Zero-rated vehicles are exempt from VAT, meaning no tax is charged at the point of sale, benefiting buyers by reducing upfront costs. Standard-rated vehicles incur VAT at the prevailing rate, increasing the overall purchase price but allowing businesses to reclaim VAT if the vehicle is used for taxable business activities. Understanding the distinction between zero-rated and standard-rated vehicles is crucial for tax planning and compliance in the automotive sector.

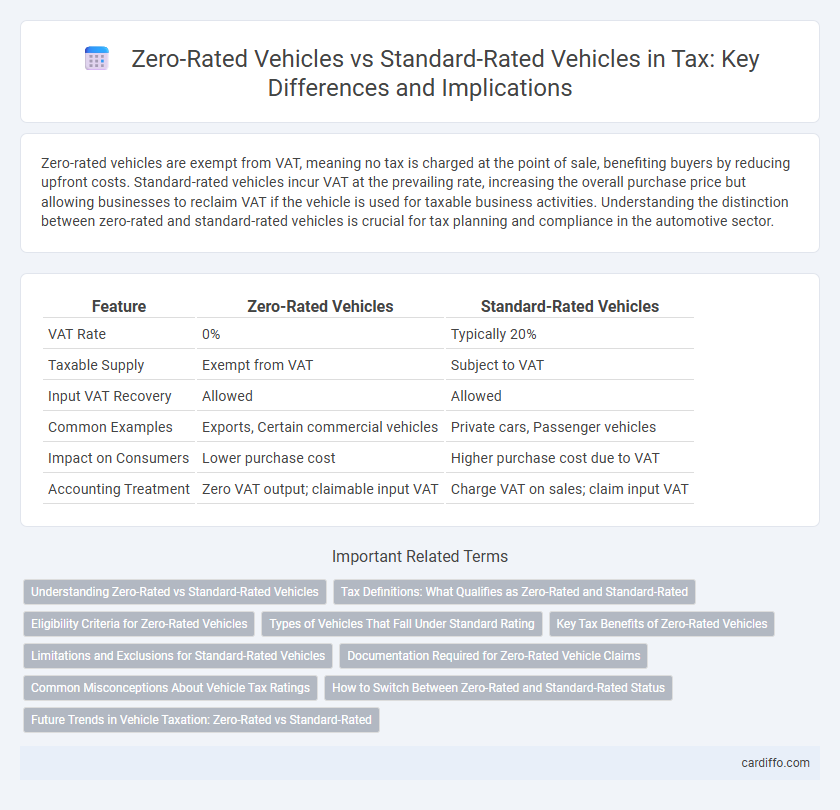

Table of Comparison

| Feature | Zero-Rated Vehicles | Standard-Rated Vehicles |

|---|---|---|

| VAT Rate | 0% | Typically 20% |

| Taxable Supply | Exempt from VAT | Subject to VAT |

| Input VAT Recovery | Allowed | Allowed |

| Common Examples | Exports, Certain commercial vehicles | Private cars, Passenger vehicles |

| Impact on Consumers | Lower purchase cost | Higher purchase cost due to VAT |

| Accounting Treatment | Zero VAT output; claimable input VAT | Charge VAT on sales; claim input VAT |

Understanding Zero-Rated vs Standard-Rated Vehicles

Zero-rated vehicles refer to those sold without charging Value Added Tax (VAT), typically including exports or vehicles used for specific purposes like agriculture or public transportation, allowing buyers to reclaim input tax. Standard-rated vehicles are subject to the full VAT percentage, usually 20%, meaning VAT is charged on the sale price and input tax recovery depends on the vehicle's business use. Understanding the distinction is crucial for compliance with tax regulations, accurate bookkeeping, and maximizing VAT recovery opportunities.

Tax Definitions: What Qualifies as Zero-Rated and Standard-Rated

Zero-rated vehicles are those that qualify for a 0% value-added tax (VAT) rate, typically including specific categories such as export-bound vehicles, certain agricultural machinery, and qualifying electric vehicles under tax law. Standard-rated vehicles incur the prevailing VAT rate, which is usually a percentage of the sale price, encompassing most passenger cars, motorcycles, and commercial vehicles not exempted under the zero-rating criteria. The distinction between zero-rated and standard-rated vehicles hinges on tax legislation definitions specifying usage, buyer status, and vehicle type eligibility for preferential tax treatment.

Eligibility Criteria for Zero-Rated Vehicles

Zero-rated vehicles are eligible for tax exemption when they meet specific criteria, such as being intended for export, used for public transportation, or specially designed for persons with disabilities. These vehicles must comply with regulatory standards set by tax authorities, including documentation proving their status and intended use. In contrast, standard-rated vehicles do not meet these conditions and are subject to full Value Added Tax (VAT) at the prevailing rates.

Types of Vehicles That Fall Under Standard Rating

Standard-rated vehicles typically include luxury cars, sports vehicles, and imported trucks that do not meet the criteria for zero-rating under tax regulations. These vehicles attract the full value-added tax (VAT) rate due to their usage, cost, or origin, distinguishing them from zero-rated categories like commercial or agricultural vehicles. Understanding the specific classifications helps businesses and consumers accurately apply tax obligations when purchasing or importing standard-rated vehicles.

Key Tax Benefits of Zero-Rated Vehicles

Zero-rated vehicles offer key tax benefits by allowing buyers to recover Value-Added Tax (VAT) on purchase and related expenses, significantly reducing upfront costs. Unlike standard-rated vehicles, zero-rated vehicles are exempt from VAT charges, improving cash flow for businesses engaged in transport and logistics. This tax advantage fosters investment in environmentally friendly or essential vehicles, enhancing operational efficiency while minimizing tax liabilities.

Limitations and Exclusions for Standard-Rated Vehicles

Standard-rated vehicles are subject to VAT, limiting input tax recovery compared to zero-rated vehicles, which typically allow full VAT reclaim. Specific exclusions include passenger cars used for personal purposes, as VAT on these vehicles is non-deductible, reducing tax efficiency. Furthermore, standard-rated vehicles frequently require detailed documentation to justify VAT claims, increasing administrative burden and risk of partial disallowance.

Documentation Required for Zero-Rated Vehicle Claims

To claim zero-rated VAT on vehicles, precise documentation such as import declarations, purchase invoices showing zero-rated VAT, and proof of exportation must be maintained. Sales records must clearly differentiate zero-rated vehicle transactions from standard-rated ones to ensure compliance with tax authorities. Failure to provide these specific documents can result in disallowance of zero-rated claims and standard VAT charges being applied.

Common Misconceptions About Vehicle Tax Ratings

Many taxpayers mistakenly assume zero-rated vehicles are entirely tax-exempt, when in fact zero-rating applies specifically to VAT on eligible sales, not on all related taxes such as registration or annual road tax. A common misconception is that zero-rated vehicles include all types of electric or hybrid cars, whereas only certain models meeting detailed criteria qualify for zero-rating under VAT rules. Understanding the precise definitions and qualifications of zero-rated versus standard-rated vehicles helps prevent costly errors in tax reporting and compliance.

How to Switch Between Zero-Rated and Standard-Rated Status

To switch between zero-rated and standard-rated vehicle status, a business must update its VAT records and notify the tax authority of the change. This involves recalculating output tax based on the vehicle's current VAT status and ensuring accurate documentation for invoicing and reporting. Compliance with local VAT rules is essential to avoid penalties and maintain valid input tax recovery.

Future Trends in Vehicle Taxation: Zero-Rated vs Standard-Rated

Future trends in vehicle taxation indicate a growing shift towards zero-rated vehicles, driven by increased environmental regulations and incentives for electric and hybrid models. Governments are expanding zero-rated tax categories to accelerate the transition to low-emission transportation, reducing the financial burden on consumers purchasing eco-friendly vehicles. Standard-rated vehicles, particularly those with higher emissions, are likely to face increased tax rates and stricter compliance requirements to discourage pollution and promote sustainable mobility.

zero-rated vehicles vs standard-rated vehicles Infographic

cardiffo.com

cardiffo.com