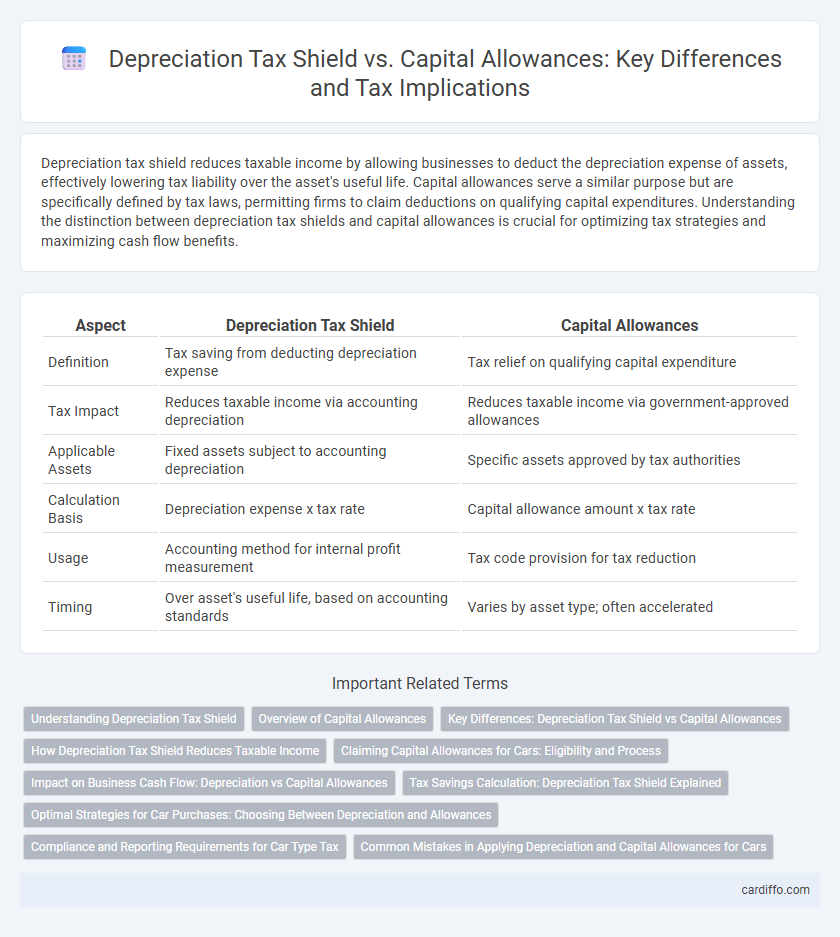

Table of Comparison

| Aspect | Depreciation Tax Shield | Capital Allowances |

|---|---|---|

| Definition | Tax saving from deducting depreciation expense | Tax relief on qualifying capital expenditure |

| Tax Impact | Reduces taxable income via accounting depreciation | Reduces taxable income via government-approved allowances |

| Applicable Assets | Fixed assets subject to accounting depreciation | Specific assets approved by tax authorities |

| Calculation Basis | Depreciation expense x tax rate | Capital allowance amount x tax rate |

| Usage | Accounting method for internal profit measurement | Tax code provision for tax reduction |

| Timing | Over asset's useful life, based on accounting standards | Varies by asset type; often accelerated |

Understanding Depreciation Tax Shield

Depreciation tax shield refers to the tax savings a company realizes by deducting depreciation expenses from its taxable income, effectively reducing its tax liability. It represents the tax benefit resulting from the non-cash expense, which lowers the company's taxable profit, enhancing cash flow. Unlike capital allowances, which are specific tax provisions allowing accelerated write-offs on qualifying assets, the depreciation tax shield is a broader concept tied to any depreciation method used for tax purposes.

Overview of Capital Allowances

Capital allowances enable businesses to deduct the cost of tangible fixed assets from their taxable profits, effectively reducing tax liabilities through government-sanctioned write-offs. Unlike the depreciation tax shield, which is an accounting concept reflecting asset value decline, capital allowances are statutory tax deductions with specific rules and rates defined by tax authorities. These allowances include categories such as Annual Investment Allowance (AIA), Writing Down Allowance (WDA), and First-Year Allowances (FYA), providing structured opportunities for tax relief on qualifying capital expenditures.

Key Differences: Depreciation Tax Shield vs Capital Allowances

Depreciation tax shield refers to the reduction in taxable income resulting from accounting depreciation expenses, while capital allowances are tax reliefs granted on qualifying capital expenditures based on tax regulations. Key differences include that depreciation is an accounting measure following accounting standards, whereas capital allowances are statutory deductions defined by tax law, often with specific rates and eligibility criteria. Capital allowances directly reduce taxable profits, whereas depreciation tax shield represents the tax savings effect of depreciation expense.

How Depreciation Tax Shield Reduces Taxable Income

Depreciation tax shield reduces taxable income by allowing businesses to deduct depreciation expenses from their earnings before tax calculation, effectively lowering the overall tax liability. Capital allowances function similarly but are specific tax deductions granted for certain types of qualifying capital expenditure, such as machinery or equipment, according to tax regulations. By leveraging depreciation tax shield and capital allowances, companies can optimize cash flow and enhance after-tax profitability through reduced taxable income.

Claiming Capital Allowances for Cars: Eligibility and Process

Claiming capital allowances for cars requires the vehicle to be used for business purposes, with eligibility determined by factors such as CO2 emissions and the car's classification (e.g., low-emission or electric vehicles often qualify for enhanced allowances). The process involves submitting a claim through the company's tax return, ensuring accurate records of business mileage and purchase price are maintained to maximize allowable deductions. Capital allowances reduce taxable profits by accounting for the car's depreciation, effectively providing a tax shield compared to straight depreciation methods.

Impact on Business Cash Flow: Depreciation vs Capital Allowances

Depreciation tax shield reduces taxable income, lowering tax liability and improving immediate business cash flow without affecting actual cash outflows, as it is a non-cash expense. Capital allowances provide time-based tax relief on qualifying asset purchases, directly reducing taxable profits and enhancing cash flow by deferring tax payments over asset life. While both serve to minimize tax burdens, capital allowances offer tangible cash flow advantages by accelerating tax deductions linked to capital expenditure.

Tax Savings Calculation: Depreciation Tax Shield Explained

The depreciation tax shield represents the tax savings generated by deducting depreciation expenses from taxable income, effectively lowering the overall tax liability for a business. Calculating this shield involves multiplying the depreciation expense by the corporate tax rate, providing a clear measure of tax reduction due to asset depreciation. In contrast, capital allowances function similarly in tax law, allowing businesses to deduct the cost of qualifying assets, but the specific rules and rates differ according to jurisdiction, affecting the total tax savings calculation.

Optimal Strategies for Car Purchases: Choosing Between Depreciation and Allowances

Optimal strategies for car purchases require analyzing the tax benefits of depreciation tax shields versus capital allowances, as depreciation reduces taxable income gradually, reflecting asset wear and tear, while capital allowances often provide accelerated tax relief through upfront deductions. Maximizing tax efficiency involves selecting cars eligible for higher capital allowances, such as low-emission vehicles, which can significantly lower tax liabilities in early years. Businesses benefit from careful consideration of tax rates, expected vehicle usage, and replacement timelines to optimize cash flow and minimize overall tax burden.

Compliance and Reporting Requirements for Car Type Tax

Depreciation tax shield allows businesses to reduce taxable income by accounting for asset wear and tear, while capital allowances provide specific tax relief on qualifying car purchases under tax law. Compliance for car type tax requires accurate classification of vehicles according to HMRC guidelines to determine applicable capital allowances or depreciation rates, ensuring proper documentation and adherence to deadlines. Reporting mandates include submitting detailed asset registers and tax computations reflecting the chosen method, facilitating transparent audits and minimizing risk of penalties.

Common Mistakes in Applying Depreciation and Capital Allowances for Cars

Common mistakes in applying depreciation tax shield versus capital allowances for cars include inaccurately calculating the allowable expense based on the vehicle's business use percentage and failing to differentiate between the statutory rates for capital allowances versus straight-line depreciation methods. Taxpayers often overlook the specific limits on deductible amounts for passenger vehicles, which can result in overstated deductions and potential tax penalties. Proper classification of the car as either a company or employee asset is essential to maximize tax benefits while ensuring compliance with HMRC rules.

Depreciation tax shield vs capital allowances Infographic

cardiffo.com

cardiffo.com